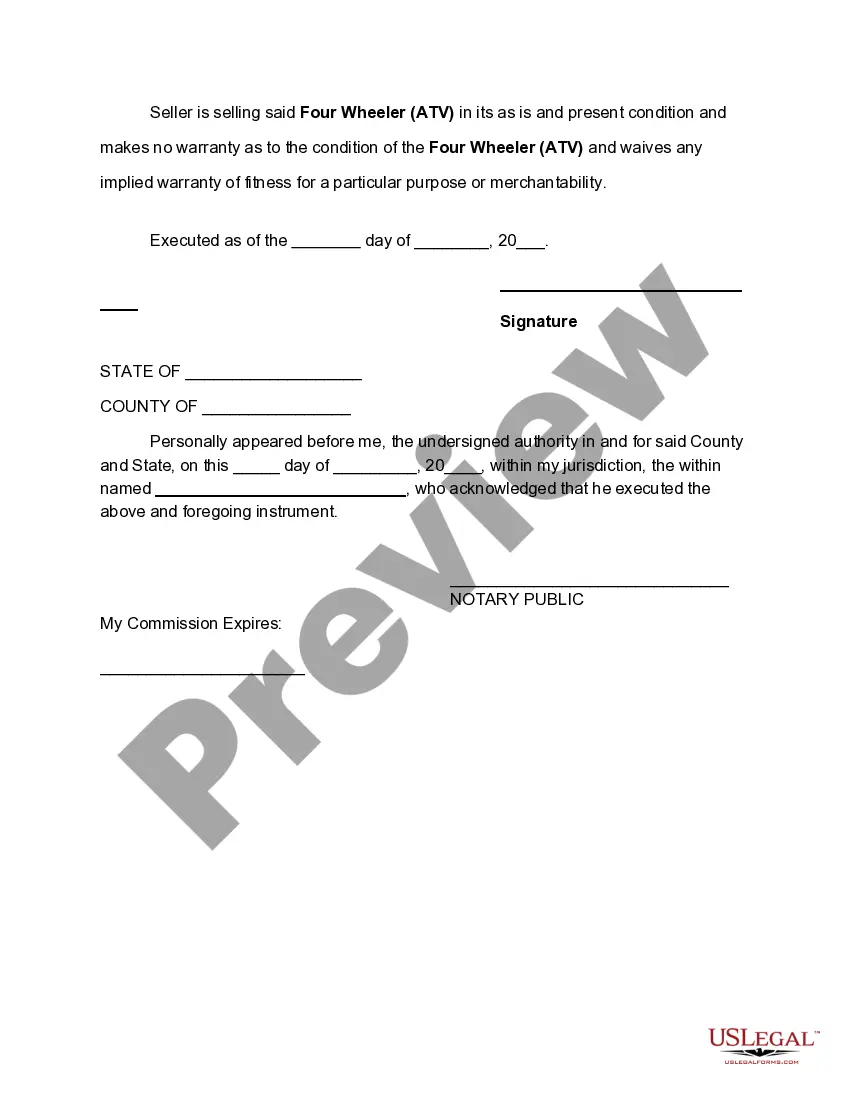

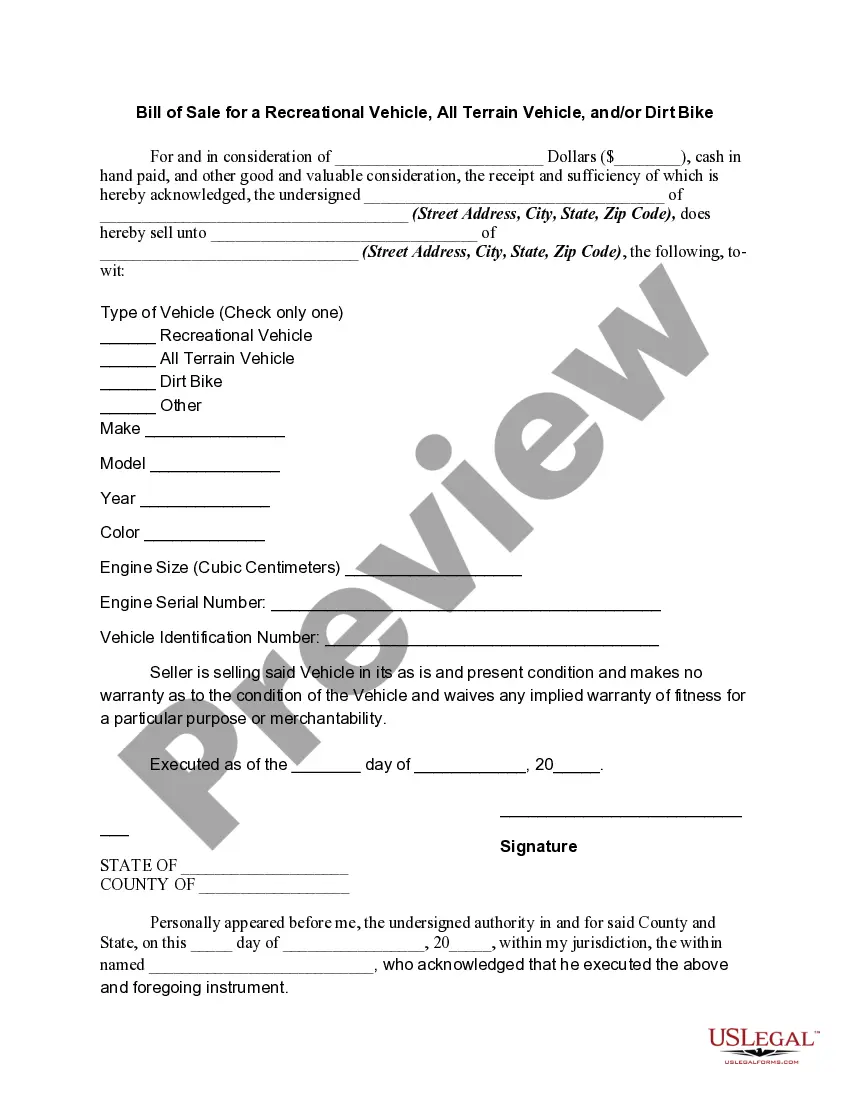

This form is a generic Bill of Sale for a Four Wheeler (ATV) from an individual rather than from a dealer. No warranty is being made as to its condition.

