Resolution Form Board With Withdrawal Of Fixed Deposit

Description

How to fill out Resolution Form Board With Withdrawal Of Fixed Deposit?

Individuals frequently link legal documents with complexity that only an expert can handle.

In some respects, this is accurate, as preparing a Resolution Form Board With Withdrawal Of Fixed Deposit demands considerable knowledge of subject matter, including regional and municipal laws.

Nonetheless, with US Legal Forms, everything has become simpler: pre-designed legal templates for various life and business events specific to state regulations are assembled in a single online directory and are now accessible to all.

Choose a pricing plan that aligns with your needs and budget. Create an account or Log In to advance to the payment page. Process the payment for your subscription using PayPal or your credit card. Select the format for your file and click Download. Print your document or import it into an online editor for faster completion. All templates in our collection are reusable: once obtained, they remain stored in your profile. Access them as needed via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents categorized by state and application area, so finding the Resolution Form Board With Withdrawal Of Fixed Deposit or any other specific template takes only a few moments.

- Previously registered users with an active subscription must Log In to their account and click Download to retrieve the document.

- New users will need to create an account and subscribe before they can access any documents.

- Follow these step-by-step instructions to obtain the Resolution Form Board With Withdrawal Of Fixed Deposit.

- Carefully review the page content to ensure it meets your requirements.

- Examine the form description or check it via the Preview option.

- If the previous option doesn't fit your needs, find another sample using the Search bar in the header.

- Once you locate the appropriate Resolution Form Board With Withdrawal Of Fixed Deposit, click Buy Now.

