Transfer Shares Which Withdraws

Description

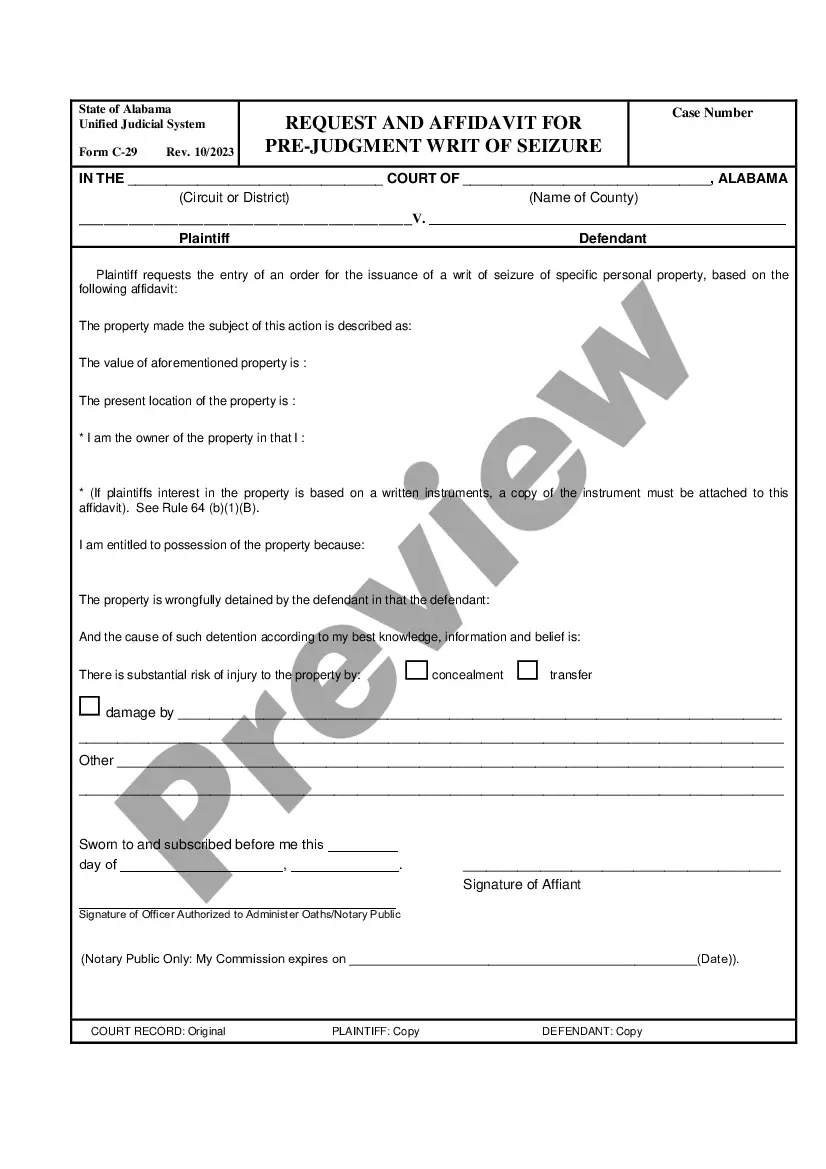

How to fill out Corporation - Transfer Of Stock?

Utilizing legal document examples that adhere to federal and local laws is crucial, and the internet provides numerous alternatives to select from.

However, what is the purpose of spending time searching for the suitable Transfer Shares Which Withdraws template online when the US Legal Forms digital library already consolidates such documents in one location.

US Legal Forms is the most extensive online legal repository with more than 85,000 fillable documents created by attorneys for any business and personal situation.

Review the template using the Preview feature or through the text description to verify it suits your requirements.

- They are straightforward to navigate with all documents organized by state and usage purpose.

- Our experts stay updated with legislative changes, ensuring that your form is current and compliant when acquiring a Transfer Shares Which Withdraws from our platform.

- Obtaining a Transfer Shares Which Withdraws is quick and easy for both existing and new users.

- If you already possess an account with a valid subscription, Log In and download the required document sample in the appropriate format.

- If you are unfamiliar with our website, follow the instructions below.

Form popularity

FAQ

Certainly, there is a way to transfer shares, and it usually involves filling out a transfer form provided by your brokerage or the company's transfer agent. You may need to provide the recipient's details and your share certificate information. Additionally, there might be fees or tax implications to consider. US Legal Forms can assist you in understanding the process and provide the necessary forms to ensure your share transfer is executed correctly.

Yes, you can transfer your shares to someone else, often referred to as a share transfer. This involves completing a transfer form, which typically requires both your signature and the recipient's information. It is important to check with your brokerage or transfer agent for any specific requirements or restrictions. Using US Legal Forms can help you find the right documentation to facilitate this transfer smoothly.

To get shares out of Computershare, log into your account and navigate to the 'Transfer Shares' section. Complete the necessary forms for withdrawal or transfer, ensuring you provide accurate information to avoid delays. You may also need to verify your identity through the platform's security measures. For a smoother experience, consider using US Legal Forms to access templates and instructions tailored for share transfers.

To process the transfer of shares, start by gathering the necessary documents, including the stock certificate and a signed transfer form. Next, contact your brokerage or the company's transfer agent for specific instructions on their process. Make sure to verify any fees associated with the transfer. Utilizing a platform like US Legal Forms can simplify this process by providing you with the required forms and guidance.

To file a share transfer form, first ensure that you have completed it with all necessary information and signatures. Then, submit the form to the company's registrar or the appropriate authority, following any specific filing procedures they have in place. Keep a copy of the submitted form for your records. Using uslegalforms can help guide you through the filing requirements specific to your situation.

When filling in a share transfer form, provide your full name and address, followed by the new owner's details. Include the number of shares being transferred and the name of the company. It's beneficial to review the form for any specific instructions or required signatures to ensure the transfer is valid and compliant with regulations.

To fill out a stock transfer ledger, start by noting the date of transfer, the names of the transferor and transferee, and the number of shares involved. Record any relevant transaction details, such as the share certificate number, if applicable. This ledger serves as an official record, so accuracy is essential. Using uslegalforms can simplify this process by providing clear formats and instructions.

Typically, the share transfer form requires both the current owner, known as the transferor, and the new owner, known as the transferee, to sign. The transferor's signature confirms the intention to transfer shares, while the transferee's signature indicates acceptance of the transfer. Ensure that both parties provide their details accurately to prevent any issues with the transfer process.

Withdrawing shares means removing them from a brokerage account or transferring ownership to another party. This action can occur when a shareholder decides to sell their shares or transfer them to a different account. Understanding the implications of withdrawing shares is crucial, especially regarding tax obligations and the impact on ownership. Always consult a professional if you are unsure.

Filling out a share transfer form involves providing essential information about the current shareholder and the new owner. Begin by entering your details as the transferor, including your name and address. Next, add the transferee's information, specify the number of shares being transferred, and sign the form. For a smooth process, consider using platforms like uslegalforms to access templates and guidelines.