Sample Claim Statement With Debt Recovery In Fulton

Description

Form popularity

FAQ

Get Custom Synonyms obligation. score. indebtedness. liabilities. bankruptcy. liability. bond. arrears.

These letters serve as a notification of the unpaid balance, a reminder of the obligation, and a request for payment. The primary goal of a debt collection letter is to prompt the debtor to settle their debt without further escalation, such as legal action.

Developing a Debt Revenue Recovery Strategy Be clear about the rights and obligations of debtors from the beginning. Be proactive rather than reactive. Give debtors options. Make debt collection friendlier. Offer multiple payment options. “ ... Utilize automated reminder systems.

You can file a claim for which you are seeking $15,000 or less. If your claim exceeds $15,000 principal, the Magistrate Court does not have jurisdiction (the legal authority) to hear your case, and it must be filed in another court; such as, Superior Court.

For example, if a creditor accepts $6,000 as payment in full for a debt that is valued at $10,000, than the savings achieved as a result of the settlement is $4,000 (i.e. $10,000 - $6,000 = $4,000).

I am requesting that you consider forgiving or releasing the debt entirely. If this is not possible, I would be grateful for your consideration of a reduced settlement amount. I believe that this approach would allow me to regain my financial footing and move forward with my life.

What things should be included in the Full and Final Settlement Letter? Settlement Amount: Clearly state the finalized amount to be settled. Settlement Cheque: Provide details regarding the issuance of the settlement cheque. Resignation/Termination Date: Specify the date on which the employee resigned or was terminated.

Critical Elements of a Settlement Demand Letter Introduction and Background Information. Start by introducing yourself and providing a brief overview of the incident. Statement of Facts. Liability. Injuries and Medical Treatment. Damages. Settlement Demand. Deadline for Response. Closing.

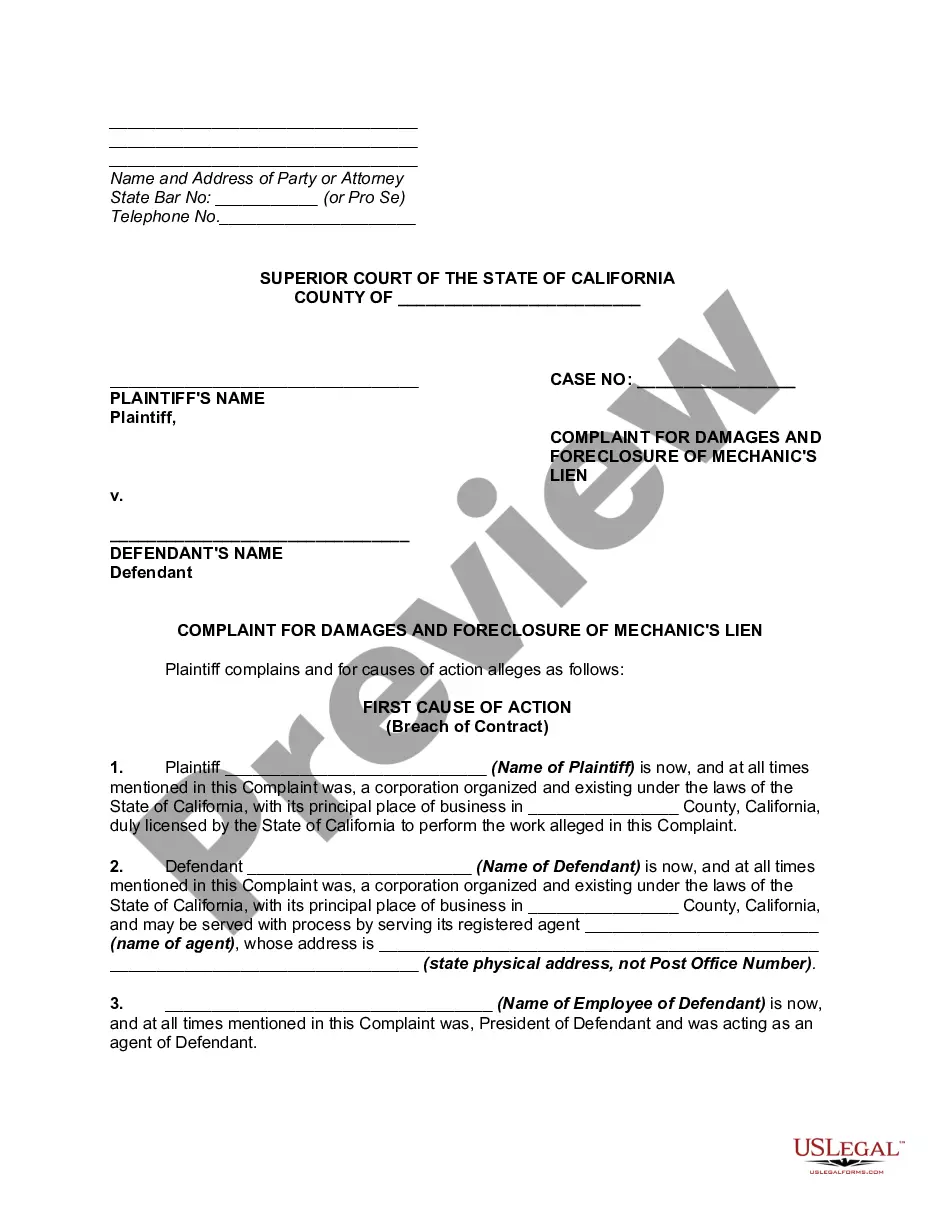

The plaintiff must file a sworn statement with the clerk of the appropriate magistrate court, describing the charges made by the plaintiff against the defendant. This statement is called a statement of claim, or a claim.

Most debt settlement letters include: The date, name, and address of the credit card company. A notation after the address that this is regarding a hardship letter. The credit card number and amount of the debt. A short statement of your financial situation, why you're in that situation, and why full payment is a hardship.