Form popularity

FAQ

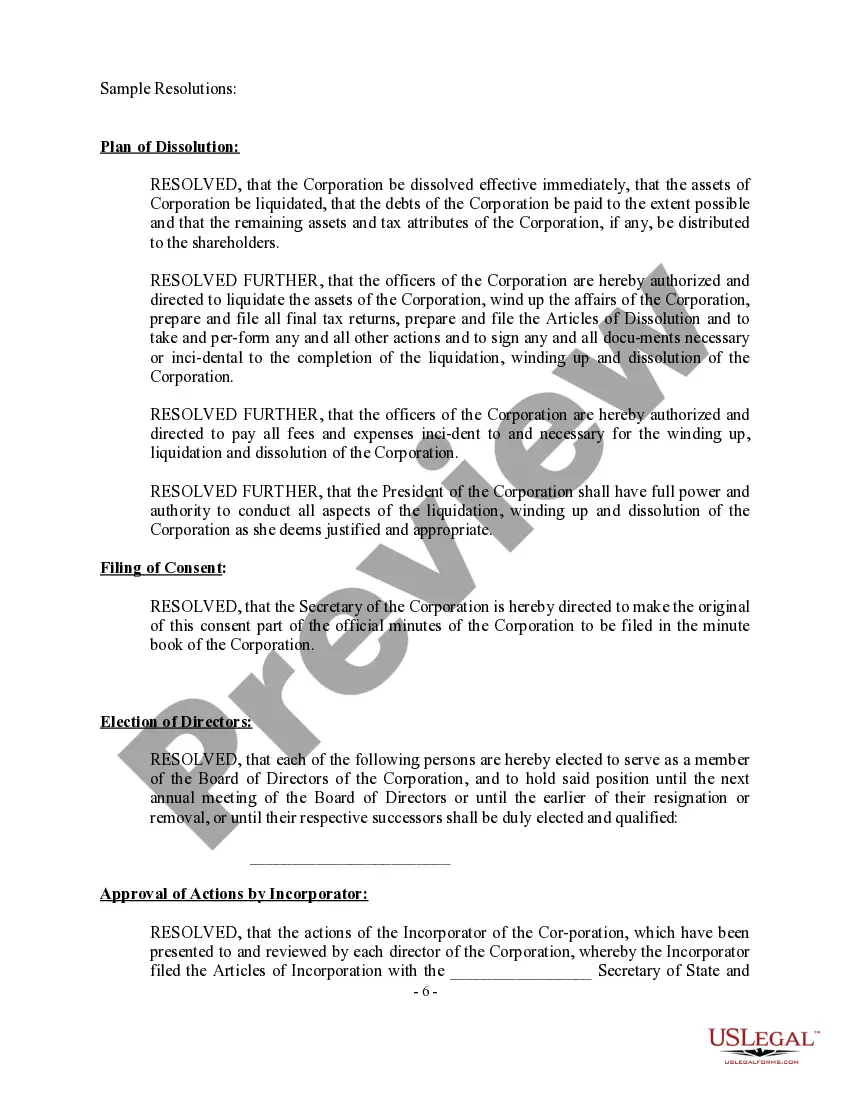

To write a fixed deposit withdrawal letter, begin by addressing the bank and stating your intention to withdraw the fixed deposit. Clearly mention the fixed deposit account number and the desired withdrawal amount. Include your full name, address, and any identification details required for verification. Utilizing a resolution form board with withdrawal of fixed deposit will streamline this process and ensure all necessary details are accurately submitted.

