Borrow Note Withholding Tax

Description

How to fill out Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

Locating a reliable source for obtaining the most up-to-date and pertinent legal templates is a significant part of navigating bureaucracy. Securing the appropriate legal documents requires accuracy and careful consideration, which is why it is essential to acquire Borrow Note Withholding Tax samples exclusively from trustworthy providers, such as US Legal Forms. An incorrect template could squander your time and delay your current circumstances. With US Legal Forms, you have minimal concerns. You can access and verify all the specifics regarding the document's applicability and relevance for your situation in your state or county.

Follow these steps to complete your Borrow Note Withholding Tax.

Once the form is on your device, you may alter it using the editor or print it out to complete it manually. Eliminate the complications associated with your legal paperwork. Explore the extensive US Legal Forms catalog where you can discover legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the library navigation or search bar to find your template.

- Review the form’s details to ensure it complies with your state and county requirements.

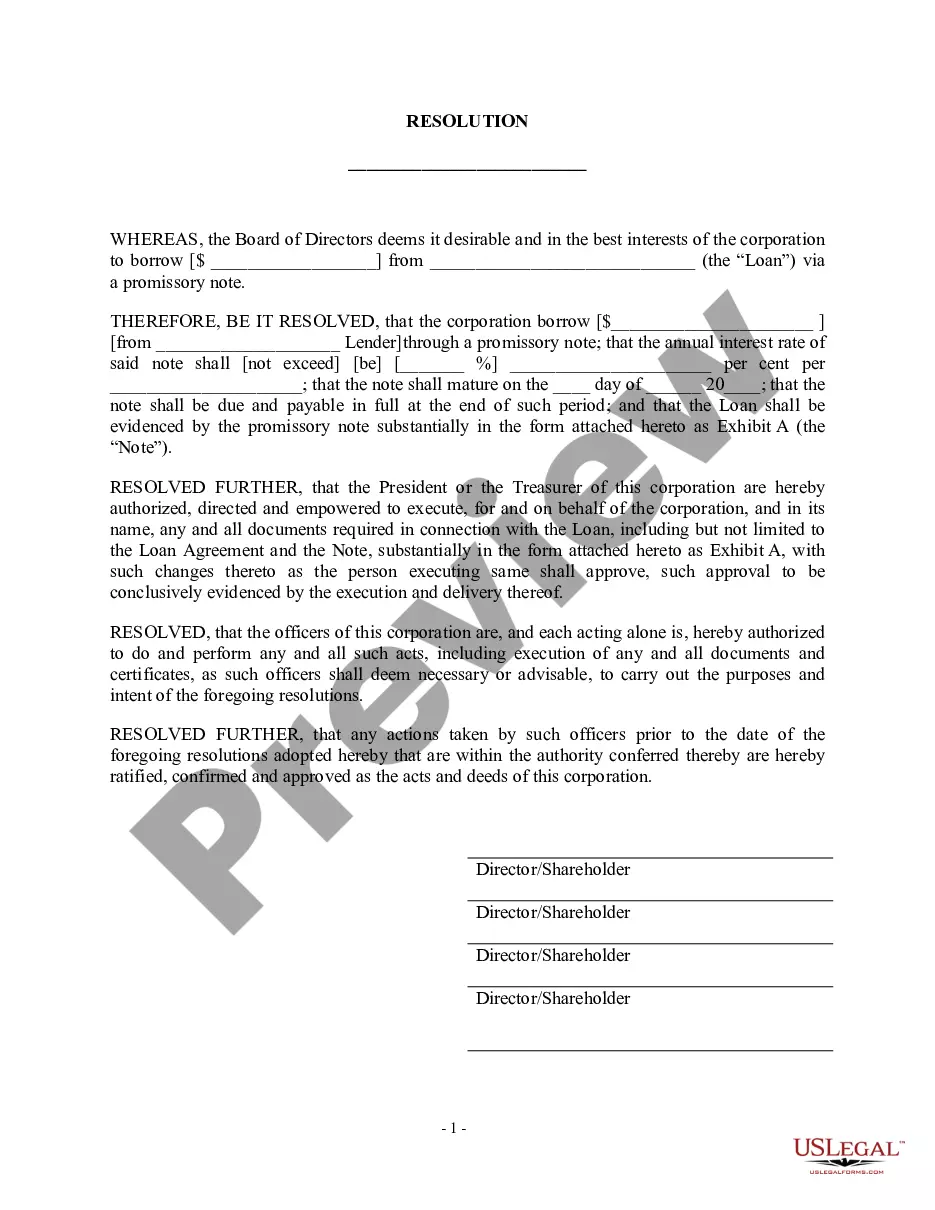

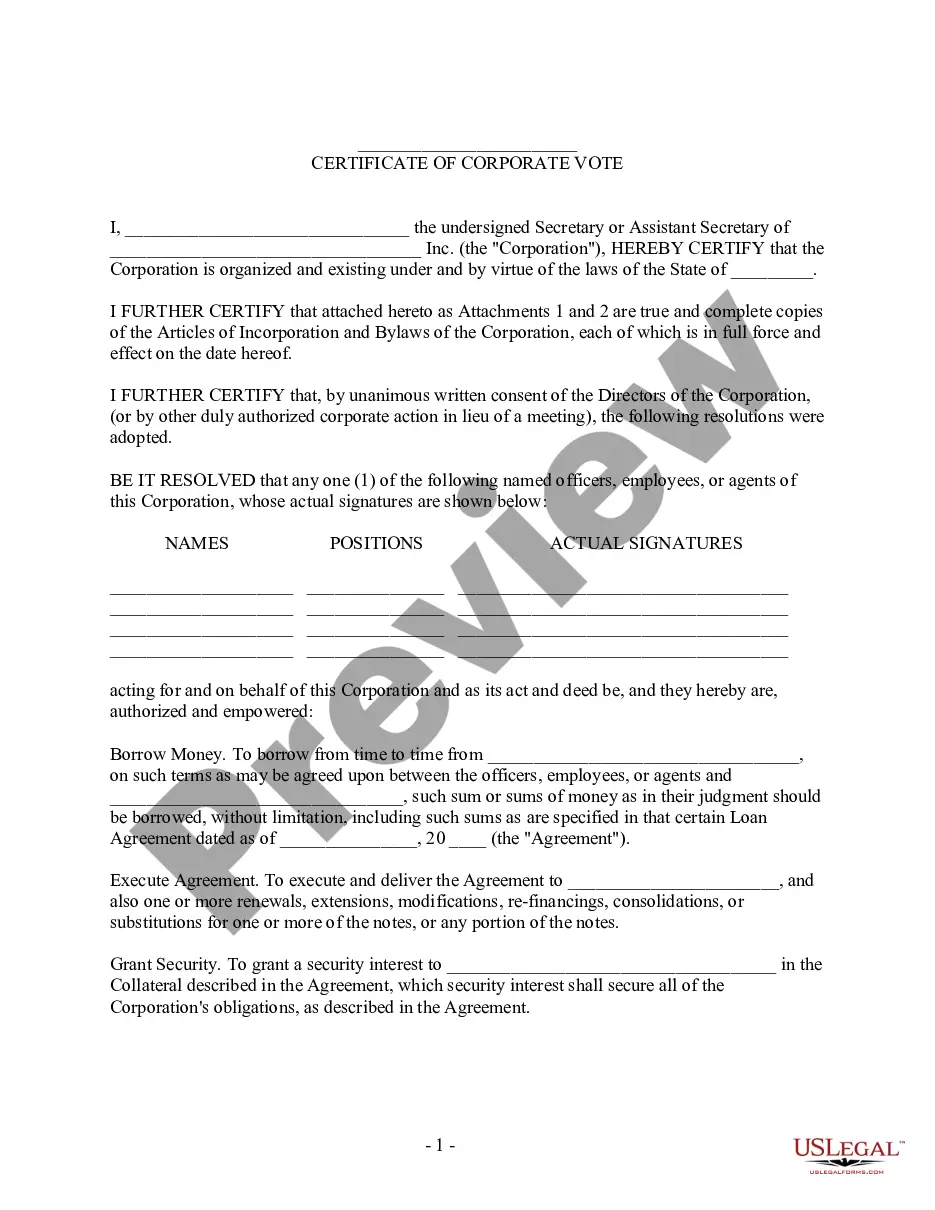

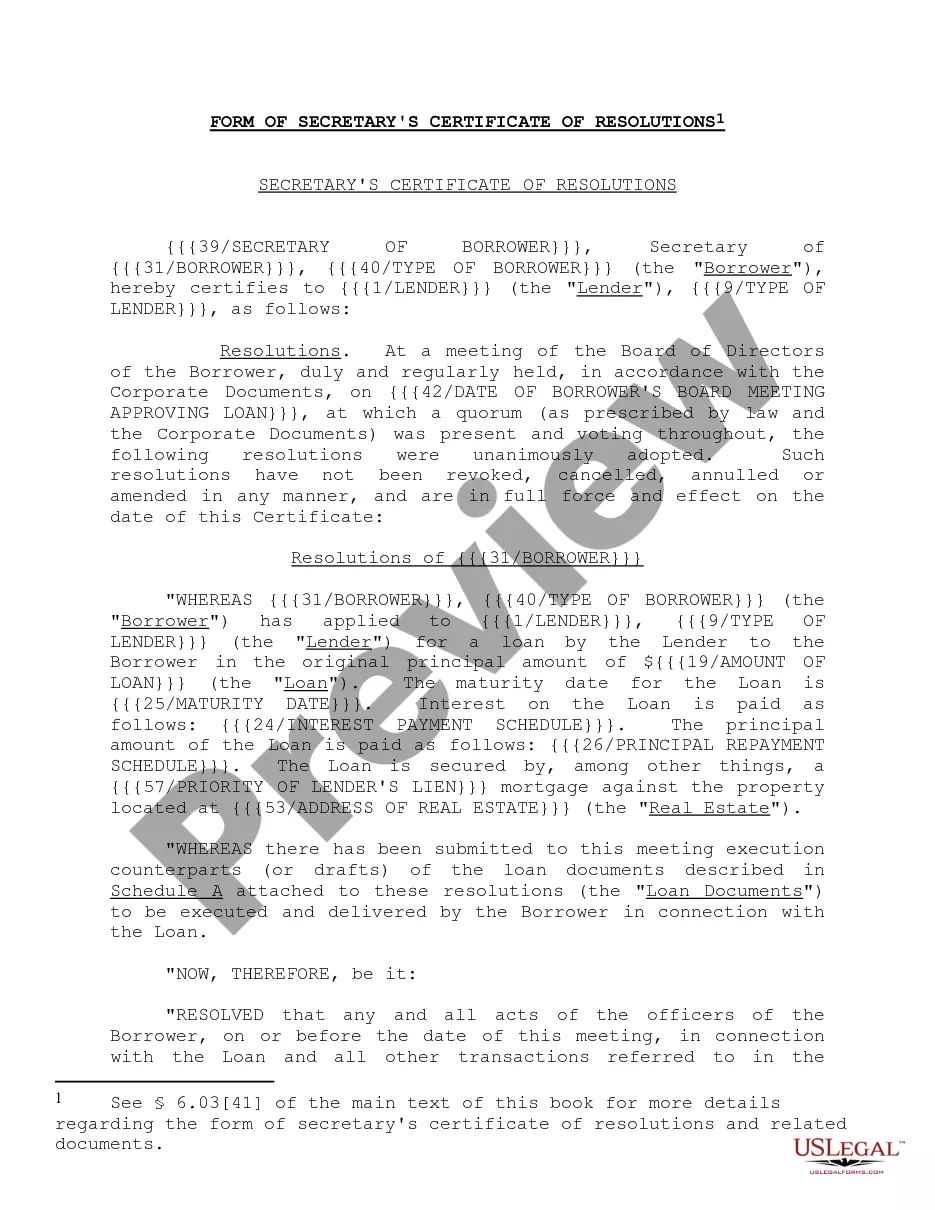

- Check the form preview, if available, to confirm that the template is indeed the one you need.

- Return to the search to find the correct template if the Borrow Note Withholding Tax does not meet your needs.

- If you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to purchase the template.

- Select the pricing plan that suits your preferences.

- Proceed with the registration to complete your purchase.

- Conclude your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Borrow Note Withholding Tax.

Form popularity

FAQ

The Maryland earned income tax credit (EITC) will either reduce or eliminate the amount of the state and local income tax that you owe. Detailed EITC guidance for Tax Year 2022, including annual income thresholds can be found here.

The IRS considers canceled debt, including most forms of student loan debt forgiveness or student loan discharge, to be taxable income. However, borrowers working toward loan forgiveness have been exempt from taxes thanks to the American Rescue Plan Act of 2021.

If the credit is more than the taxes you would otherwise owe, you will receive a tax refund for the difference. For example, if you owe $800 in taxes without the credit, and then claim a $1,000 Student Loan Debt Relief Tax Credit, you will get a $200 refund.

Debt Expenses That Can Be Deducted Though personal loans are not tax-deductible, other types of loans are. Interest paid on mortgages, student loans, and business loans often can be deducted on your annual taxes, effectively reducing your taxable income for the year.

Most canceled debt is taxable Similar to income tax forms, you will also receive a copy of the 1099-C forgiveness of debt form from the forgiving creditor in the tax year the final payment is made. ?That form will give you the amount forgiven,? says Tayne, which is the amount that's considered taxable income.