Corporation Any Loan Without Bvn In Mecklenburg

State:

Multi-State

County:

Mecklenburg

Control #:

US-0043-CR

Format:

Word;

Rich Text

Instant download

Description

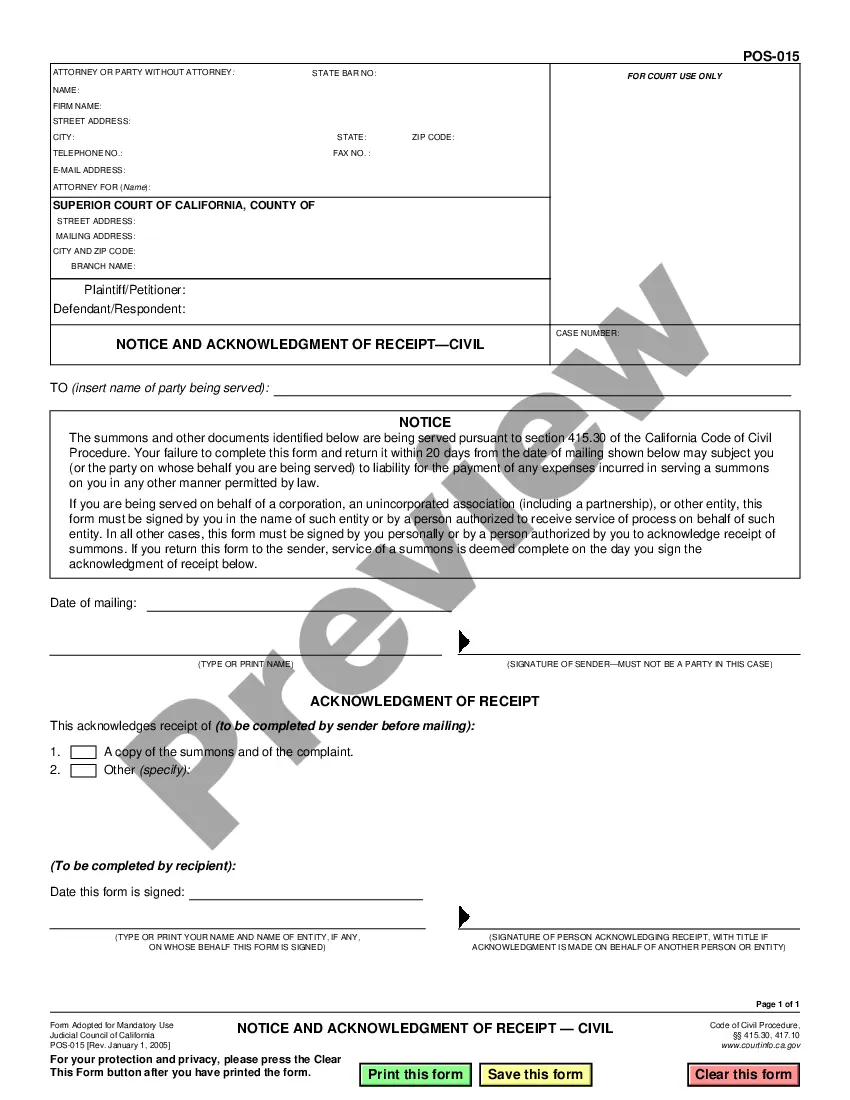

Form with which a corporation may resolve to authorize an officer or representative to loan a specific amount of funds to another party.

Free preview

Form popularity

FAQ

If a customer's BVNs have been blacklisted, it means that they have been involved in fraudulent activities or have contravened the regulations governing the BVNs. This could result in the restriction of access to banking services and other financial activities in Nigeria.

No, once a customer is enrolled at one bank and a BVN is generated, the customer only has to take the BVN to other banks to link such accounts.

Under the Guidelines, financial institutions are required to blacklist individuals who have been implicated in offenses such as fraud, forgery, breach of fiduciary duty, violations of banking regulations and laws, deliberate breaches of confidentiality, misrepresentation of facts, criminal breach of trust, and ...