Finance Form Documents Without

Description

How to fill out Financial Statement Form - Husband And Wife Joint?

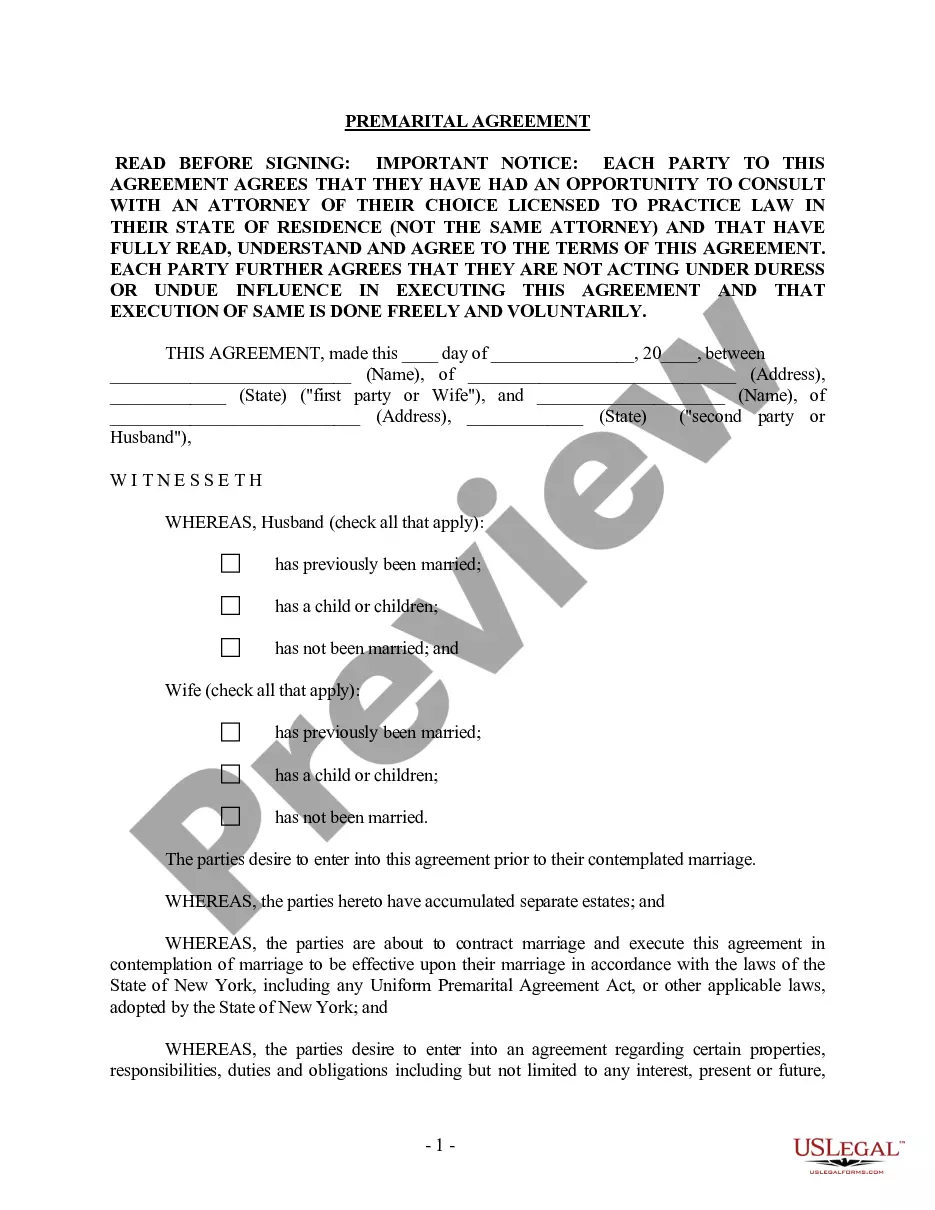

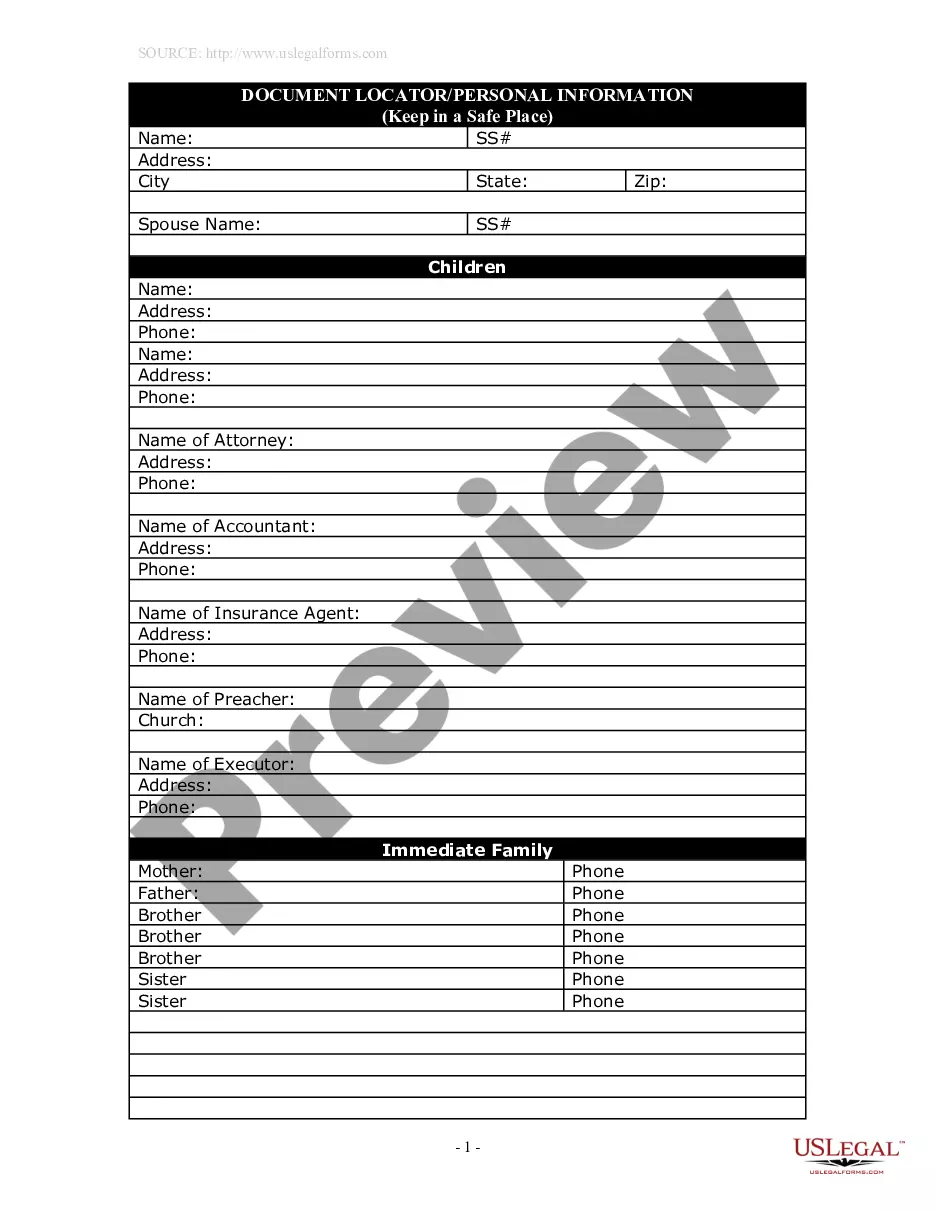

Whether for corporate matters or personal issues, everyone must confront legal circumstances at some point in their lives.

Filling out legal documents demands meticulous focus, beginning with selecting the proper form template.

With an extensive US Legal Forms catalog available, you will never need to waste time searching for the right sample across the web. Utilize the library’s user-friendly navigation to find the suitable template for any circumstance.

- For example, if you choose an incorrect version of the Finance Form Documents Without, it will be denied upon submission.

- Thus, it is vital to obtain a reliable source of legal documents like US Legal Forms.

- If you need to acquire a Finance Form Documents Without template, adhere to these simple steps.

- 1. Retrieve the sample you require using the search bar or catalog navigation.

- 2. Review the form’s details to confirm it aligns with your situation, state, and locality.

- 3. Click on the form’s preview to examine it.

- 4. If it is the incorrect form, return to the search functionality to locate the Finance Form Documents Without sample you require.

- 5. Obtain the template if it corresponds with your needs.

- 6. If you hold a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- 7. In case you don’t have an account yet, you may download the form by clicking Buy now.

- 8. Select the suitable pricing option.

- 9. Complete the account registration form.

- 10. Choose your payment method: you can utilize a bank card or PayPal account.

- 11. Pick the file format you desire and download the Finance Form Documents Without.

- 12. Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Unsubsidized federal student loans begin accruing interest immediately, so if you don't send the money back, you will have to pay interest on it at some point. The same is true if you have private student loans. Any overage you don't send back will start accruing interest immediately.

If you can't provide information about your parent, you can indicate that you have special circumstances that make you unable to get your parents' info. You'll then be able to submit your application without entering data about your parents. Although your FAFSA form will be submitted, it won't be fully processed.

While it's possible to apply for FAFSA without filing taxes, some schools might request additional verification or proof of non-filing status. It's essential to be prepared with the necessary documentation.

To complete the Free Application for Federal Student Aid (FAFSA®), you will need: Your Social Security Number. Your Alien Registration Number (if you are not a U.S. citizen) Your federal income tax returns, W-2s, and other records of money earned.

If you don't end up applying or getting accepted to a school, the school can just disregard your FAFSA form. However, you can remove schools at any time to make room for new schools.