Sample Claim Statement With Debt Recovery In Wake

Description

Form popularity

FAQ

What are the different types of recovery? Amicable debt collection. Judicial collection. Debt collection by assignment. Debt collection through a debt collection agency. Conclusion.

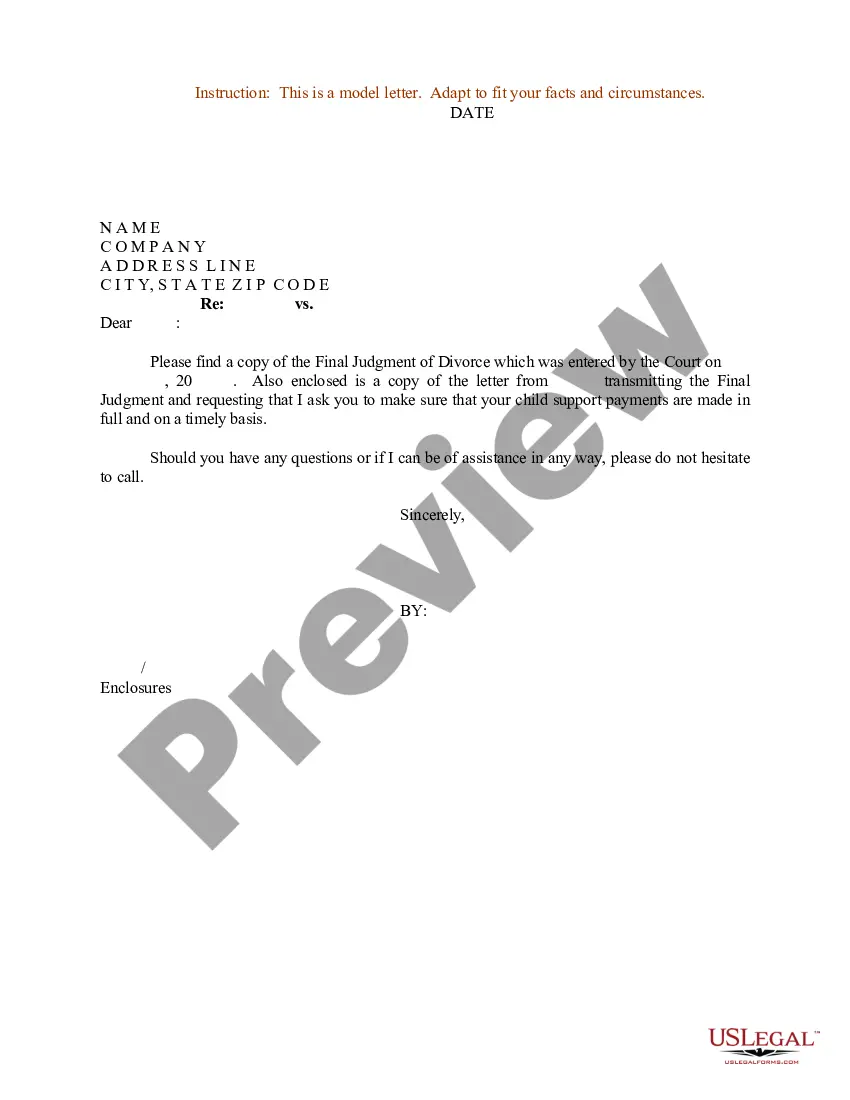

A letter before action (also known as a 'letter of claim' or 'letter before claim') is the first step in a formal debt recovery process. It is a notice sent out by a creditor's solicitor to let the debtor know that the creditor is planning to take legal action against them.

As the payment is due for a long, we would appreciate it if you could make the full amount deposit at the earliest. I request you to kindly look into the matter within the next six working days. In case of failure of payment, strict legal action will be taken. Kindly acknowledge the matter.

Some brief guidelines, letters should: Be addressed to 'Dear You' Written in the first person e.g. 'I felt that...' Be up to 1,000 words in length, preferably less. Be supportive and give comfort to the person reading the letter. Use your first name or a pseudonym to end the letter.

Developing a Debt Revenue Recovery Strategy Be clear about the rights and obligations of debtors from the beginning. Be proactive rather than reactive. Give debtors options. Make debt collection friendlier. Offer multiple payment options. “ ... Utilize automated reminder systems.

Most debt settlement letters include: The date, name, and address of the credit card company. A notation after the address that this is regarding a hardship letter. The credit card number and amount of the debt. A short statement of your financial situation, why you're in that situation, and why full payment is a hardship.

This is done by putting your request in writing and sending it to the court and to the plaintiff. Once you have been served with the citation, you have 14 days to file an answer, which is your response to your lawsuit. You must give your answer to the court and also send it to the plaintiff.

Developing a Debt Revenue Recovery Strategy Be clear about the rights and obligations of debtors from the beginning. Be proactive rather than reactive. Give debtors options. Make debt collection friendlier. Offer multiple payment options. “ ... Utilize automated reminder systems.

Debt recovery is the process of pursuing payment of outstanding debts. Recovery actions typically involve issuing formal demand letters, engaging in negotiations, or escalating to legal proceedings if necessary.

How to write a debt collection letter: Step by step guide Step 1: Use a professional format. Step 2: Write a clear subject line (if sending via email) ... Step 3: Address the recipient. Step 4: State the purpose of the letter. Step 5: Provide detailed information on the debt. Step 6: Include payment instructions.