Rules For Document Retention In Washington

Description

Form popularity

FAQ

A document retention policy (DRP) (also known as a records and information management policy, recordkeeping policy, or a records maintenance policy) that sets out a company's expectations for how its employees should manage company information from creation through destruction.

Income tax returns and payment checks. Important correspondence. Legal documents. Vital records (birth / death / marriage / divorce / adoption / etc.)

Bank statements: All business banking, credit card, and investment statements, as well as canceled checks, should be kept for seven years, possibly longer, depending on your business or tax circumstances. Hiring records: Keep job advertisements, applications, and resumes on file for at least one year.

The law requires businesses to keep complete and adequate records for a period of at least five years. In general, records should be kept that provide: The amount of gross receipts and sales from all sources, including barter or exchange transactions.

Good record keeping is an important element of running a successful business. The law requires businesses to keep complete and adequate records for a period of at least five years.

On the Data lifecycle management page, click the Retention policies tab, then click New retention policy. In the Name field, give your new retention policy a descriptive name. Choose the type of retention policy: adaptive or static. Decide if you want to retain content, delete it, or both.

Six Key Steps to Developing a Record Retention Policy STEP 1: Identify Types of Records & Media. STEP 2: Identify Business Needs for Records & Appropriate Retention Periods. STEP 3: Addressing Creation, Distribution, Storage & Retrieval of Documents. STEP 4: Destruction of Documents. STEP 5: Documentation & Implementation.

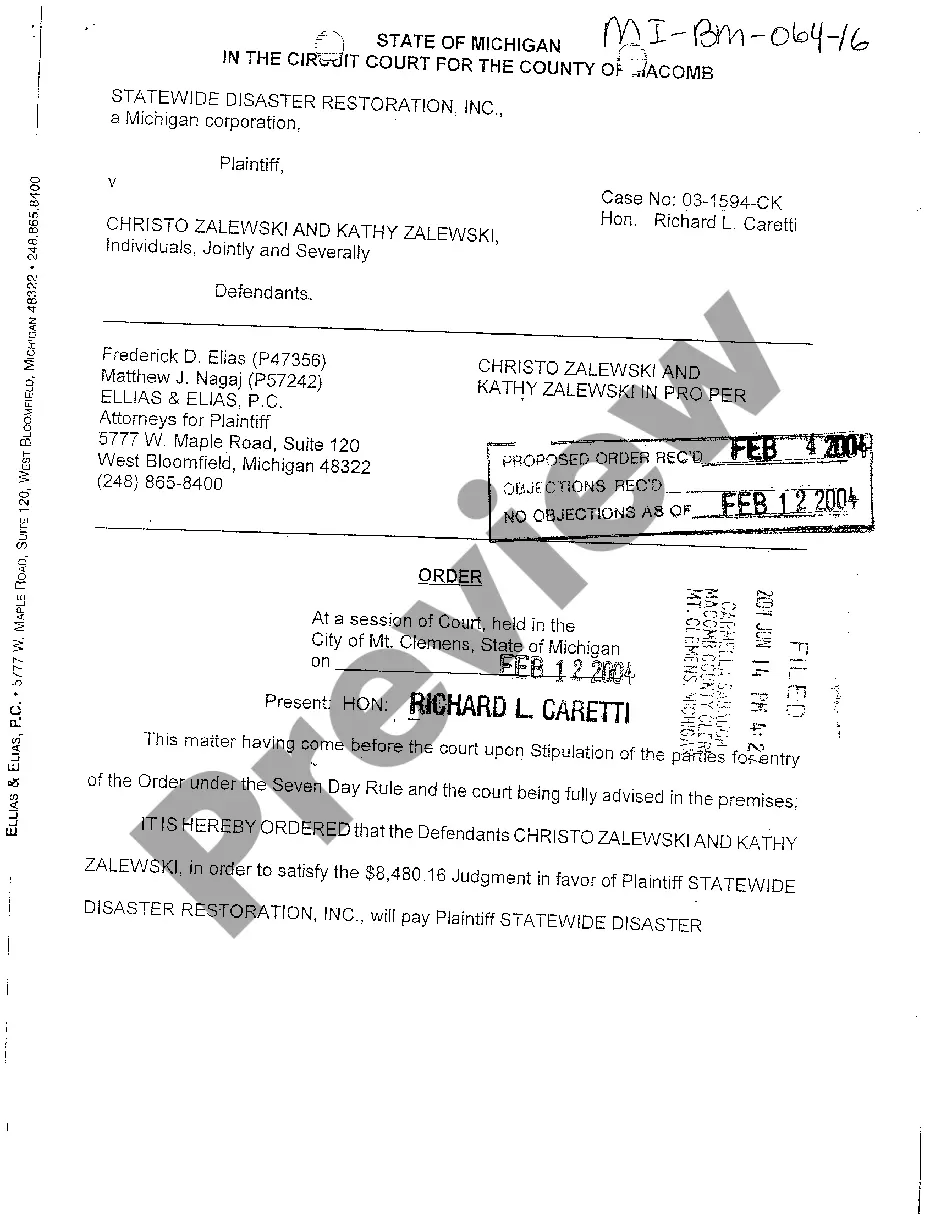

Contract Action 7 years after satisfaction of judgment, dismissal, or settlement. is most appropriate, such as based on the client's last known residence. Excluding tax, 10 years after final judgment; tax basis information should be kept permanently.

Record Retention Schedule for Businesses DocumentRetention Period Contracts and leases (expired) 7 years Correspondence, general 2 years Correspondence, legal and tax related Permanently Deeds, mortgages and bills of sale Permanently36 more rows

Assign retention labels and archive policies Go to the Microsoft 365 sign-in page. In the message list or the folder pane, right-click the message or folder that you want to assign a policy to, then select Assign policy. Select the retention label or archive policy you want to assign to the message or folder.