Credit Card Form Statement Without Bank In Phoenix

Description

Form popularity

FAQ

In short, no. You don't have to be an existing customer with a bank to open a credit card there. Widening your search to banks you don't already have a relationship with may even lead you to more rewarding offers. Here are some things to consider as you weigh all the options.

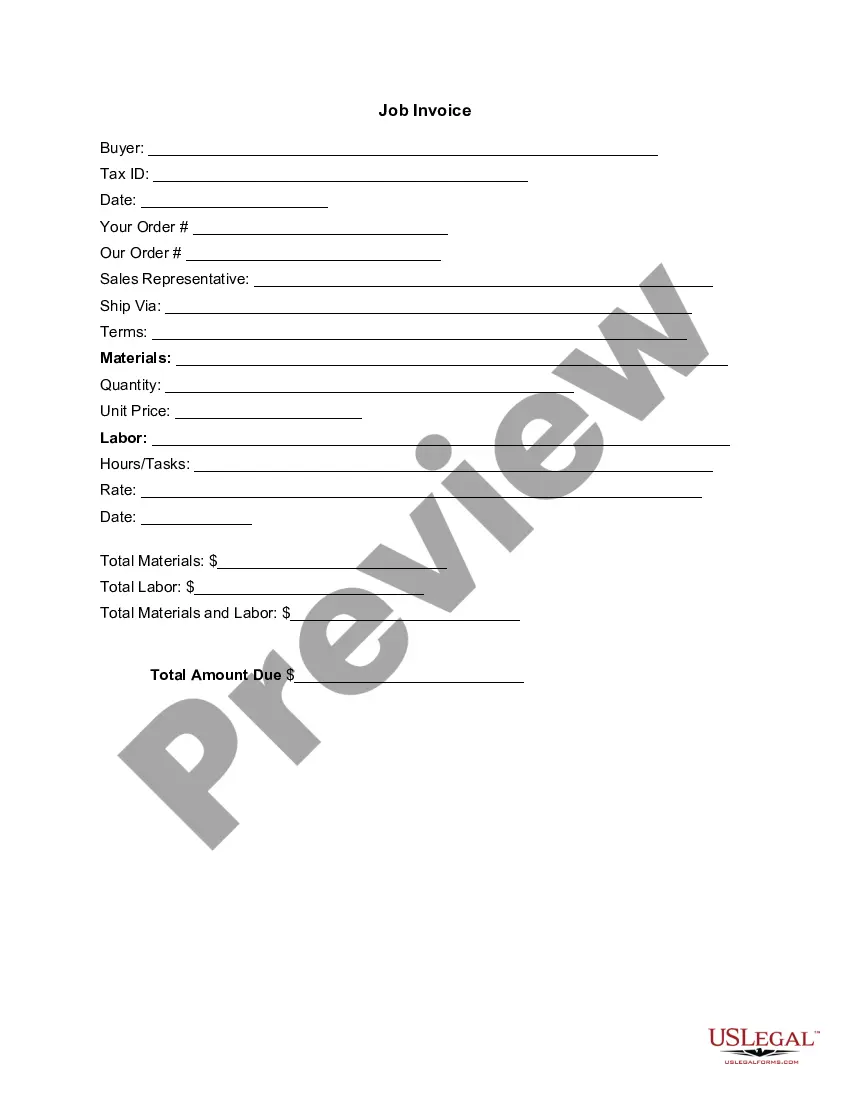

This form is typically used when the card is not present (such as for payments over the phone or via email) or recurring charges. It helps businesses get the necessary information to process the payment securely. Credit card authorization forms can be paper or electronic.

No, you cannot have a credit card without having a bank account. Credit cards are typically issued by banks or credit unions, and you must have a bank account in order to be approved for a credit card.

To access your credit card statement, you'll first have to create an online account via your card issuer's website. If you obtained a credit card through your current bank or credit union, your credit card account may be accessible through your existing online banking account.

The information on such a form must include: Cardholder's name. Card number. Card network (Visa, Mastercard, American Express, Discover, etc.) Card expiration date. Cardholder's billing zip code. Business name. Statement authorizing charges. Cardholder's signature and the date they signed.

Physical credit authorization forms have many security issues: They may get lost, stolen, or mishandled by employees. Having to type data manually may lead to errors and financial discrepancies. Physical forms are not encrypted, meaning anyone can read and understand the information.

You can get your credit card statement both online and offline. Online: Typically, the credit card issuer sends the credit card statement to the customer's registered email ID every month, also known as the billing date. You can also access it by logging into your net banking portal.

BC – Bank credit A credit from another bank or building society, or a merchant - for example, a refund for goods.

A bank statement is a document that your financial institution gives you, the account holder. It lists the transactions on your account over a set amount of time, usually monthly. Reviewing your statements regularly offers great insights into your spending habits and help with budgeting.

A bank statement is an official document that summarizes your account activity over a certain period of time—typically one month. You'll find records of all transactions—both incoming and outgoing—so you know exactly what was going on with your funds during that period.