Engagement Letter Format For Chartered Accountants In Collin

Description

Form popularity

FAQ

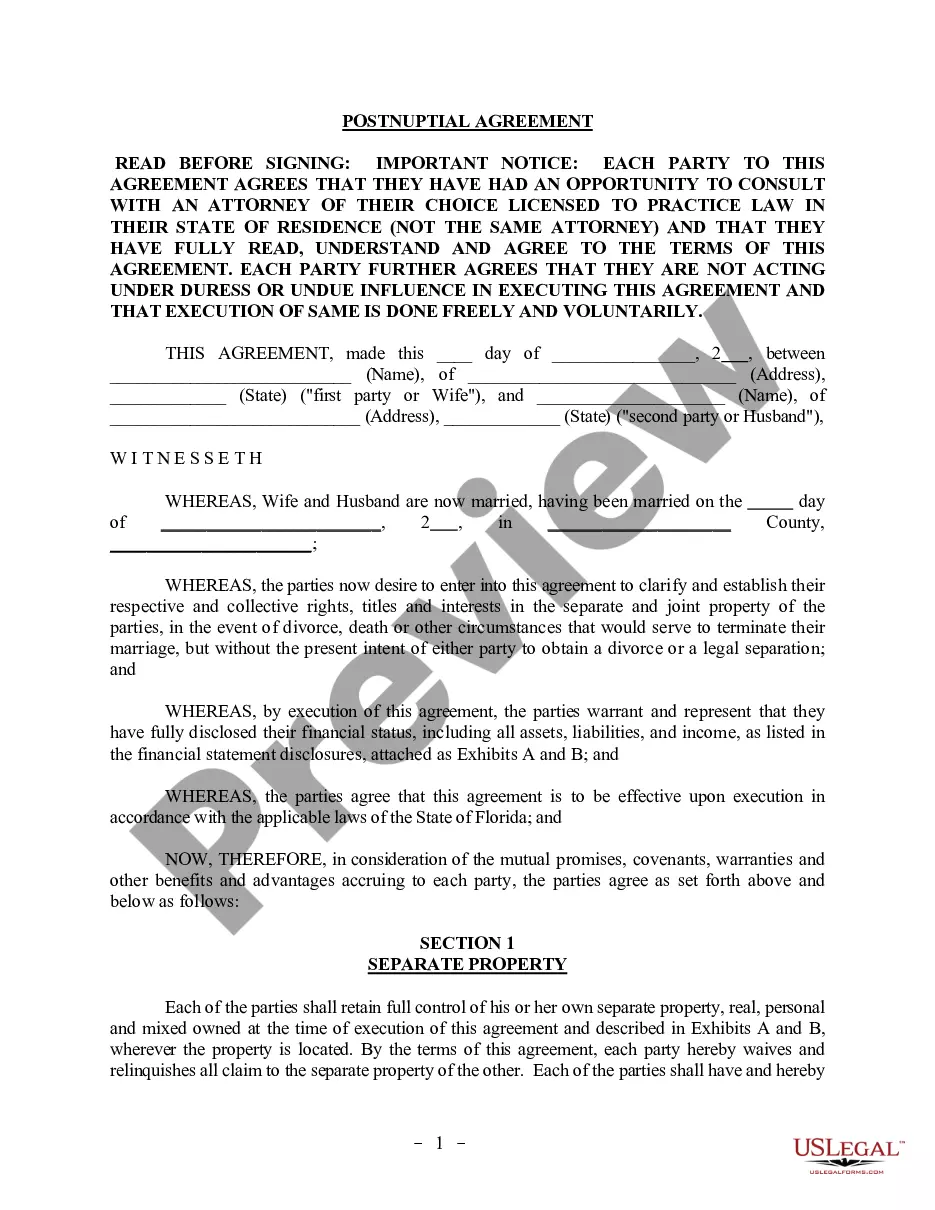

Engagement letters set the terms of the agreement between two parties and include details such as the scope, fees, and responsibilities, among others. Some of the benefits of engagement letters are that they are legally binding documents, they reduce misunderstandings, and they set clear expectations.

