Sample Letter Engagement Draft With Keepers In Fulton

Description

Form popularity

FAQ

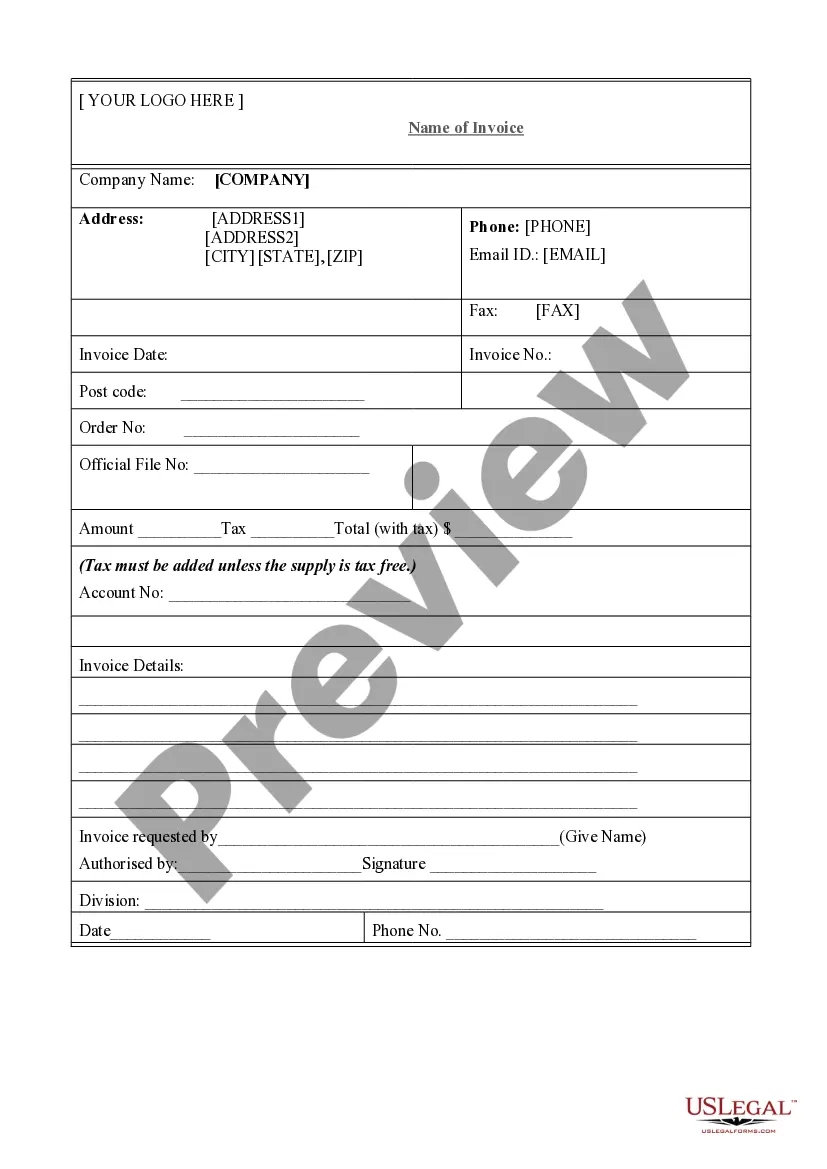

How to write an engagement letter Write the name of the business leader. Specify the purpose of the partnership. List the duties of the client. Identify the timeline for completing the project. Include resources the client delivers. Attach a disclaimer. Validate the terms of the agreement.

Purpose of Engagement Letters It's the responsibility of the service provider to draft this document in alignment with the services to be rendered and in compliance with legal and professional standards.

Engagement letters are essential for both bookkeeping and accounting services to set clear expectations and responsibilities. Bookkeeping letter of engagement focus on daily financial tasks like transaction recording, bank reconciliations, and basic financial reporting.

An engagement letter refers to a legal document that defines the relationship between a business providing professional services and its clients. Engagement letters set the terms of the agreement between two parties and include details such as the scope, fees, and responsibilities, among others.

Who Prepares a Letter of Engagement? An engagement letter is drafted by the company rendering the service, often with the help of a lawyer.

Engagement letters set expectations for both the client and the party providing the service, it specifies the exact service or task to be performed by the firm and the information to be provided by the client. All engagement letters also generally contain various deadlines for each sub-task.

8 Critical Elements of an Effective Engagement Letter CLIENT NAME. The first critical element may seem obvious—the identities of the parties involved in the engagement. SCOPE OF SERVICES. CPA FIRM RESPONSIBILITIES. CLIENT RESPONSIBILITIES. DELIVERABLES. ENGAGEMENT TIMING. TERMINATION AND WITHDRAWAL. BILLING AND FEES.

Engagement letters are important because they outline the expectations and responsibilities of both the bookkeeper and the client. They also help protect both parties in case of any disputes or misunderstandings, especially involving the scope of work to be completed.

Bookkeepers are frequently required to be bonded, either by their employer or to build trust with their customers. These are surety bonds and are provided by an insurance company as a guarantee of compensation in the event of dishonesty or malfeasance on the part of the bookkeeper.

8 Critical Elements of an Effective Engagement Letter CLIENT NAME. The first critical element may seem obvious—the identities of the parties involved in the engagement. SCOPE OF SERVICES. CPA FIRM RESPONSIBILITIES. CLIENT RESPONSIBILITIES. DELIVERABLES. ENGAGEMENT TIMING. TERMINATION AND WITHDRAWAL. BILLING AND FEES.