Closing Property Title Format In Orange

Description

Form popularity

FAQ

Annual property tax bills are mailed every year in October to the owner of record as of January 1 of that year. If you do not receive the original bill by November 1, contact the County Tax Collector or Assessor for a duplicate bill. Note, the original bill may still have the prior owner's name on it the first year.

They provide proof of ownership. Help establish property rights and can be used in legal disputes orMoreThey provide proof of ownership. Help establish property rights and can be used in legal disputes or when selling or refinancing a property. They are like the DNA of Real Estate.

Public records California law is very clear. It states that property records, once recorded with the county recorder, become public record. This means anyone can view these records, but the depth of information available to the public varies.

For more recent records (including birth certificates, property records, and tax liens), please contact the Orange County Clerk-Recorder at (714) 834-2500 or click on the “ Clerk-Recorder Home Page ” link.

For more recent records (including birth certificates, property records, and tax liens), please contact the Orange County Clerk-Recorder at (714) 834-2500 or click on the “ Clerk-Recorder Home Page ” link.

Public records California law is very clear. It states that property records, once recorded with the county recorder, become public record. This means anyone can view these records, but the depth of information available to the public varies.

The Clerk-Recorder manages the indexing and archiving of all these essential records to give the public access. Researchers and homebuyers can visit the Clerk-Recorder's office locations to look up current and historical property records for parcels in Orange County.

The following should help you find out who owns property in California so you can approach them about potential deals. Contact the county tax assessor's office. Reach out to the county clerk or recorder. Knowing the property owner isn't always enough. Get accurate information quickly from a membership database.

For more recent records (including birth certificates, property records, and tax liens), please contact the Orange County Clerk-Recorder at (714) 834-2500 or click on the “ Clerk-Recorder Home Page ” link.

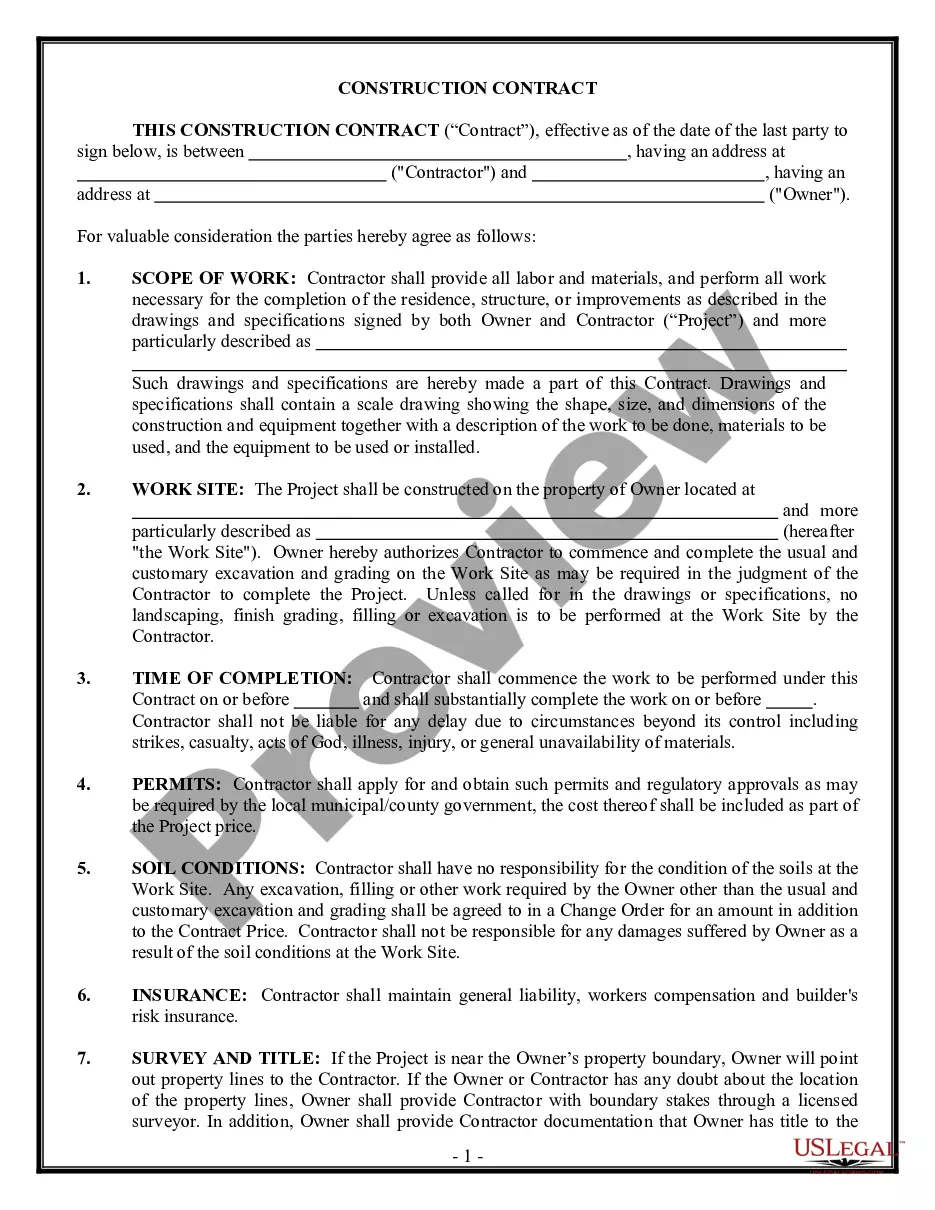

First, you need to make sure you fill out the quitclaim deed properly and get it notarized. Next, take the quitclaim deed to the County Recorder's Office. Make sure to file a Preliminary Change of Ownership Report and a Documentary of Transfer Tax or a Notice of Exempt Transaction.