A Deed of reconveyance without extinguishment of debt is a legal document that transfers the title or ownership of a property back to the borrower upon the completion of a mortgage or loan. Unlike a traditional reconveyance deed, which typically cancels the debt and releases the lender's lien on the property, a reconveyance without extinguishment of debt allows the borrower to maintain the existing loan or debt obligation. In this type of reconveyance, the lender acknowledges that the borrower has fulfilled their payment obligations under the loan agreement. The reconveyance deed is then executed to transfer the property title back to the borrower, removing the lender's claim on the property. Keywords: 1. Deed of reconveyance: This refers to the legal instrument used to transfer the property title back to the borrower. 2. Re conveyance without extinguishment of debt: This highlights the specific type of reconveyance that allows the borrower to retain the debt obligation after the transfer of property ownership. 3. Mortgage or loan: It denotes the underlying financial agreement between the borrower and the lender, requiring repayment for the property. 4. Title transfer: Describes the process of transferring the ownership rights from the lender back to the borrower. 5. Lien release: Refers to the removal of the lender's claim or encumbrance on the property. 6. Loan fulfillment: The borrower's completion of the payment obligations under the loan agreement. 7. Property ownership: Indicates the legal rights and ownership of a particular property. Different types of Deed of reconveyance without extinguishment of debt may include: 1. Partial Re conveyance Deed: In this variation, only a portion of the property's title is transferred back to the borrower while the loan or debt obligation remains intact. 2. Subordinate Re conveyance Deed: This type involves repositioning the priority of the lien or claim against the property, allowing the borrower to maintain the original loan agreement. 3. Collateral Re conveyance Deed: Here, the deed signifies the transfer of ownership for collateral securing the original loan, while the borrower continues their obligation to repay the borrowed funds. These different types of reconveyance without extinguishment of debt provide flexibility for borrowers who may prefer to retain their existing loan terms while regaining ownership of the property. It is crucial for both the borrower and the lender to consult legal professionals to ensure compliance with relevant laws and regulations when executing such deeds.

Deed Of Reconveyance Without Extinguishment Of Debt

Description

How to fill out Deed Of Trust - Release?

Acquiring legal document examples that adhere to federal and state regulations is essential, and the internet provides numerous choices to select from.

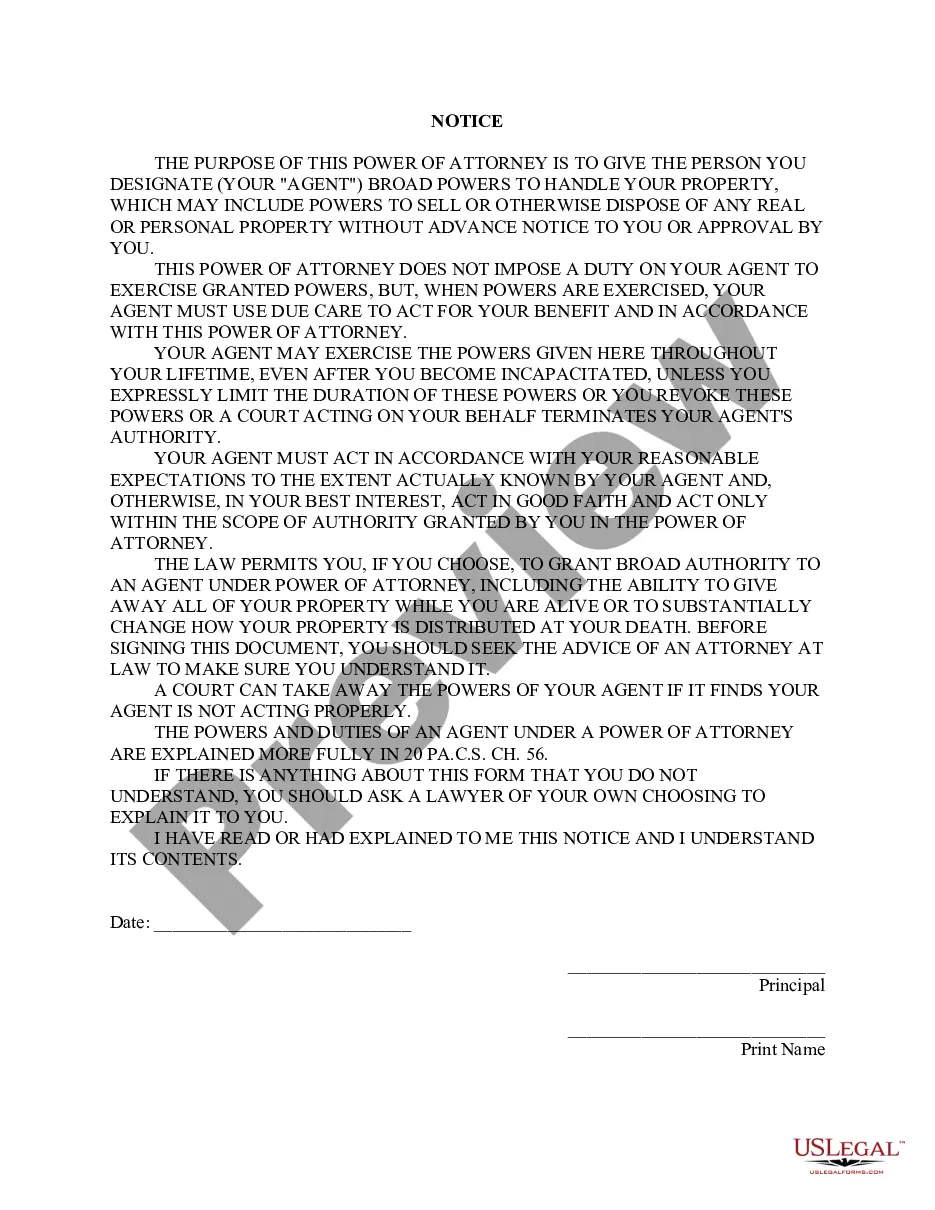

However, what is the advantage of spending time searching for the properly drafted Deed Of Reconveyance Without Extinguishment Of Debt template online when the US Legal Forms digital library already houses such documents collectively in one location.

US Legal Forms is the largest online legal repository with more than 85,000 customizable templates created by lawyers for any business and personal situation.

Examine the template using the Preview option or via the text outline to ensure it suits your requirements.

- They are easy to navigate with all documents categorized by state and purpose of use.

- Our specialists keep track of legislative changes, ensuring that your form is always current and compliant when obtaining a Deed Of Reconveyance Without Extinguishment Of Debt from our site.

- Getting a Deed Of Reconveyance Without Extinguishment Of Debt is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document example you need in the appropriate format.

- If you are new to our platform, follow the steps outlined below.

Form popularity

FAQ

A defeasance clause is a provision in some mortgage contracts indicating that the borrower will receive the title to the property once all of the mortgage payments have been made.

*To record the reconveyed deed, the property owner must go to the office of the Registrar-Recorder in which the property is located. For example, if the property is located in Los Angeles County, the reconveyed deed must be taken to the Los Angeles County Recorder's Office.

For example, a corporation may defease a bond issue by purchasing all of the outstanding bonds or by depositing cash or other securities with the issuer. Another example would be a lender who offers a defeasance clause to a borrower as an incentive to enter into a loan agreement.

As an example, say Sally decides to purchase a house, and in doing so, she needs to take out a mortgage of $300,000 from the bank. The new property acts as collateral under the deed of trust. Once Sally has fully paid off her mortgage, the trustee must then complete a ?Request for Reconveyance.?

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.