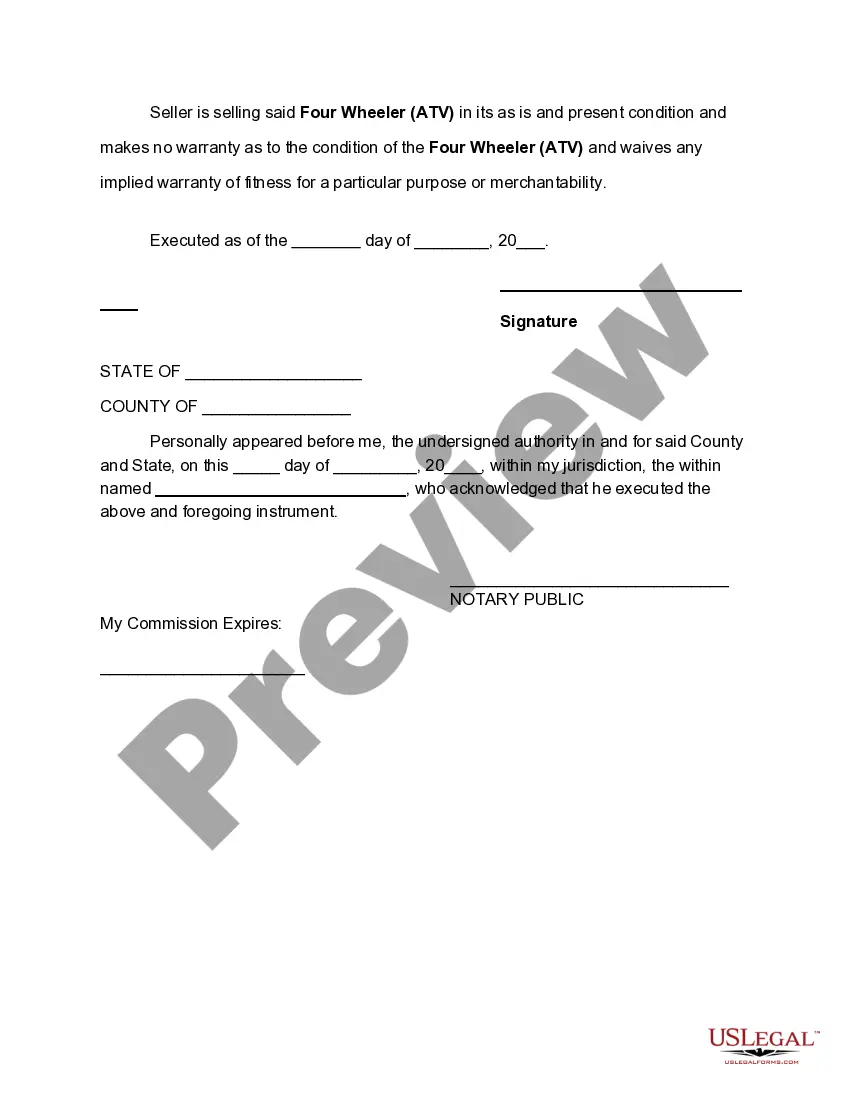

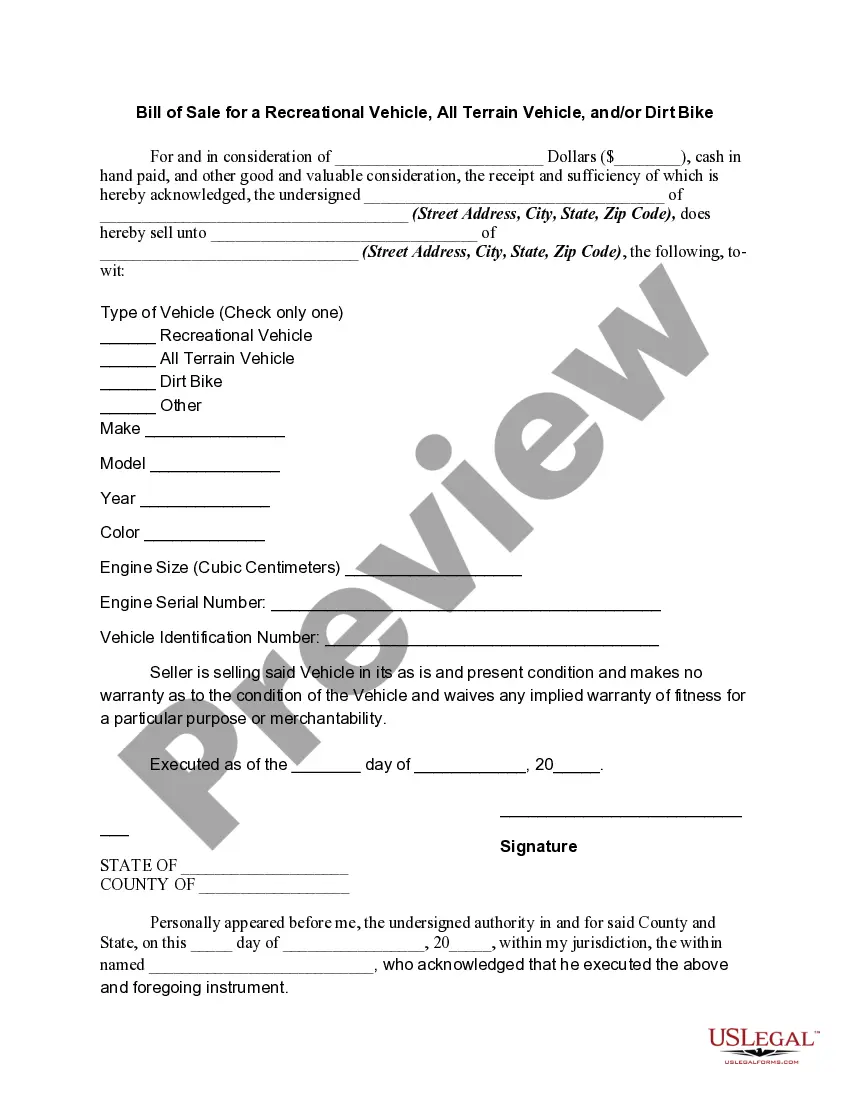

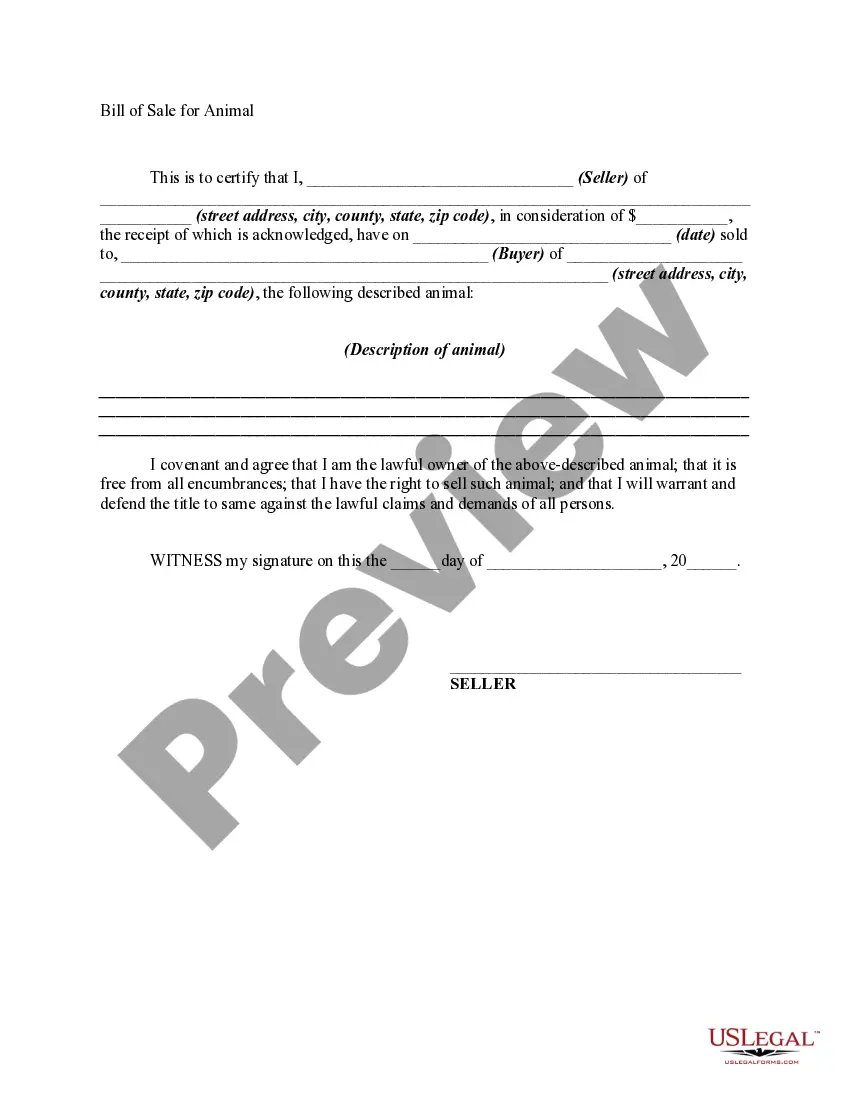

This form is a generic Bill of Sale for a Four Wheeler (ATV) from an individual rather than from a dealer. No warranty is being made as to its condition.

Atv Form With Decimals In Sacramento

Description

Form popularity

FAQ

To submit Form 568, you can e-file through the Franchise Tax Board's website. If choosing to submit by mail, send your completed form to the California Franchise Tax Board, P.O. Box 942840, Sacramento, CA 94240-0040. Make sure to keep a copy for your records.

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

H. Where to File Mail Form 100S with payment to: Mail Franchise Tax Board. PO Box 942857. Sacramento, CA 94257-0501. e-filed returns: Mail form FTB 3586, Payment Voucher for Corporations and Exempt Organizations e-filed Returns, with payment to: Mail Franchise Tax Board. PO Box 942857. Sacramento, CA 94257-0531.

This address is also used for other Western States mentioned earlier additional tips when mailingMoreThis address is also used for other Western States mentioned earlier additional tips when mailing your tax return make sure to double check the address to avoid any delays.

You must file California S Corporation Franchise or Income Tax Return (Form 100S) if the corporation is: Incorporated in California. Doing business in California. Registered to do business in California with the Secretary of State (SOS)

If you cancel your LLC within one year of organizing, you can file Short form cancellation (SOS Form LLC-4/8) with the SOS. Your LLC will not be subject to the annual $800 tax for its first tax year.

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

The purpose of Form 568 is to facilitate tax reporting for Limited Liability Companies in California. It ensures that LLCs comply with state regulations by accurately reporting income, deductions, and credits. This form is vital for fulfilling tax obligations and avoiding penalties.

To produce the amended return on the CA 565 or CA 568, select Amended Return under line G on federal screen 1 (Name, Address, and General Info.). Complete the amended return as necessary.