Accident Settlement Letter Without Insurance

Description

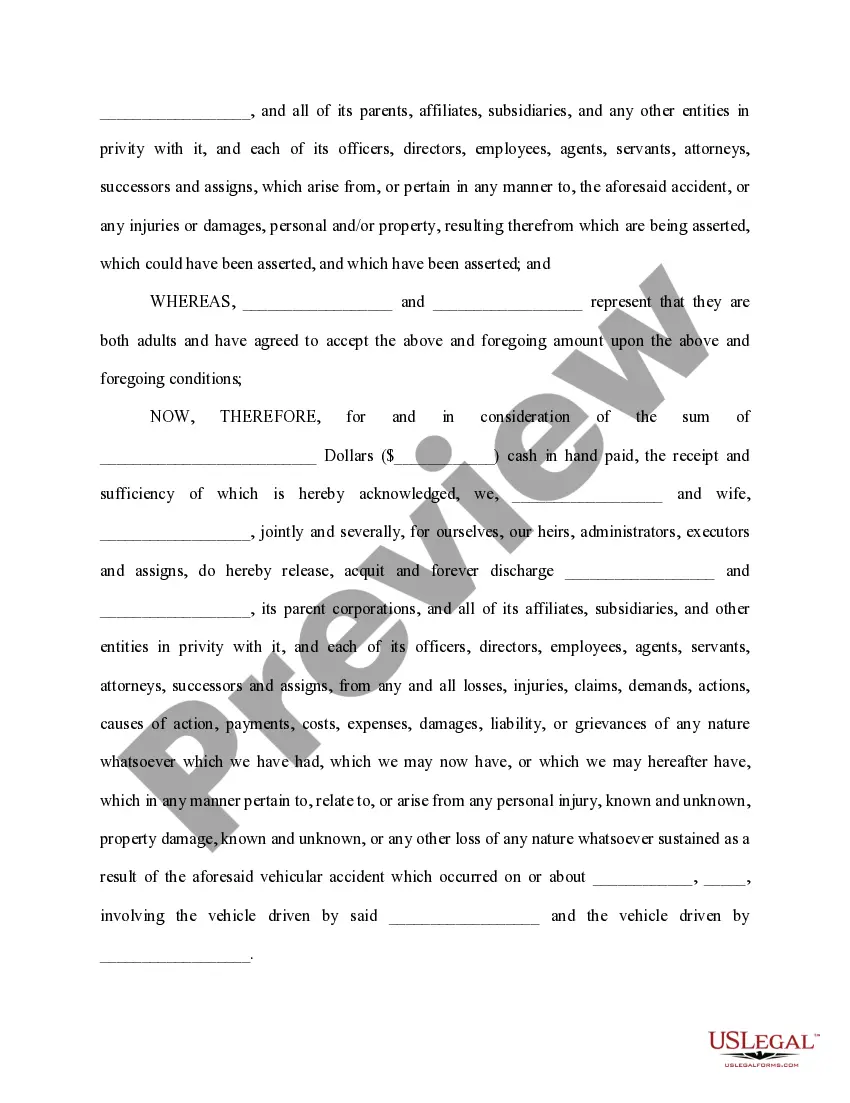

How to fill out Settlement Agreement Auto Accident?

Irrespective of whether for professional objectives or for personal matters, every individual must confront legal circumstances at some stage in their existence. Completing legal documentation necessitates meticulous care, beginning with selecting the appropriate form template. For instance, if you opt for an incorrect version of an Accident Settlement Letter Without Insurance, it will be rejected upon submission. Thus, it is crucial to obtain a trustworthy source of legal documents such as US Legal Forms.

If you wish to acquire an Accident Settlement Letter Without Insurance template, adhere to these straightforward steps.

With a comprehensive catalog from US Legal Forms available, there is no need to waste time searching for the correct template online. Take advantage of the library’s user-friendly navigation to find the right form for any situation.

- Utilize the search bar or browse through the catalog to find the template you require.

- Review the form’s description to confirm it corresponds to your situation, state, and locality.

- Click on the preview of the form to inspect it.

- If it is the incorrect form, return to the search feature to find the Accident Settlement Letter Without Insurance template you need.

- Download the template once it satisfies your requirements.

- If you possess a US Legal Forms account, click Log in to access files you’ve saved in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the registration form for your account.

- Choose your payment method: either a credit card or a PayPal account.

