Suing An Estate Executor Without A Will In San Antonio

Description

Form popularity

FAQ

An estate beneficiary has a right to sue the executor or administrator if they are not competently doing their job or are engaged in fiduciary misconduct.

In Texas, executors don't have a legal obligation to probate a will. If they choose not to, they (or another person who has the will) must surrender it to the court clerk. The clerk will notify the executor and/or beneficiaries and give everyone a chance to probate it.

An executor is someone named in a will as the person who will carry out the testator's formal wishes. Typical duties of an executor include paying outstanding taxes/debt and distributing any remaining assets among the testator's heirs.

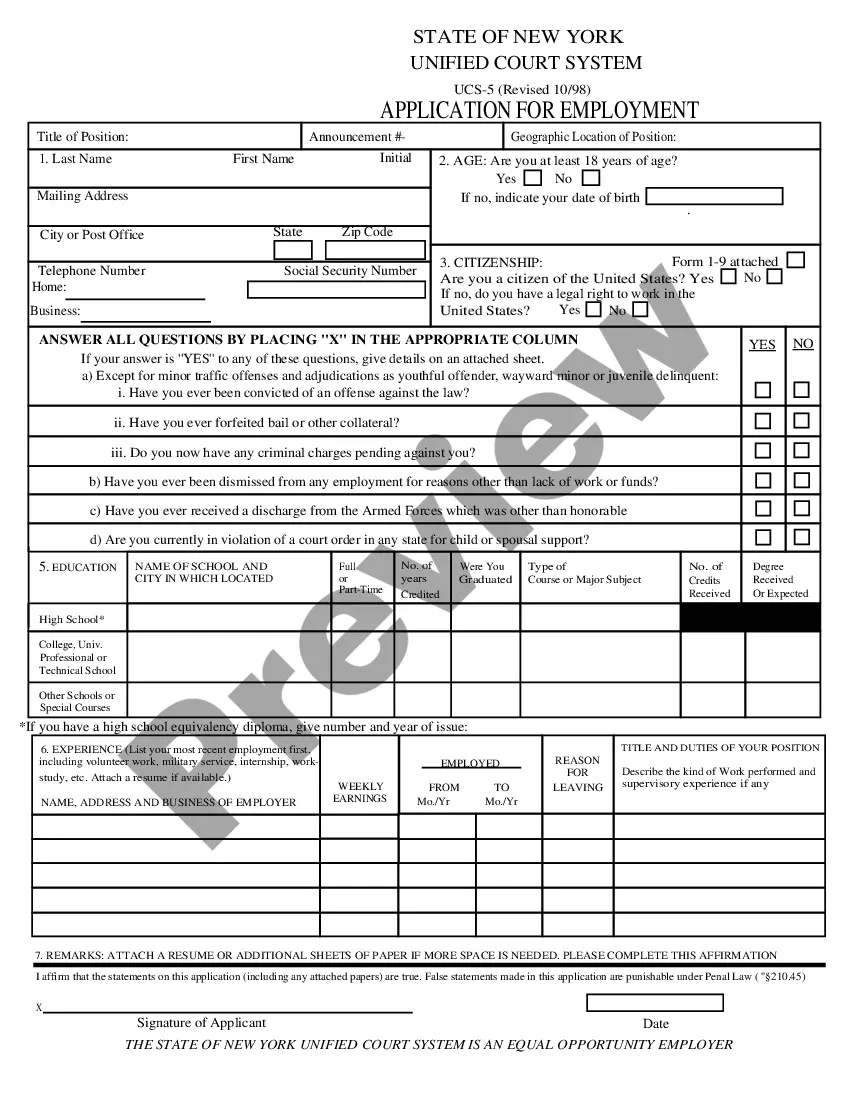

Section 304.003 - Persons Disqualified To Serve As Executor Or Administrator (a) Except as provided by Subsection (b), a person is not qualified to serve as an executor or administrator if the person is: (1) incapacitated; (2) a felon convicted under the laws of the United States or of any state of the United States ...

Probate timelines can vary significantly. If the estate is small or simple, the probate court can often conclude the process within six months. However, there are many cases where probate can last for a year or longer.

If a creditor wishes to file a claim against the estate, they must do so in writing and provide documentation of the debt. The claim must be filed with the probate court and a copy must be sent to the executor or administrator of the estate.

The executor will then collect and distribute the estate property. This is almost always done with the help from an attorney. If there is no will, the personal representative is called an "administrator." If there is a will but the executor can't serve for any reason, the court will also appoint an administrator.

In Texas, the surviving spouse and children will usually inherit all probate assets. If there are no children or grandchildren, the property may pass to the spouse, parents, siblings, nieces, nephews, and/or other heirs, depending on the situation.

If you would like the court to appoint an administrator of the estate, that application must generally be brought within four years after the death of the decedent. The court will often ignore this rule if there is property due to the estate that needs to be collected by an administrator.

If a creditor wishes to file a claim against the estate, they must do so in writing and provide documentation of the debt. The claim must be filed with the probate court and a copy must be sent to the executor or administrator of the estate.