Bylaws Of The Corporation Form Of Business Ownership In California

Description

Form popularity

FAQ

LLCs are not required to have bylaws. However, they are governed by an operating agreement which is like a corporation's bylaws.

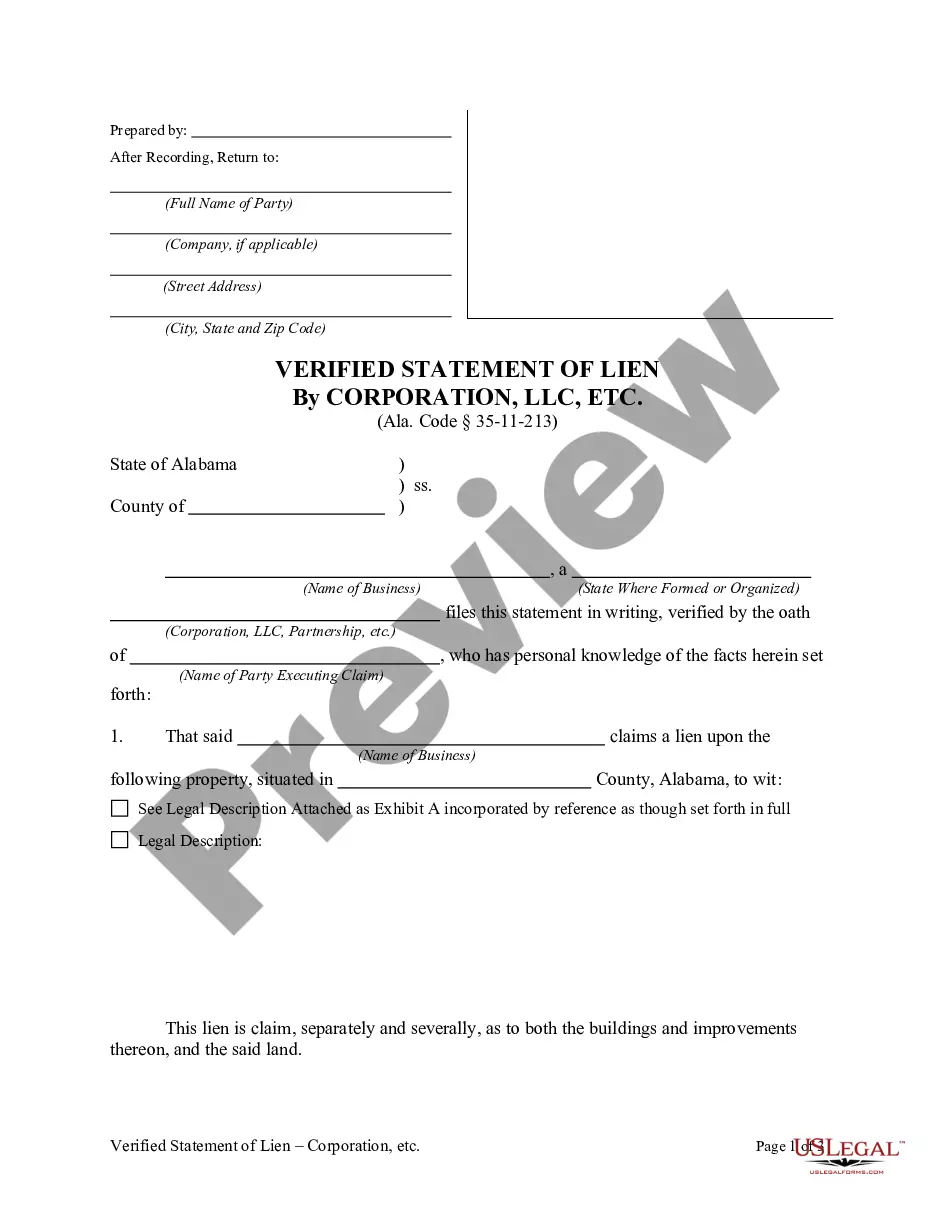

"The law requires any person or legal entity acquiring ownership control in any corporation, partnership, limited liability company, or other legal entity owning real property in California subject to local property taxation to complete and file a change in ownership statement with the State Board of Equalization at ...

Every California and registered foreign limited liability company must file a Statement of Information with the California Secretary of State, within 90 days of registering with the California Secretary of State, and every two years thereafter during a specific 6-month filing period based on the original registration ...

There's also the fact that if you don't list the number of directors in your Articles of Incorporation, you're legally required to list that information in your bylaws (see California Corp Code § 212). The bottom line: corporate bylaws are not legally required, but they're pretty much essential for your corporation.

To submit Form SI-100, you may file it online at the California Secretary of State's website or mail it to the Statement of Information Unit at P.O. Box 944230, Sacramento, CA 94244-2300. For in-person submissions, visit the Sacramento office located at 1500 11th Street, Sacramento, CA 95814.

LLCs are not required to have bylaws. However, they are governed by an operating agreement which is like a corporation's bylaws.

It is important to realize, however, that bylaws are not required as a matter of law with one exception. Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation.

There's also the fact that if you don't list the number of directors in your Articles of Incorporation, you're legally required to list that information in your bylaws (see California Corp Code § 212). The bottom line: corporate bylaws are not legally required, but they're pretty much essential for your corporation.

Whether the LLC is member managed or manager managed, the LLC may have officers, including a president, chief financial officer, and secretary. Corp C §17154. Officers, like managers, may, but need not, be members.