- Select the file format you prefer and download the Accident Settlement Letter Without Insurance.

- Once saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

After an accident, you typically have a limited timeframe to file a claim, generally ranging from one to three years depending on your state. This deadline is crucial for ensuring you can pursue an accident settlement letter without insurance. It is always wise to act promptly, as gathering evidence and documenting your case will strengthen your position. Explore options on the US Legal Forms platform for help in navigating this process effectively.

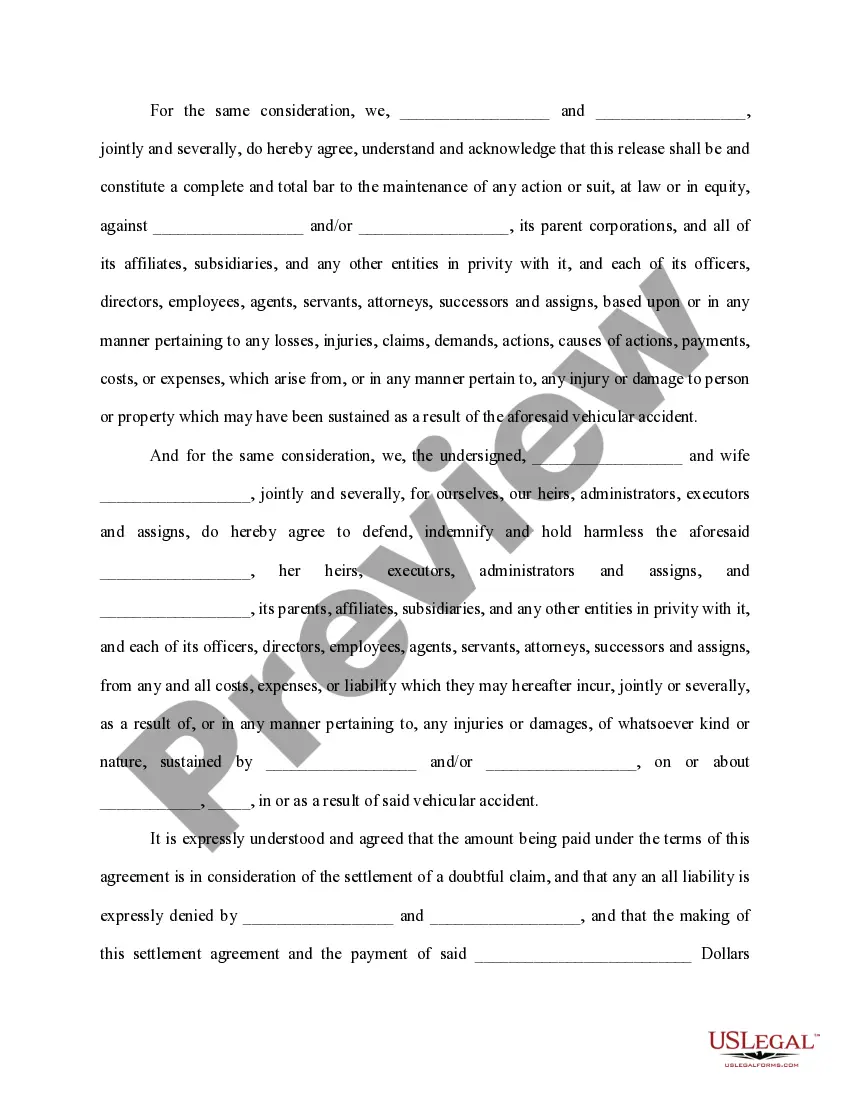

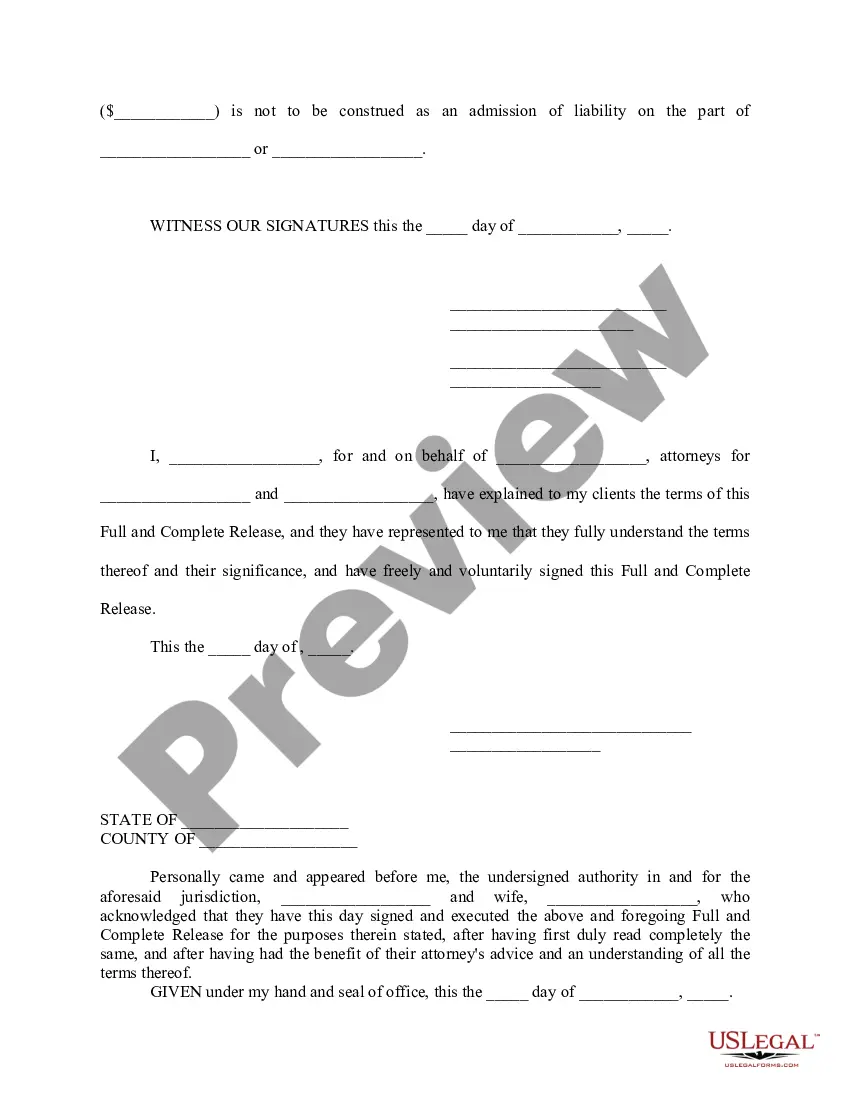

Writing a settlement letter for a car accident involves clearly stating the details of the incident, the damages incurred, and your proposed compensation. Include information such as the date, location, and parties involved in the accident. A well-drafted accident settlement letter without insurance will serve as a formal request for compensation. Make use of USLegalForms to generate a professional template for your letter.

The time it takes for most car accident settlements can vary significantly, often ranging from a few weeks to several months. Factors influencing this duration include the complexity of the case, negotiations between parties, and insurance involvement. Even if you are navigating this without insurance, you can expedite the process by issuing an accident settlement letter without insurance sooner. Consider using USLegalForms for efficient document preparation.

