Agreement Security Form For Lending Money

Description

How to fill out Agreement Security Form For Lending Money?

Well-prepared official documents are among the key assurances for preventing complications and legal disputes, but obtaining them without a lawyer's help may require some time.

Whether you need to swiftly locate a current Agreement Security Form For Lending Money or any other templates related to employment, family, or business matters, US Legal Forms is always available to assist you.

The procedure is even easier for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and press the Download button next to the selected document. Furthermore, you can access the Agreement Security Form For Lending Money anytime later, as all documents ever acquired on the platform remain accessible within the My documents section of your profile. Save time and expenses on preparing official documents. Experience US Legal Forms today!

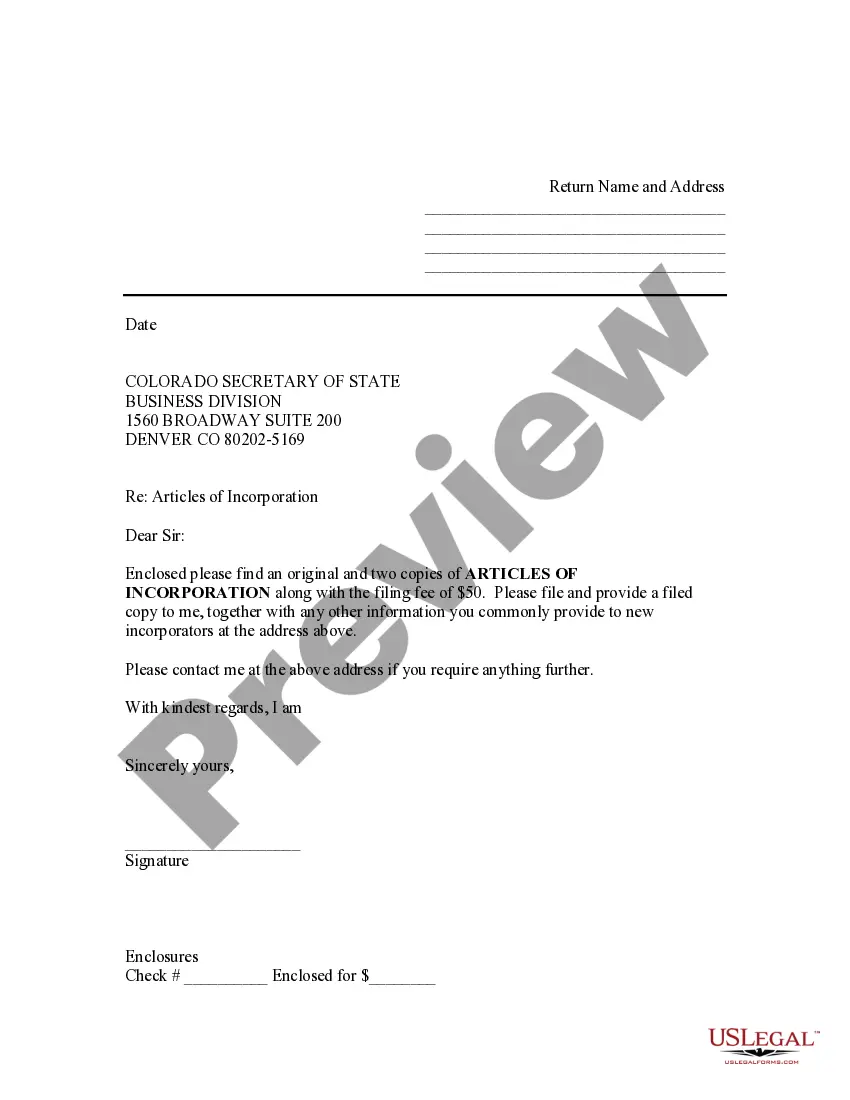

- Ensure that the form matches your situation and location by reviewing the description and preview.

- Search for another sample (if necessary) using the Search bar at the top of the page.

- Select Buy Now when you find the appropriate template.

- Pick the pricing option, sign in to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (through a credit card or PayPal).

- Select PDF or DOCX file format for your Agreement Security Form For Lending Money.

- Hit Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.