S Corporation For Llc In Minnesota

Description

Form popularity

FAQ

Because of the one-class-of-stock restriction, an S corporation cannot allocate losses or income to specific shareholders. Allocation of income and loss is governed by stock ownership, unlike partnerships or LLCs taxed as partnerships where the allocation can be set in the partnership agreement or operating agreement.

FL, SD and WY are typically the best for no personal/business taxes. Nexus rules still apply to other states.

Wyoming, Delaware, and Nevada are among the top states for forming holding companies due to their favorable business environments, asset protection, and low taxes.

The appeal of Delaware and Nevada Some potential advantages of forming your corporation or LLC in Delaware include: Delaware's corporation and LLC laws are considered the most flexible in the country. The Court of Chancery has expertise in business law and uses judges instead of juries.

A limited liability company (LLC) is a business structure that blends characteristics of corporations and partnerships. LLCs must file their Articles of Organization with the Minnesota Secretary of State if they are: Based in Minnesota. Based in another state or country but doing business in Minnesota.

The following 10 states are among those most frequently cited as the best states to start a business in America. Texas. North Carolina. Indiana. South Dakota. Nevada. 1.17% General Business Modified Business Tax rate. Montana. 6.75% corporate tax rate. Alaska. 9.4% corporate tax rate. New Hampshire. 7.5% corporate tax rate.

S Corporation Tax applies to companies or organizations that file an annual federal income tax return as an S Corporation and meets at least one of the following: Located in Minnesota. Have a business presence in Minnesota.

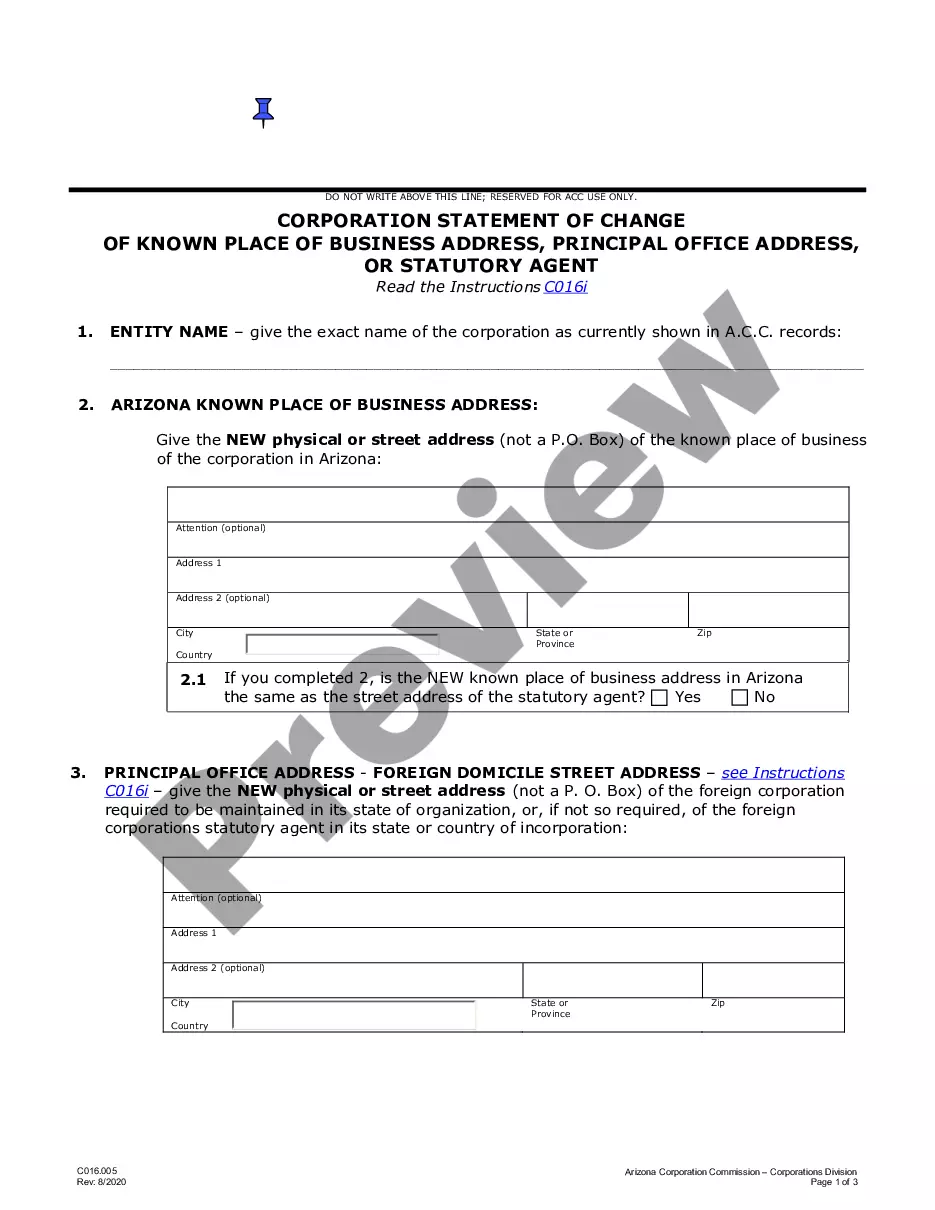

To form an S Corporation in Minnesota, you'll need to file Articles of Incorporation with the Secretary of State. Once the corporation is established, you'll need to file IRS Form 2553 to elect S Corporation status.

The IRS requires a single-member LLC to have an EIN if any of the following apply: It has employees. It files taxes as a corporation. It files any of these tax returns: excise, employment, or alcohol, tobacco, or firearms.

Most Minnesota businesses will need a Minnesota state tax ID number, but don't realize that this number is distinct from your federal tax ID number. Your Federal EIN (FEIN) number is often referred to simply as a “tax ID.” You may also hear it called an employer identification number, or EIN.