Suing An Estate Executor For Child Support In Queens

Description

Form popularity

FAQ

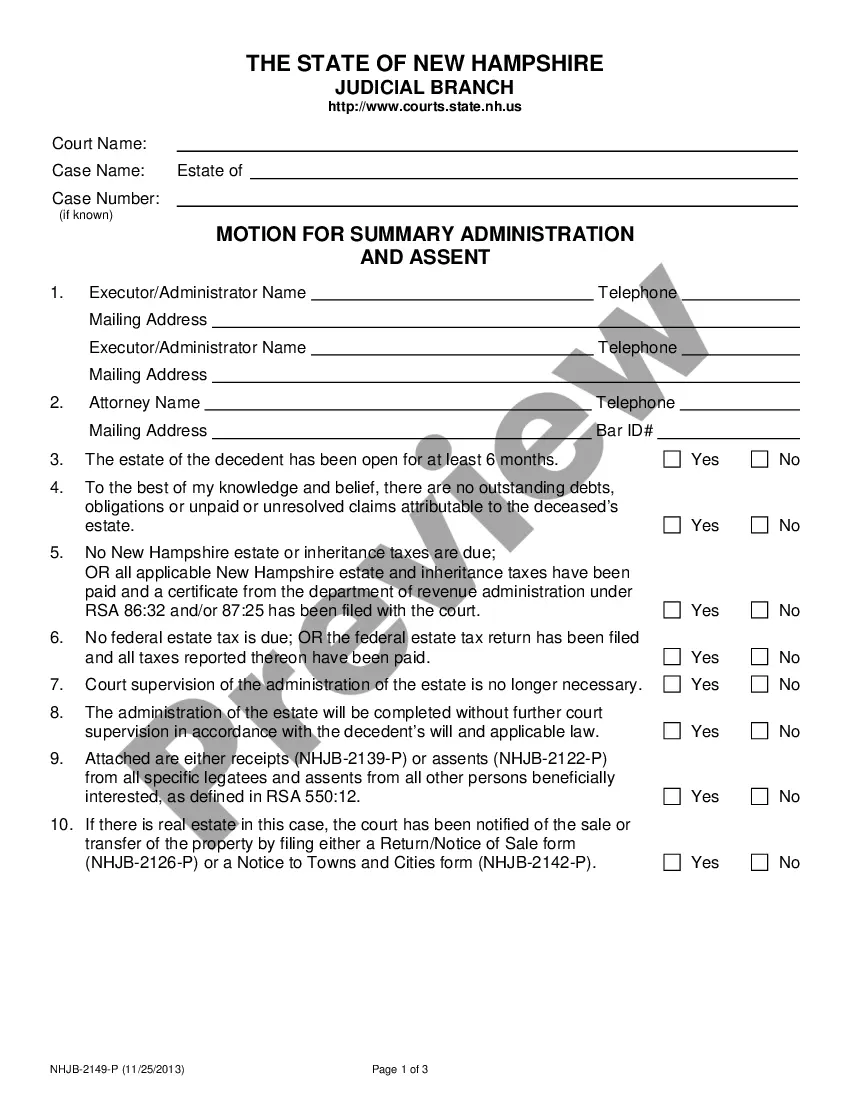

The first step in this process is to obtain letters testamentary, also known as a letter of testamentary, a document issued by a probate court that provides proof that an individual is an executor and therefore has the authority to act on behalf of the estate.

Yes, an executor can sue on behalf of the estate. California Probate Code §9820 empowers an executor to commence and maintain legal actions and proceedings for the benefit of the estate.

California Probate Codes on Suing an Estate Probate Code 551 allows for filing a lawsuit within 40 days with an additional year if the injured person was unaware of the defendant's demise.

You'll have to file a request in the county where the deceased person lived at the time of their death. The paperwork will ask for you to be officially acknowledged as the legal executor representing the estate. In addition to the petition, you'll need to file a valid will, if one exists, and the death certificate.

