Claim Against Estate File For Texas In Bexar

Description

Form popularity

FAQ

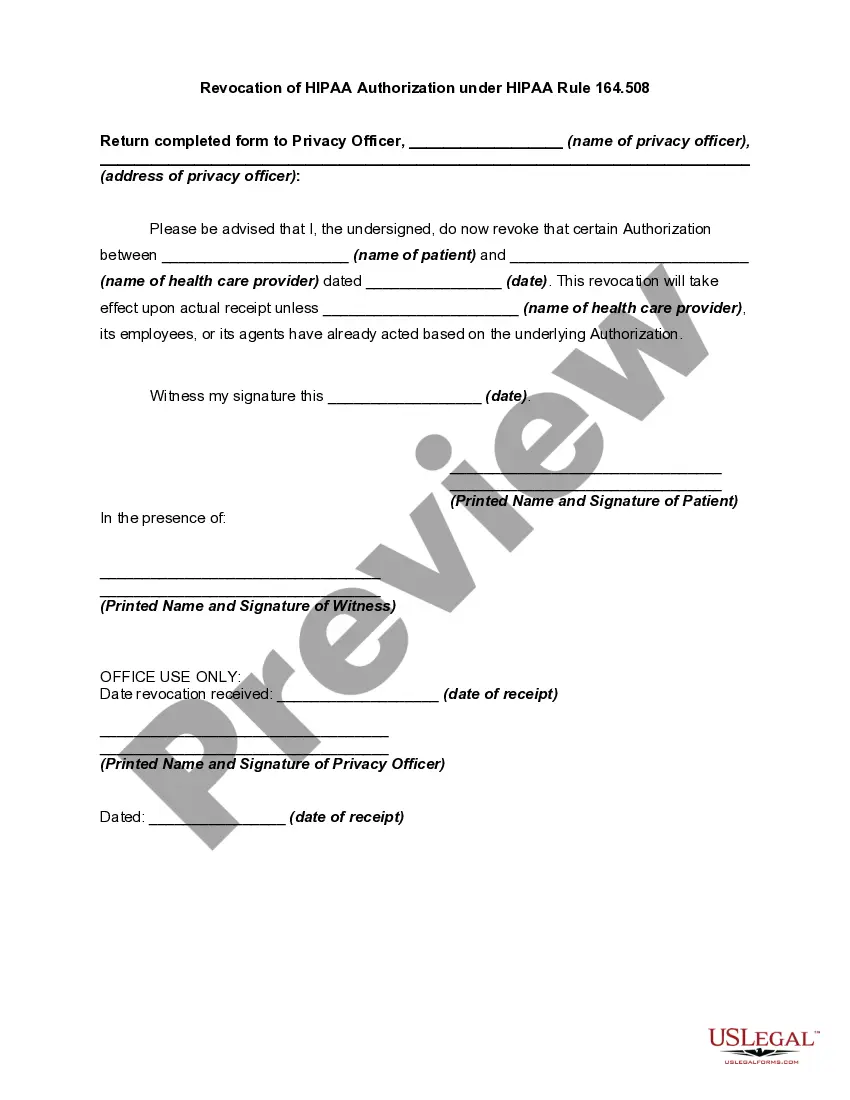

If a creditor wishes to file a claim against the estate, they must do so in writing and provide documentation of the debt. The claim must be filed with the probate court and a copy must be sent to the executor or administrator of the estate.