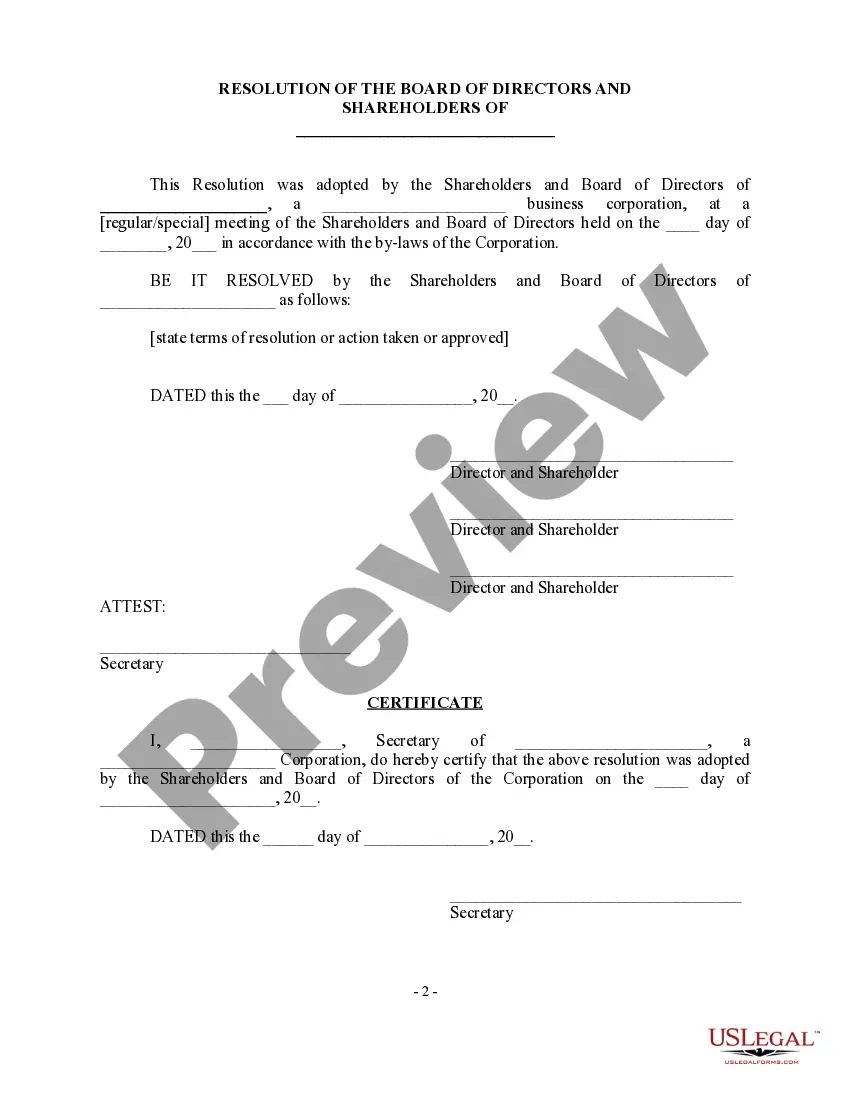

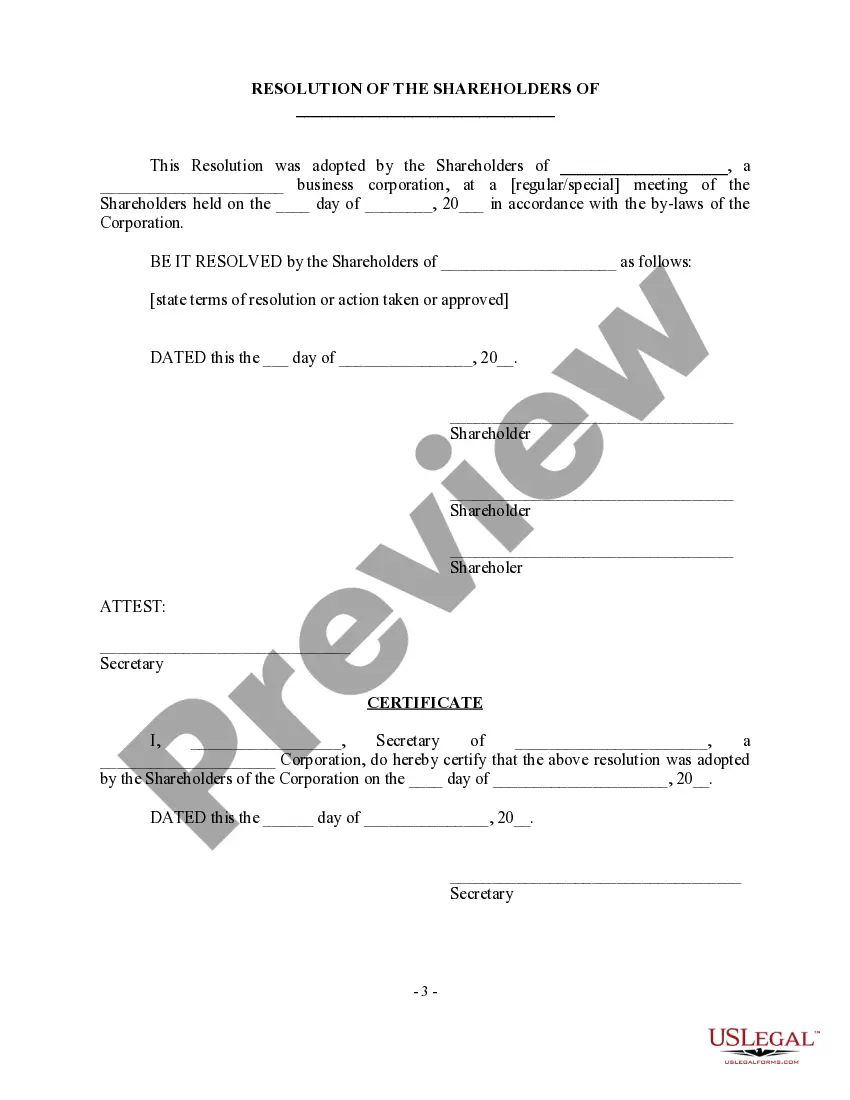

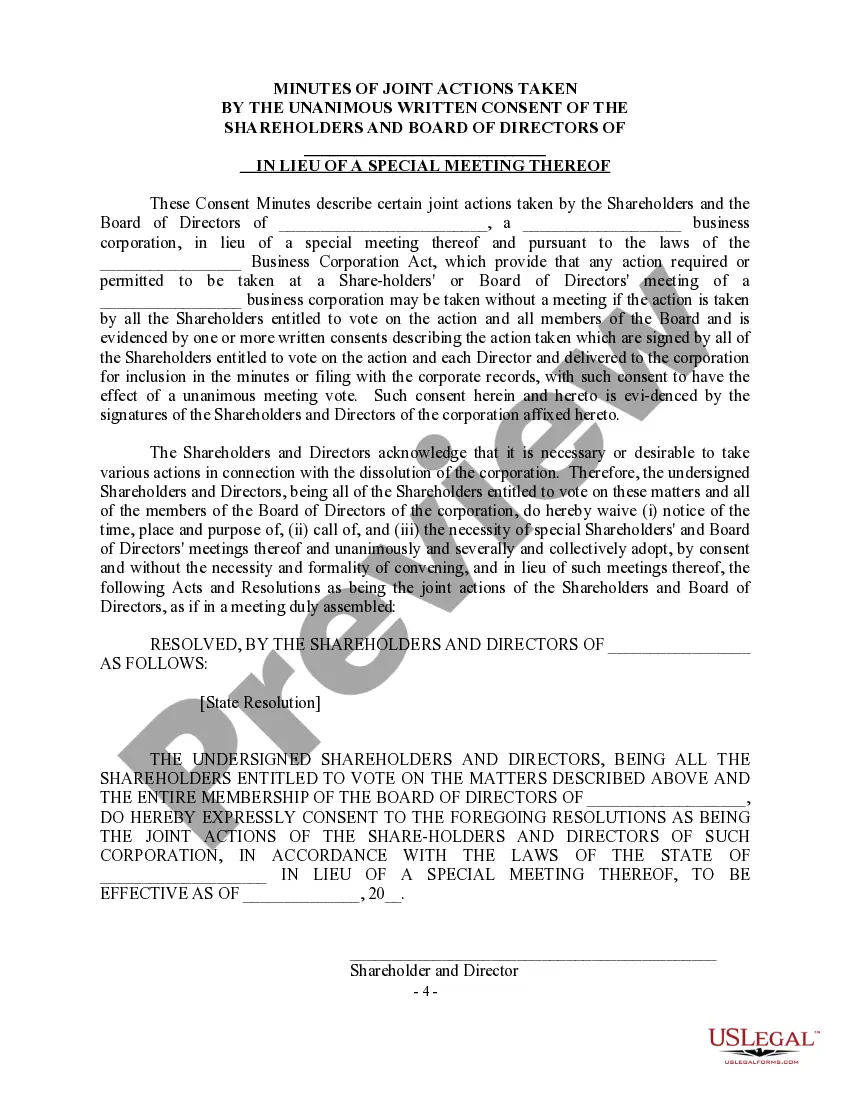

Filling out a board of directors resolution requires you to begin by clearly stating the purpose of the resolution. Next, include details related to the decision, followed by the names and signatures of the directors who approved it. When working on a resolution form board with withdrawal of fixed deposit, be sure to specify the fixed deposit terms and any other pertinent information necessary for clarity.

The format of a board resolution resembles a formal document that begins with a header indicating it as a resolution. It includes the date, the subject matter, and then a series of 'resolved' statements that articulate the decisions made by the board. It is wise to comply with the standards for a resolution form board with withdrawal of fixed deposit to ensure that all legal requirements are met.

A resolution's format generally includes a title, the date, a statement of the resolution, and a section for signatures. It is important to be clear and concise, stating the decision being made and its implications. When creating a resolution form board with withdrawal of fixed deposit, make sure to include details related to the specifics of the fixed deposit and the decision-making process.

To write an application for withdrawal of a fixed deposit, start by addressing the bank or financial institution holding the deposit. Include essential information such as your account number, the amount to be withdrawn, and the reason for withdrawal. You can use the resolution form board with withdrawal of fixed deposit to formalize this request, ensuring your intentions are clearly communicated.

