Agreement Satisfaction With Judgment In Franklin

Description

Form popularity

FAQ

All judgments and court records are filed in the County Clerk Office in the County where the lawsuit was filed. You can go in person to the County Clerk Office in the County where you live to ask if a judgment has been entered against you. Most counties also allow you to search online.

Typically, a judgment can be renewed multiple times for 10 years, with a 10% interest rate on any unpaid balance. However, some judgments for medical expenses or personal debt can only be renewed once for 5 years, with a 5% interest rate.

The tax commissioner has determined that this rate is 8% for the year 2025. This is the second year in a row that the judgment interest rate is 8%. Prior to this, the judgment interest rate was 3% in 2022 and 5% in 2023.

DATESPOST JUDGMENT INTEREST RATE ALLOWED June 30, 2022 2.45 July 1, 2022 Dec. 31, 2022 3.70 June 30, 2023 6.45 July 1, 2023 Dec. 31, 2023 6.9572 more rows

Fact-Checked Legal Maximum Rate of Interest8% (§1343.01) Penalty for Usury (Unlawful Interest Rate) Excess interest applied to principal (§1343.04) Interest Rates on Judgments Contract rate (§1343.02), otherwise 10% (§1343.03)1 more row

A judgment is good for five years, but any activity of execution on the judgment extends the 5 years.

(a) When and by Whom. A judgment may be revived by order of the court that entered it pursuant to a motion for revival filed by a judgment creditor within ten years after entry of the judgment, the last payment of record, or the last prior revival of the judgment.

Judgments may be classified as in personam, in rem, or quasi in rem. An in personam, or personal, judgment, the type most commonly rendered by courts, imposes a personal liability or obligation upon a person or group to some other person or group.

Except as provided in Chapter 454, RSMo, or Chapter 517, RSMo, the lien of a judgment commences upon entry of the judgment, continues for a period of ten years, and is revived by a revival of the judgment.

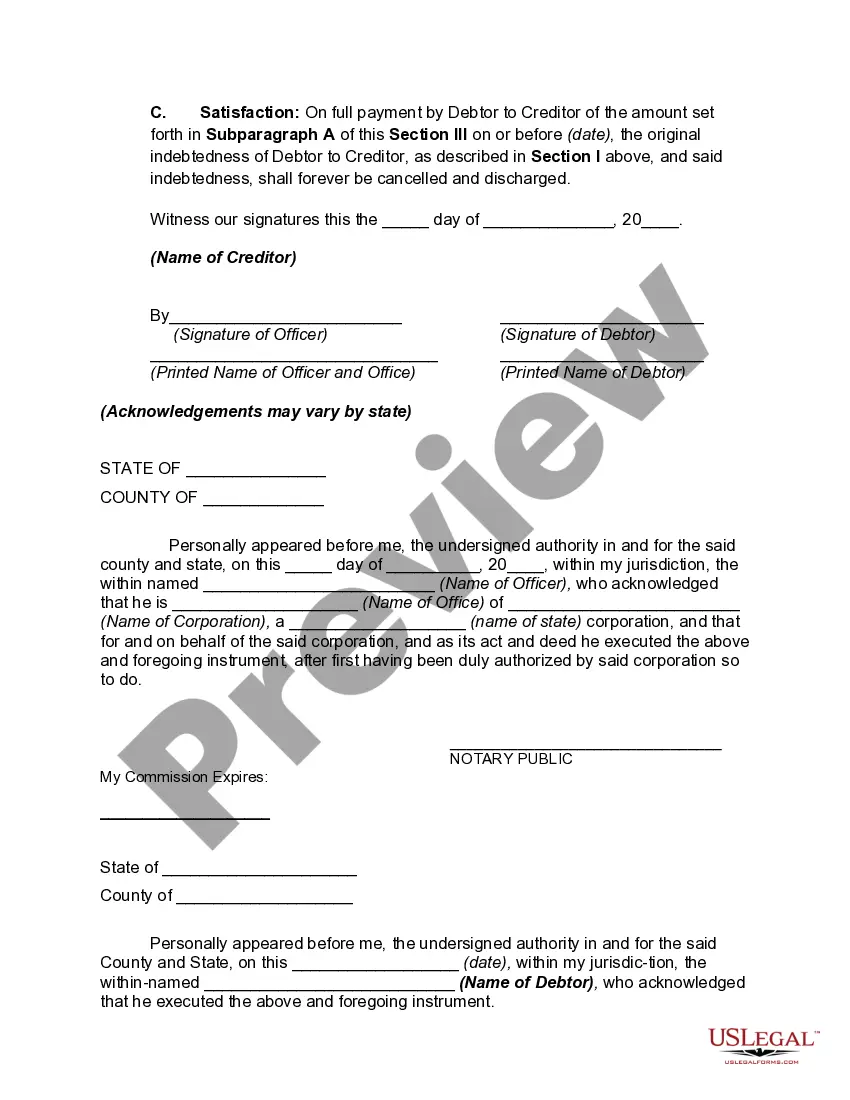

(a) Acknowledgment of Satisfaction. When any judgment or decree is satisfied, the judgment creditor shall immediately file an acknowledgment of satisfaction.