Contract Contractor Building For Rent In Oakland

Category:

State:

Multi-State

County:

Oakland

Control #:

US-00462

Format:

Word;

Rich Text

Instant download

Description

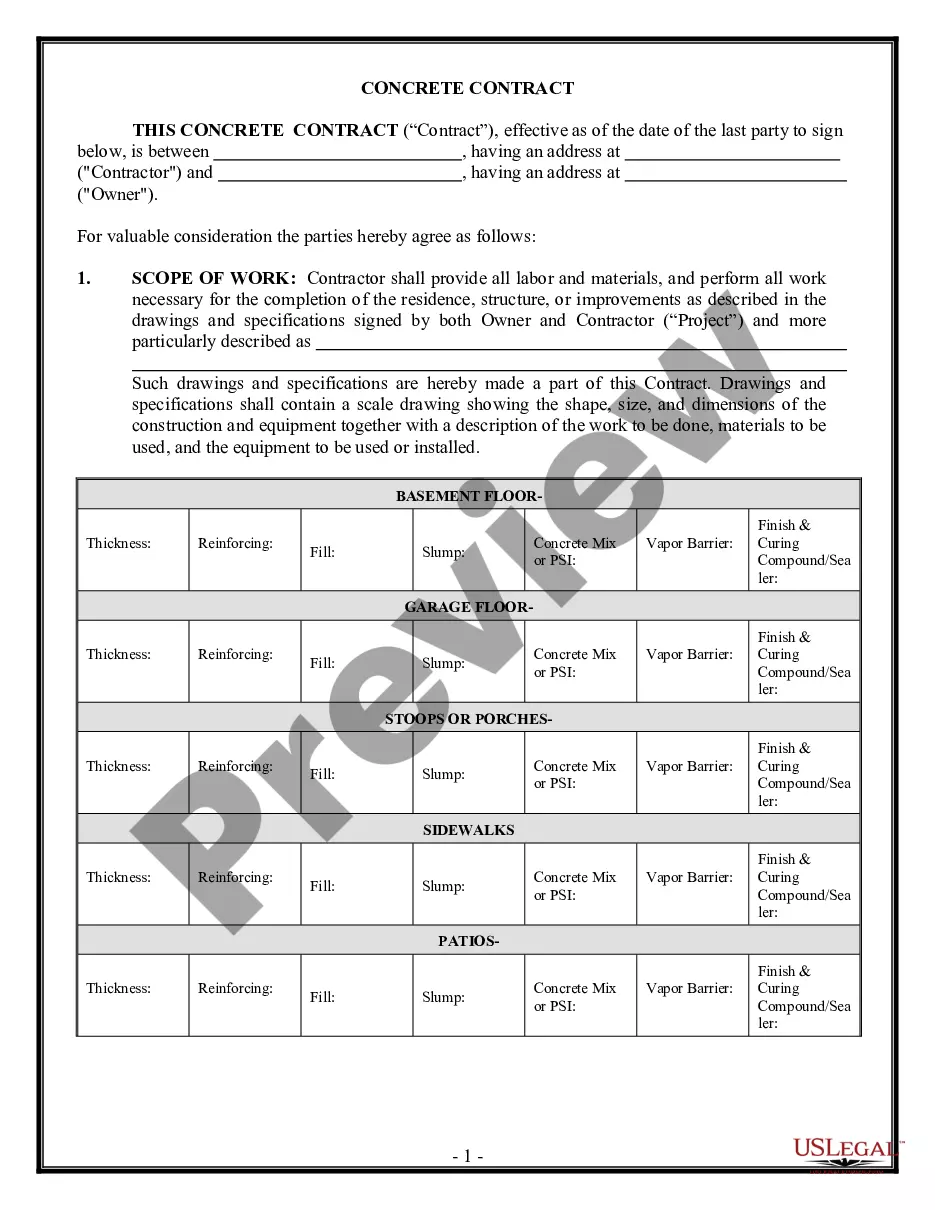

The Contract Contractor Building for Rent in Oakland is a formal agreement outlining the responsibilities and expectations between a contractor and an owner for construction projects. This document includes essential sections such as the scope of work, work site details, permits, and insurance requirements. The contractor is responsible for managing labor and materials according to the provided plans and specifications, while the owner must ensure the work site is ready and compliant with local regulations. Changes to the project's scope can be negotiated through written change orders, which may affect the overall cost. The contract specifies payment terms, including late fees and warranties for workmanship defects. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in construction and rental agreements, ensuring clarity and legal compliance in dealings. Users are advised to fill in specific details, review all terms carefully, and retain copies for their records.

Free preview

Form popularity

FAQ

Application Process You will receive an emailed containing your certificate from the Business Tax Office within 5 days.

5.04. 205 - Tax rates for Class A through Class S—Progressive rates. If annual gross receipts are:Then the business tax is: Not over $42,857.00 $60.00 Over $42,857.00 but not over $1,000,000.00 $60.00, plus $1.40 per $1,000.00 of annual gross receipts over $42,857.004 more rows

Rent Adjustment Program. The mission of the Rent Adjustment Program is to promote community stability, healthy housing, and diversity for Oakland residents, while preventing illegal rent increases and evictions, and ensuring a fair return for property owners.