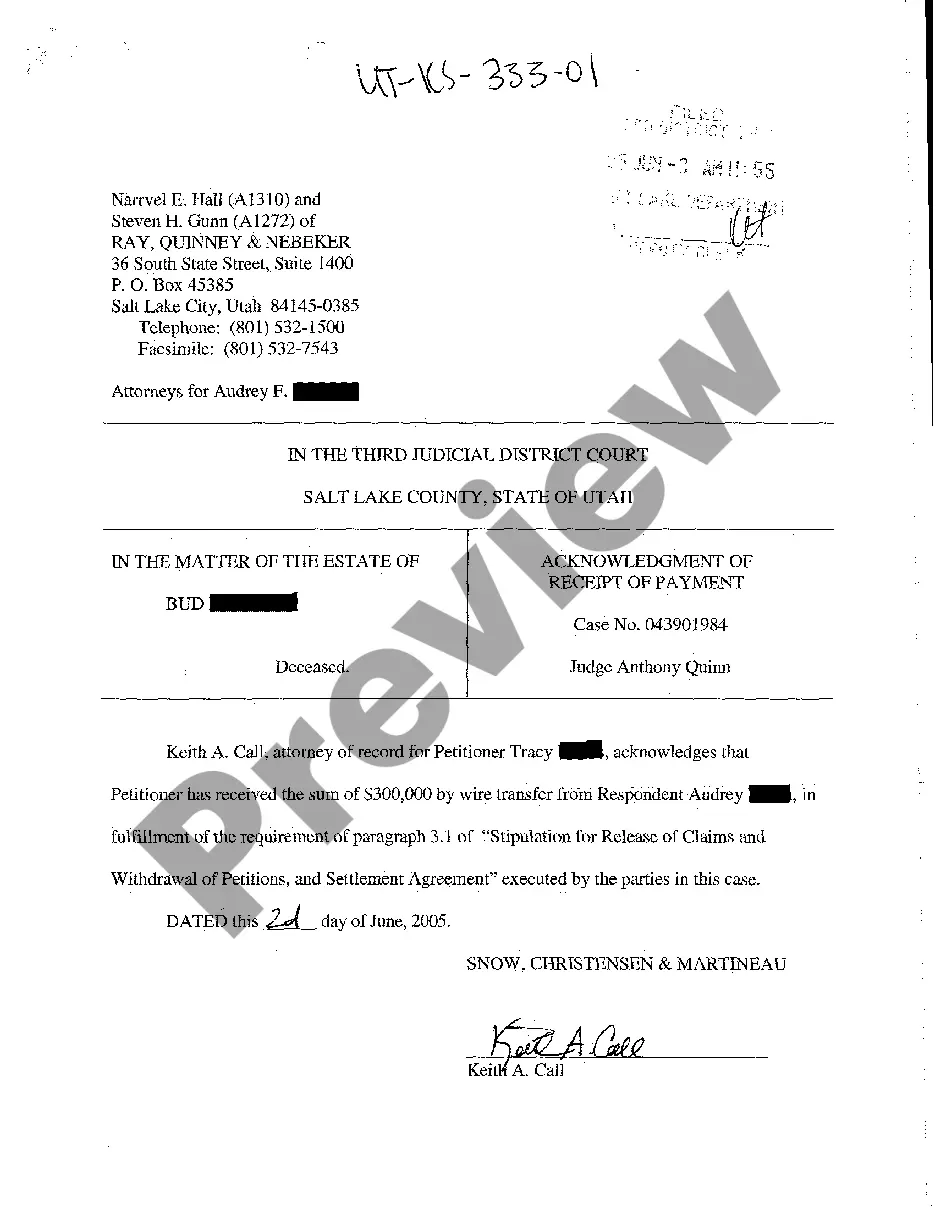

To settle an accident without insurance, both parties must reach an agreement on the damages caused. Start by communicating openly, discussing the situation, and evaluating the costs involved. Following this, draft an accident settlement letter without insurance to document your agreement formally. Platforms like USLegalForms provide templates to simplify this process.

When both parties lack insurance in an accident, you may face difficulty recovering damages. Typically, you will need to negotiate directly with the other party to reach an agreement. In these situations, an accident settlement letter without insurance can help formalize the terms of the settlement. Consider using resources like USLegalForms to guide you in creating a suitable document.

Writing a settlement agreement requires clarity and thoroughness. Start with the facts of the accident, followed by the terms of the settlement, including payment details and any waivers of future claims. If you are utilizing an accident settlement letter without insurance, state this clearly to avoid future confusion. A well-structured agreement helps ensure that both parties understand their obligations and can prevent disputes down the road.

To secure the best settlement from a car accident, document everything related to the incident, from photos of the damage to medical records. Communicate assertively with insurance companies; emphasize any missing coverage, such as in cases of an accident settlement letter without insurance. Consider negotiating and presenting a well-researched demand based on your expenses and the circumstances of the accident. Seeking legal advice can also strengthen your position.

To write an effective letter for your insurance claim, start by gathering all relevant details about the accident. Include specifics like dates, locations, and any injuries sustained. State your purpose clearly; mention that it is an accident settlement letter without insurance, as this can impact your claim's evaluation. End with a request for a timely response, ensuring you include your contact information.

If you total your car without insurance, first assess your financial situation and consider how to cover repair or replacement costs. You should communicate with any other parties involved to discuss potential settlements. Drafting an accident settlement letter without insurance may help formalize your compensation request. Lastly, consider seeking legal advice to understand your options moving forward.

To get your car repaired after an accident without insurance, you can negotiate directly with mechanics or repair shops for rates. Check for local assistance programs that may offer help for uninsured drivers. You can also explore personal loans or payment plans to cover the repair costs. Using an accident settlement letter without insurance can help you negotiate effectively with the other party for financial assistance.