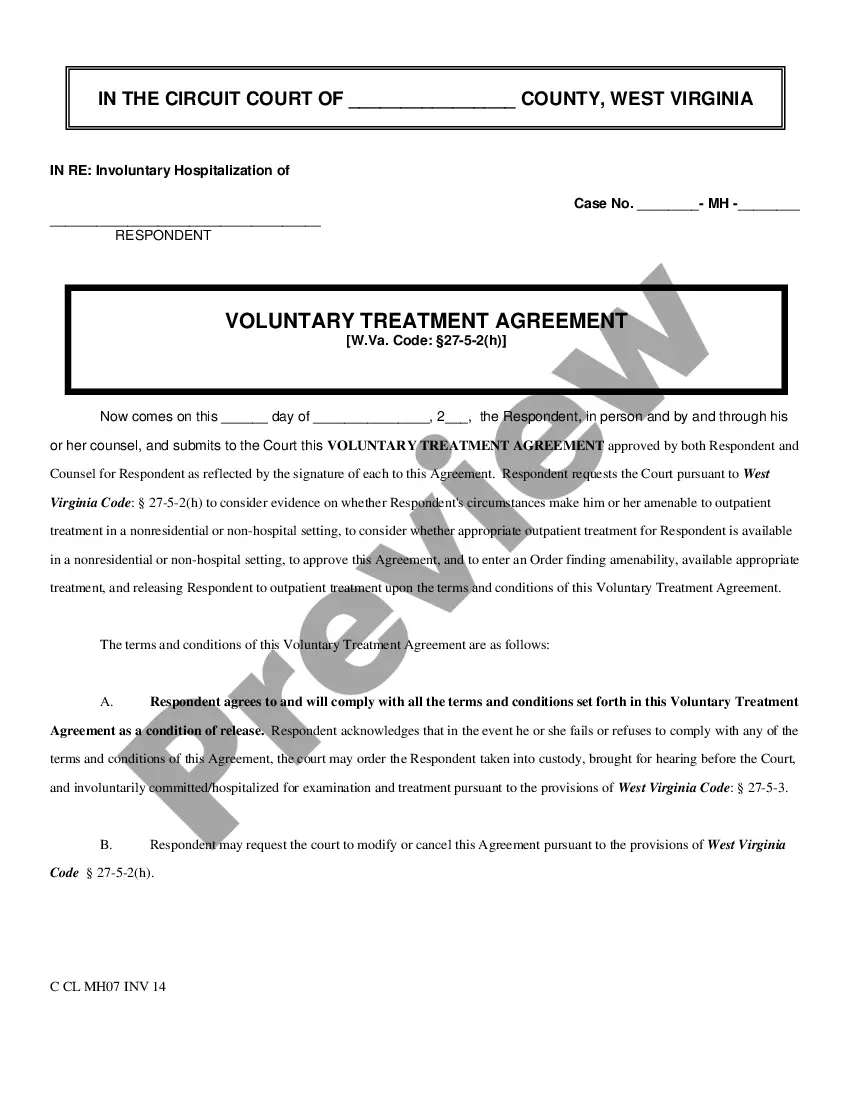

Only a petition to terminate child support in NY cancels the payments after the court reviews the specific circumstances used as grounds for termination. However, either one of the parents can request a modification to the settlement if there is a significant change in the earnings of the noncustodial parent.

Cases are referred to the NY State Department of Taxation and Finance for identification and seizure of assets to satisfy past-due support obligations if the amount owed is equal to or greater than four months of the current obligation amount, greater than $500, and no payments have been received from payroll ...

Child Support can be terminated only after the court issues an order to stop payments towards the cause. This is done after a critical review of the petition filed by the parent to terminate child support.

The statute of limitations on unpaid child support is 20 years in New York. That means that a child support debt can be collected up to 20 years from the date of default. This could mean that a parent is still on the hook for unpaid child support well into their child's adult life.

New York state law does not have a specific time limit for settling an estate. The time frame varies depending on the size of the estate and the complexity of the situation.

The person who performs this work is a fiduciary of the estate, also known as an administrator or executor. In New York, creditors have a maximum of seven months to file claims against an estate.