Bill Of Sale Form For Atv With Bad Credit In Illinois

Description

Form popularity

FAQ

Form RUT-50 is generally obtained when you license and title your vehicle at the local driver's license facility or currency exchange. If you need to obtain the forms prior to registering the vehicle, send us an email request or call our 24-hour Forms Order Line at 1 800 356-6302.

To gift someone a vehicle, you must transfer the vehicle title to their name and create a bill of sale. Selling a vehicle for $1 instead of gifting it could result in your recipient paying sales tax based on the car's fair market value — it's better to stick with the official gifting process.

RUT-50 Instructions for Private Party Vehicle Use Tax Transaction. Form RUT-50 General Information. Who must file Form RUT-50? You must file Form RUT-50, Private Party Vehicle Use Tax Transaction, if you purchased or acquired by gift or transfer a motor vehicle from a. private party.

RUT-25 is the Illinois sales tax form used when a vehicle is purchased out-of-state and titled in Illinois.

RUT-50 Instructions for Private Party Vehicle Use Tax Transaction. Form RUT-50 General Information. Who must file Form RUT-50? You must file Form RUT-50, Private Party Vehicle Use Tax Transaction, if you purchased or acquired by gift or transfer a motor vehicle from a. private party.

If you had the vehicle titled in another state for more than three months, no Illinois tax is due, but you still must file Form RUT-50 to reflect that fact. On Forms RUT-25 and RUT-50, the exemption for using the vehicle outside Illinois for more than three months applies only to individuals moving into Illinois.

RUT-25 is the Illinois sales tax form used when a vehicle is purchased out-of-state and titled in Illinois.

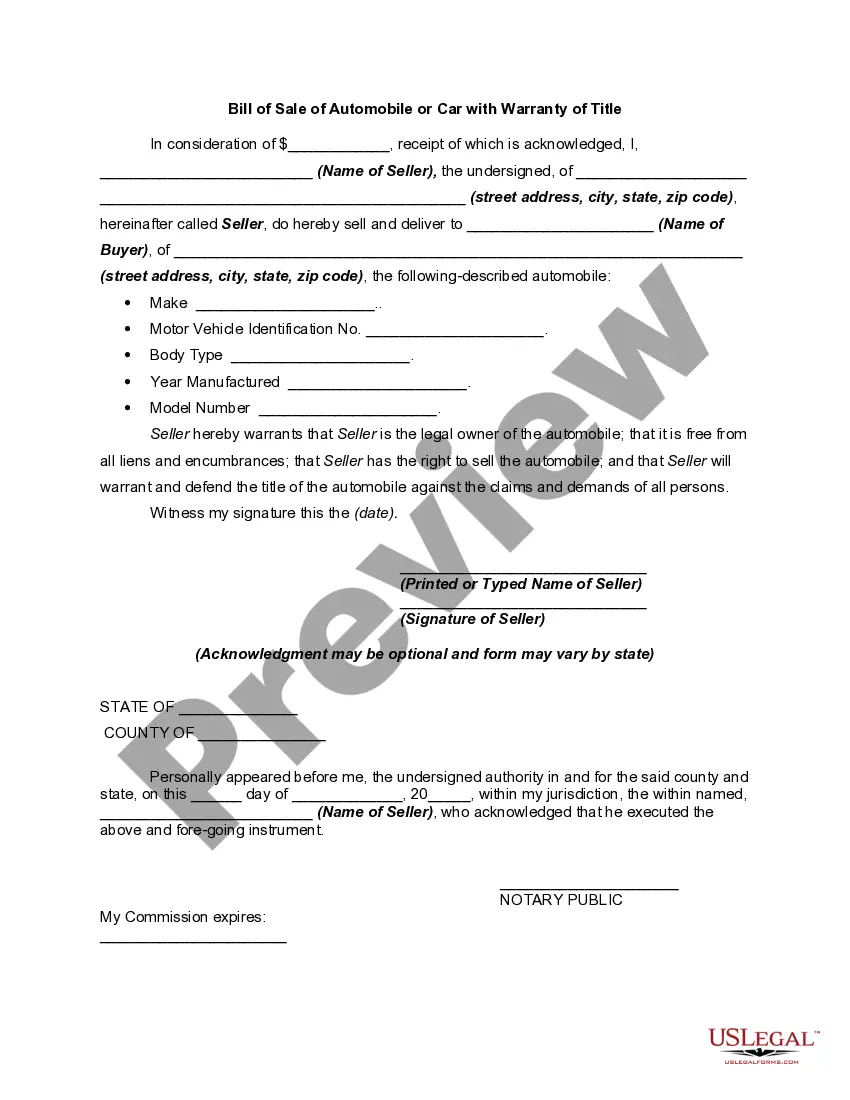

Does an Illinois Bill of Sale Have to Be Notarized? Bills of sale do not require notarization in the state of Illinois, but it is always an option.