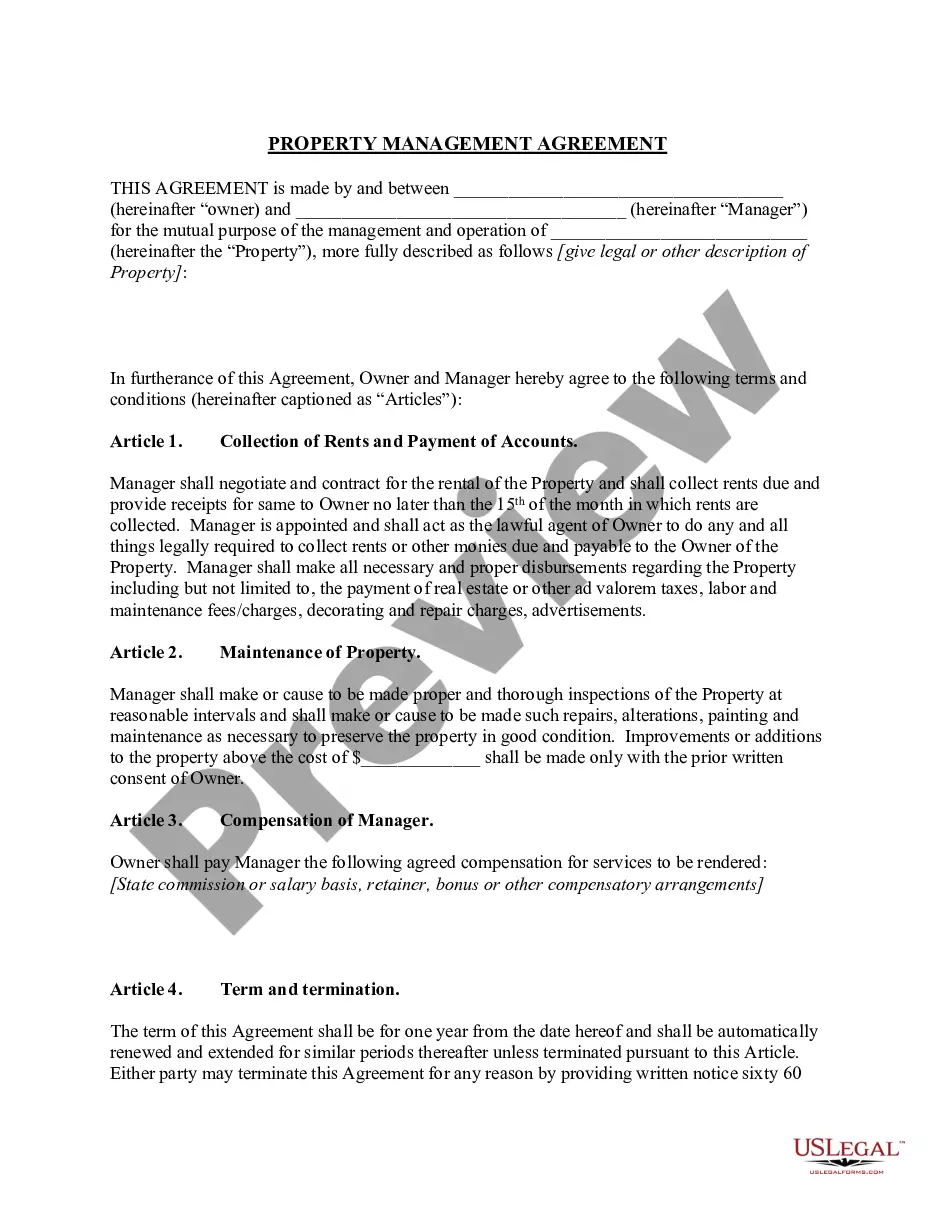

Executor's Role and Timeline for Asset Distribution. In Texas, an executor is given up to three years from their court appointment to distribute assets, excluding those allocated to creditors.

No. In Texas, an estate is not a legal entity. Therefore, it cannot sue or be sued. A court will need to appoint a personal representative of an estate, acting in his or her capacity.

Can You Sue an Estate After Probate? Typically, no. Texas law states that claimants must make their claims on an estate before probate closes. However, many claimants can still seek payment from beneficiaries who received assets from the estate during distribution.

A creditor then has a time limit within which they may file a claim against the estate. They must do so within the later of: Six months from when the probate process officially begins (i.e., the date letters testamentary or of administration are granted), or. Four months after the date the mandatory notice is received.

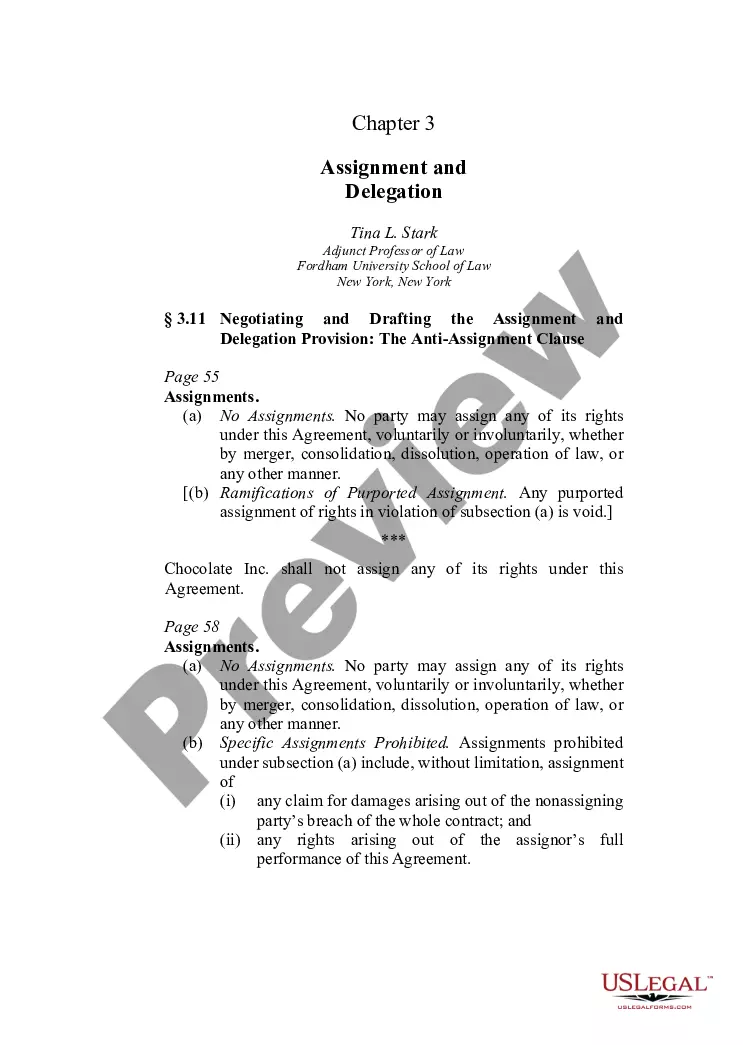

If the court has already admitted the will to probate, the will may be contested within 2 years (with some exceptions). Because challenging a will can be expensive and time consuming, wills often try to minimize disputes by using a "no-contest" clause.

Executor's Role and Timeline for Asset Distribution. In Texas, an executor is given up to three years from their court appointment to distribute assets, excluding those allocated to creditors.

Ordinarily, an application to probate a will must be filed within four (4) years of the date of death of the decedent. Also, under normal circumstances, letters testamentary or letters of administration cannot be authorized more than four (4) years after the date of death of the decedent.

Independent Administration Application for Probate of Will and Issuance of Letters Testamentary. Form 7-2. Application for Probate of Copy of Will and Issuance of Letters Testamentary. Form 7-3. Application for Probate of Will and Issuance of Letters of Independent Administration. Form 7-4.

If a creditor wishes to file a claim against the estate, they must do so in writing and provide documentation of the debt. The claim must be filed with the probate court and a copy must be sent to the executor or administrator of the estate.