This is a generic form for the sale of residential real estate. Please check your state=s law regarding the sale of residential real estate to insure that no deletions or additions need to be made to the form. This form has a contingency that the Buyers= mortgage loan be approved. A possible cap is placed on the amount of closing costs that the Sellers will have to pay. Buyers represent that they have inspected and examined the property and all improvements and accept the property in its "as is" and present condition.

Purchase Agreement For Sale By Owner With An Fha Loan In Travis

Description

Form popularity

FAQ

If you're asking whether you need a lawyer to draft a contract, legally, the answer is no. Anyone can draft a contract on their own and as long as the elements above are included and both parties are legally competent and consent to the agreement, it is generally lawful.

How to make a contract in 7 steps Step 1: Outline the basics. Step 2: Define the key terms and scope of work. Step 3: Set payment terms. Step 4: Include protective clauses. Step 5: Negotiate. Step 6: Get a contract review. Step 7: Sign and date.

How do you write a contract for sale? Title the document appropriately. List all parties involved in the agreement. Detail the product or service, including all rights, warranties, and limitations. Specify the duration of the contract and any important deadlines.

If you're set on buying a house without your spouse's name on the deed, you'll need to rustle up a sole ownership agreement faster than a jackrabbit on a date. This legal document clarifies that the home is your separate property, and it's as essential as having a good fence on your property.

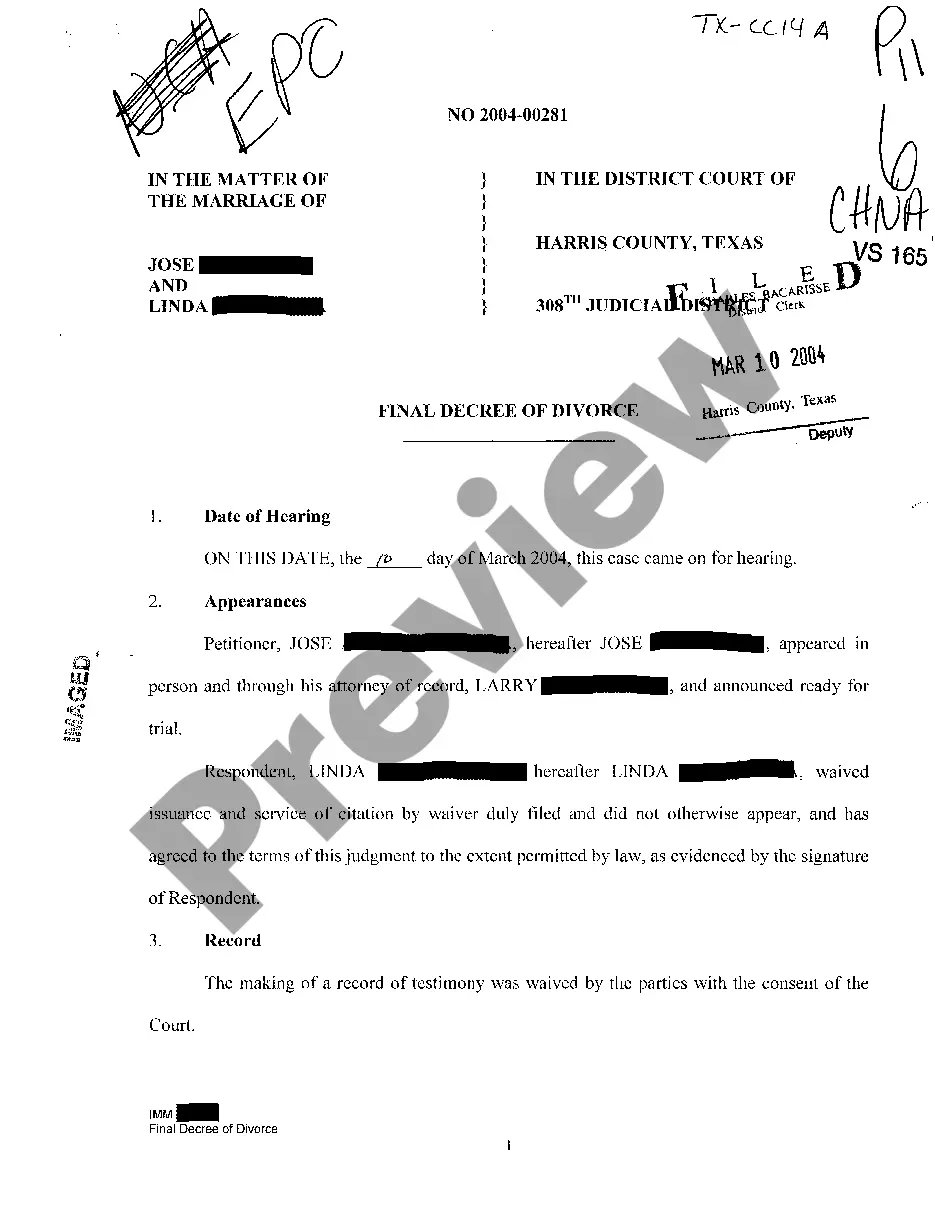

The non-purchasing spouse needs to sign closing documents to acknowledge the debt being placed against their home. It's imperative that a non-purchasing spouse be present a closing to sign the closing documents when purchasing or refinancing a primary home in a community property state (like Texas).