An accounting engagement letter is a comprehensive legal document that outlines and then details the terms of your business relationship with each client. Though it is generally shorter than a contract, it is legally binding and designed to reduce liability.

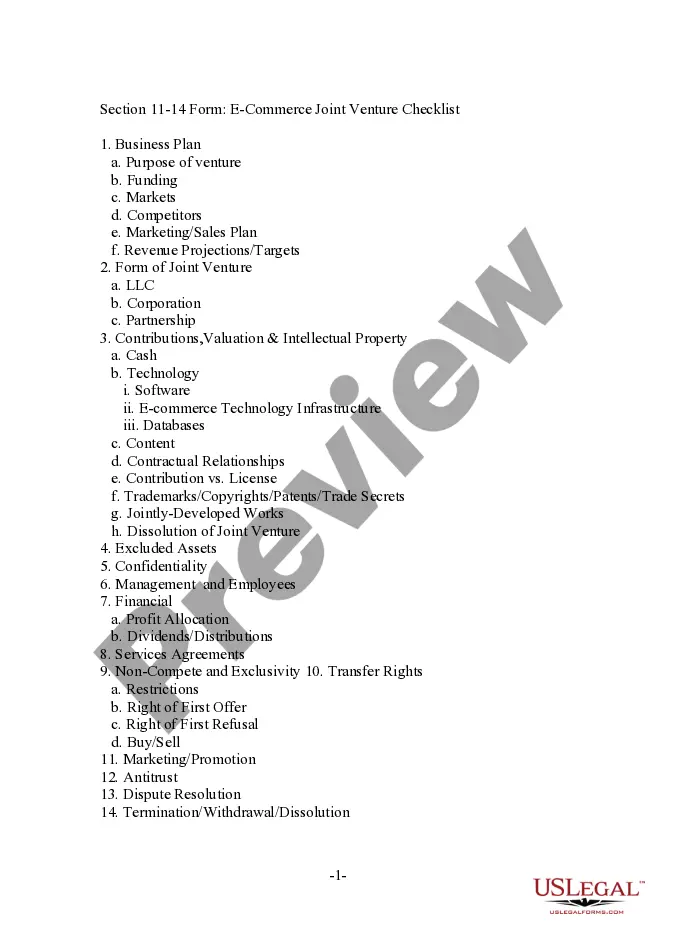

8 Critical Elements of an Effective Engagement Letter CLIENT NAME. The first critical element may seem obvious—the identities of the parties involved in the engagement. SCOPE OF SERVICES. CPA FIRM RESPONSIBILITIES. CLIENT RESPONSIBILITIES. DELIVERABLES. ENGAGEMENT TIMING. TERMINATION AND WITHDRAWAL. BILLING AND FEES.

The financial statement review engagement letter is designed to spell out the who, what and how of the review. It generally contains five parts: the introduction, the CPA responsibilities, the company responsibilities, the report and other matters. Like any contact it is a binding legal agreement if properly prepared.

The engagement letter is a legally binding document and the purpose of the engagement letter is to: Specify the parties of the audit engagement. Define the scope of the audit, including the in-scope services and systems. Specify the timeline of the audit and related deliverables.

An engagement letter protects the firm by provide a record of the contract between your firm and the client, and minimises the risk of any future misunderstandings between the parties. Information on the best ways to develop relationships with your clients.

We are pleased to accept the instruction to act as your bookkeeper/accountant and we are writing to confirm the terms of our appointment. The purpose of this letter is to set out our terms for carrying out the work and to clarify our respective responsibilities.

It is in the interests of both the entity and the auditor that the auditor sends an audit engagement letter before the commencement of the audit to help avoid misunderstandings with respect to the audit.

The IRS performs audits by mail or in person. The notice you receive will have specific information about why your return is being examined, what documents if any they need from you, and how you should proceed. Once the IRS completes the examination, it may accept your return as filed or propose changes.

Engagement letters set expectations for both the client and the party providing the service, it specifies the exact service or task to be performed by the firm and the information to be provided by the client. All engagement letters also generally contain various deadlines for each sub-task.