This is a generic form for the sale of residential real estate. Please check your state=s law regarding the sale of residential real estate to insure that no deletions or additions need to be made to the form. This form has a contingency that the Buyers= mortgage loan be approved. A possible cap is placed on the amount of closing costs that the Sellers will have to pay. Buyers represent that they have inspected and examined the property and all improvements and accept the property in its "as is" and present condition.

Closing Property Title For Liens In Maricopa

Description

Form popularity

FAQ

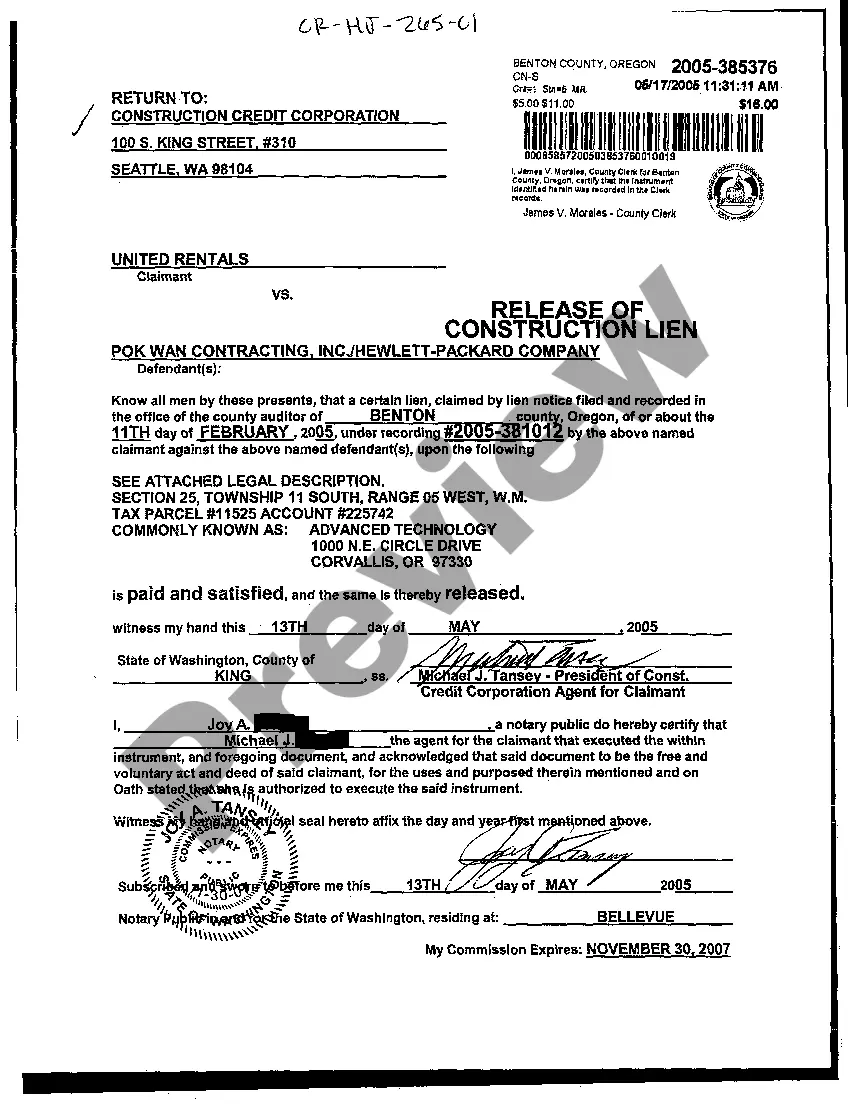

Yes, a house can be sold with a lien on it, but the process involves additional steps to ensure a smooth transaction. The lien typically needs to be resolved before or during the sale to provide the buyer with a clear title. Buyers and lenders usually require assurance that the lien will not transfer with the property.

Can Property Liens Expire in Arizona? Yes, under certain legal circumstances property liens can expire in Arizona based on the statute of limitations. The law of rules determines the maximum time frame a creditor can legally enforce a debt through a property lien.

How long does a judgment lien last in Arizona? A judgment lien in Arizona will remain attached to the debtor's property (even if the property changes hands) for five years.

Except as provided in sections 33-1002 and 33-1003, every person who labors or furnishes professional services, materials, machinery, fixtures or tools in the construction, alteration or repair of any building, or other structure or improvement, shall have a lien on such building, structure or improvement for the work ...

In Arizona, an individual may buy tax liens and gain up to 16% on their investment if they are redeemed. If they are not redeemed, the investor may foreclose upon the home after three (and up to 10 years). The process is relatively straightforward.

Arizona has a flat income tax rate of 2.5% for all tax filers. Arizona also allows a subtraction of up to $2,500 for U.S. government civil service, military pensions and state or local pension income. Pensions from other states do not qualify.

A tax lien sale is held in February each year in ance with ARS 42-18112.

1. Within three years after the date of sale. 2. After three years but before the entry of a judgment foreclosing the right to redeem or the delivery of a treasurer's deed to the purchaser or the purchaser's heirs or assigns.