A director's resolution typically outlines specific decisions made by the board regarding company operations. It includes the title of the resolution, the date it was approved, and signatures from the directors present. When using the resolution form board with withdrawal of fixed deposit, the document should clearly state the intent to withdraw funds and any relevant details about the fixed deposit.

To write an application for the closure of a fixed deposit, start with a formal greeting to the bank manager. Specify your account number and the reason for the closure. Ensure you request the necessary paperwork, such as a resolution form board with withdrawal of fixed deposit, to facilitate a quick and organized closure.

Writing an application for the withdrawal of a fixed deposit should be straightforward. Begin by addressing the bank manager and state your account details, including the FD number. Clearly mention your intent to withdraw the deposit, and include your request for a resolution form board with withdrawal of fixed deposit to expedite the process.

In the case of a federal bank, the penalty for premature closure of a fixed deposit can vary, typically involving a deduction of 1% from the applicable interest rate. This can significantly affect your total earnings, so it is essential to plan accordingly. To mitigate issues, use a resolution form board with withdrawal of fixed deposit to make your request formal.

The recent updates from the RBI regarding fixed deposits focus on improving customer rights and ensuring transparency in banking operations. Key changes include the need for clear disclosures related to interest rates and penalties for earlier withdrawals. To navigate these changes effectively, using a resolution form board with withdrawal of fixed deposit is advisable.