Irrevocable Living Trust Forms With Trust

Description

How to fill out Living Trust - Irrevocable?

Legal managing might be overpowering, even for skilled experts. When you are looking for a Irrevocable Living Trust Forms With Trust and do not get the a chance to devote searching for the appropriate and up-to-date version, the operations may be nerve-racking. A robust online form catalogue could be a gamechanger for anybody who wants to deal with these situations efficiently. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available to you at any moment.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any requirements you may have, from personal to business paperwork, all-in-one place.

- Make use of advanced tools to finish and manage your Irrevocable Living Trust Forms With Trust

- Gain access to a resource base of articles, tutorials and handbooks and resources relevant to your situation and requirements

Help save effort and time searching for the paperwork you need, and employ US Legal Forms’ advanced search and Preview feature to get Irrevocable Living Trust Forms With Trust and get it. In case you have a subscription, log in in your US Legal Forms profile, look for the form, and get it. Review your My Forms tab to find out the paperwork you previously saved as well as manage your folders as you see fit.

If it is the first time with US Legal Forms, register a free account and have unrestricted usage of all advantages of the library. Here are the steps to take after accessing the form you need:

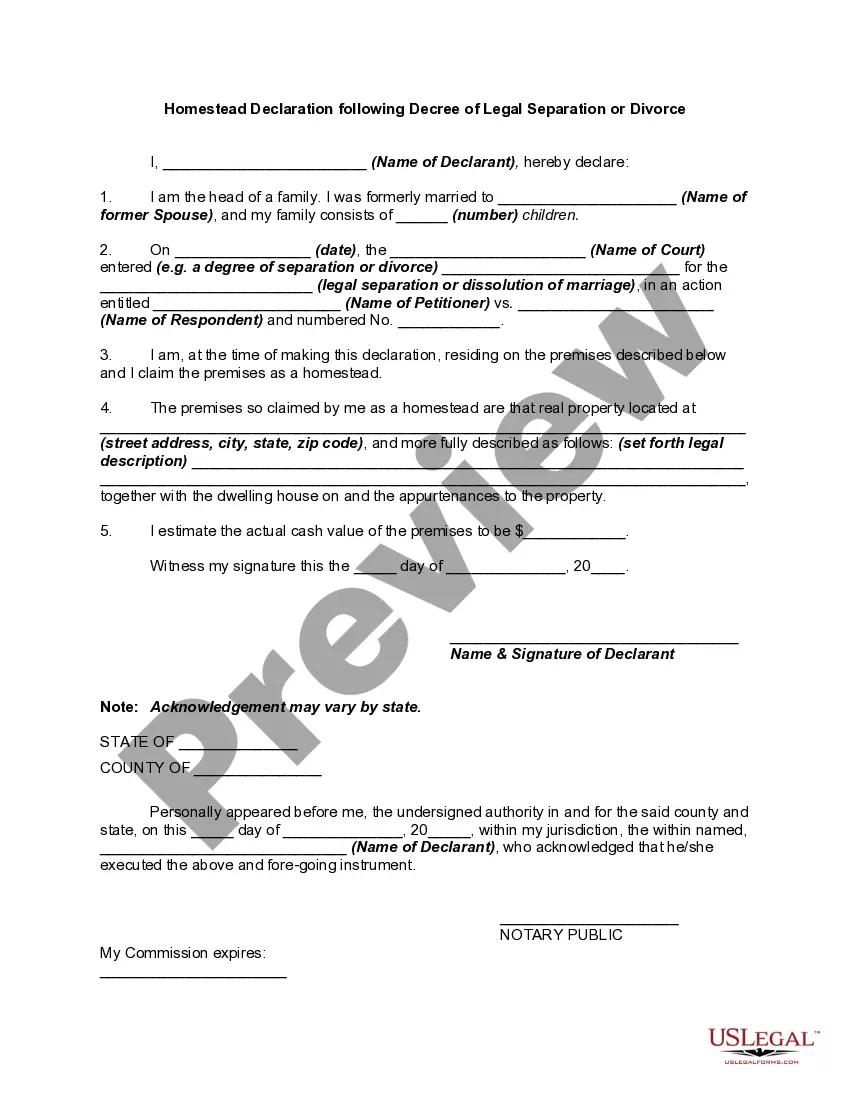

- Confirm it is the right form by previewing it and reading its information.

- Be sure that the sample is accepted in your state or county.

- Select Buy Now once you are ready.

- Select a monthly subscription plan.

- Pick the file format you need, and Download, complete, eSign, print and deliver your document.

Benefit from the US Legal Forms online catalogue, backed with 25 years of experience and reliability. Enhance your daily document managing into a easy and intuitive process right now.

Form popularity

FAQ

Don't use trust assets to pay personal expenses. Don't use trust assets to purchase an automobile (since all the assets in the trust will be exposed to liability if there is a car accident). Don't take principal or capital gains from trust assets. Don't transfer IRA's or 401(k)'s to the trust.

However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

Irrevocable trusts are generally set up to minimize estate taxes, access government benefits, and protect assets.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

Draft the written irrevocable trust agreement. Spell out which assets will be placed into the trust, name a trustee and beneficiaries, and outline the terms by which the trust assets will be distributed (how, when, to whom, etc.).