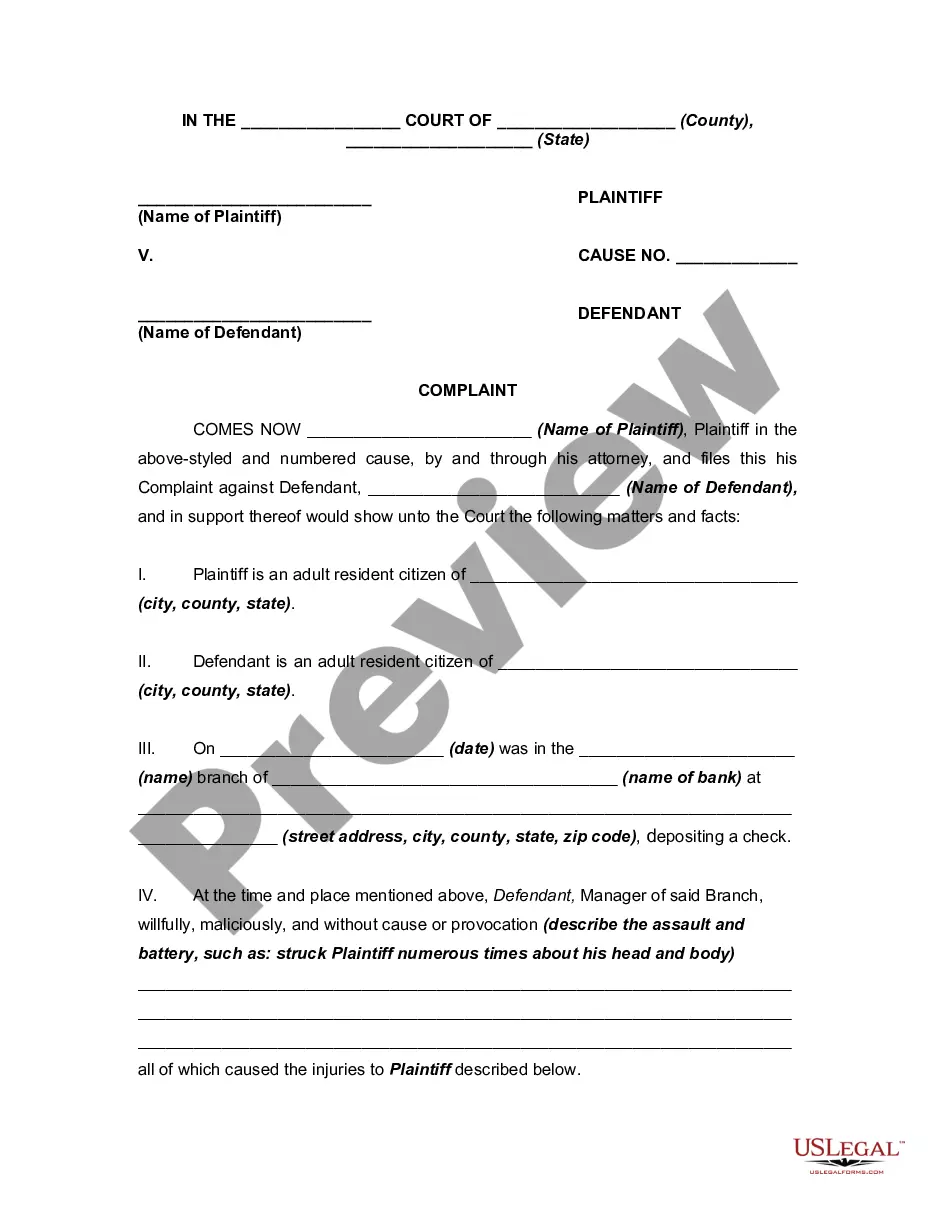

The parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. In order for there to be an accord and satisfaction, there must be a bona fide dispute; an agreement to settle the dispute; and the performance of the agreement. An example would be settlement of a lawsuit for breach of contract. The parties might settle for less than the amount called for under the contract.

Dispute Claim Form With Irs In Palm Beach

Description

Form popularity

FAQ

For example if you've received a letter or notice from the IRS. And need immediate help toMoreFor example if you've received a letter or notice from the IRS. And need immediate help to understand what to do next. You might be able to walk in without an appointment.

In your formal protest, include a statement that you want to appeal the changes proposed by the IRS and include all of the following: ∎ Your name, address, and a daytime telephone number. ∎ List of all disputed issues, tax periods or years involved, proposed changes, and reasons you disagree with each issue.

If you disagree with the amount the IRS says you owe, you can dispute it by calling the IRS help number on your notice.

The only two ways to reduce a tax debt would be an Offer In Compromise or Penalty Abatement. Assuming, of course, that you didn't miss any deductions or credits and that amending the returns to include those would help.

When taxpayers disagree with the IRS's decision on their tax situation, they can submit a written request to have the IRS Independent Office of Appeals review the decision.

The Internal Revenue Service (IRS) may levy your assets, seize your property, and issue a federal tax lien if you have unpaid taxes. A Collection Appeal Program (CAP) can be requested by taxpayers to challenge a collection action by the IRS.

Make a copy of the notice you received from the IRS and include it with your letter. In the first paragraph of your letter, explain why you are writing the IRS. Mention the date of their notice. For example, you can write, “I am writing to request an abatement of $4,512.33 as assessed in the notice sent 7/3/2017.”