Broker Property Real With You Chief In Maricopa

Description

Form popularity

FAQ

Eddie Cook brings a wealth of technological, leadership, and public service experience to the Maricopa County Assessor's Office. He was appointed in February 2020 and then elected in November 2020.

This does not freeze your property tax bill, but it does freeze the property valuation. To qualify, you must meet the following criteria: Property owner must be 65 years of age or older. Property must be the primary residence and the owner(s) must have resided at the residence for at least 2 years.

Property taxes are usually billed in two installments. The first installment is due on October 1 of the tax year and becomes delinquent after November 1 of that year. The second installment is due on the following March 1, and becomes delinquent after the following May 1. A.R.S.

The refund checks are the result of a court ruling in the case of Qasimyar et al. v. Maricopa County, which addressed changes in property classifications and how they impacted property taxes.

Online or in person to search online visit the record's office website use their public recordsMoreOnline or in person to search online visit the record's office website use their public records search tool you can search by document number recording date or party. Name.

The Limited Property Value is determined by law. State statutes provide the formulas to be used in calculating the Limited Property Value (see Arizona Revised Statutes §§ 42-13301 through 13304). RULE A: Typically, for real property, the Limited Value will increase 5% over the prior year's Limited Property Value.

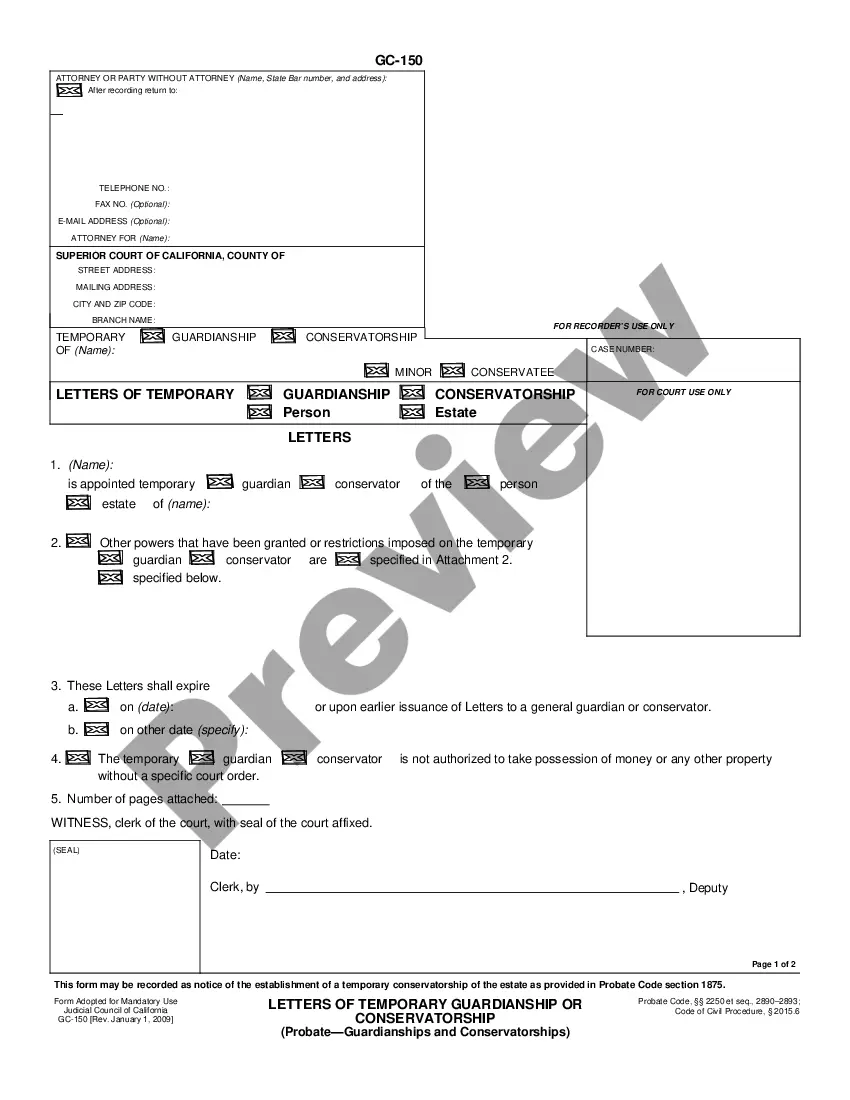

Recording Requirements Each document must have original signatures or carbon copies of original signatures, except when otherwise provided by law. Each document must be no larger than 8 1/2 inches wide by 14 inches long, and shall have a print size no smaller than ten point type.

Definition And Purpose An affidavit of ownership is a sworn declaration made under oath claiming that one owns a certain piece of property or asset. Usually include information about the property description, present owner's data, and any pertinent ownership history in this paper.

The Affidavit is used only to transfer title of a deceased person's real property, including a debt secured by a lien on real property.

Stephen Richer is the 30th Recorder of Maricopa County. He was elected in November 2020 and took office January 2021. Prior to his election as Recorder, Stephen worked as a lawyer and business person.