Handwritten Bill Of Sale For Car Example With Notary Signature In Utah

Description

Form popularity

FAQ

Selling a vehicle for $1 instead of gifting it could result in your recipient paying sales tax based on the car's fair market value — it's better to stick with the official gifting process.

When you sell your vehicle: Remove your license plate from the vehicle. Give the new owner the signed title, current registration certificate, and current safety and emission certificates. Report the vehicle as sold to the Division of Motor Vehicles.

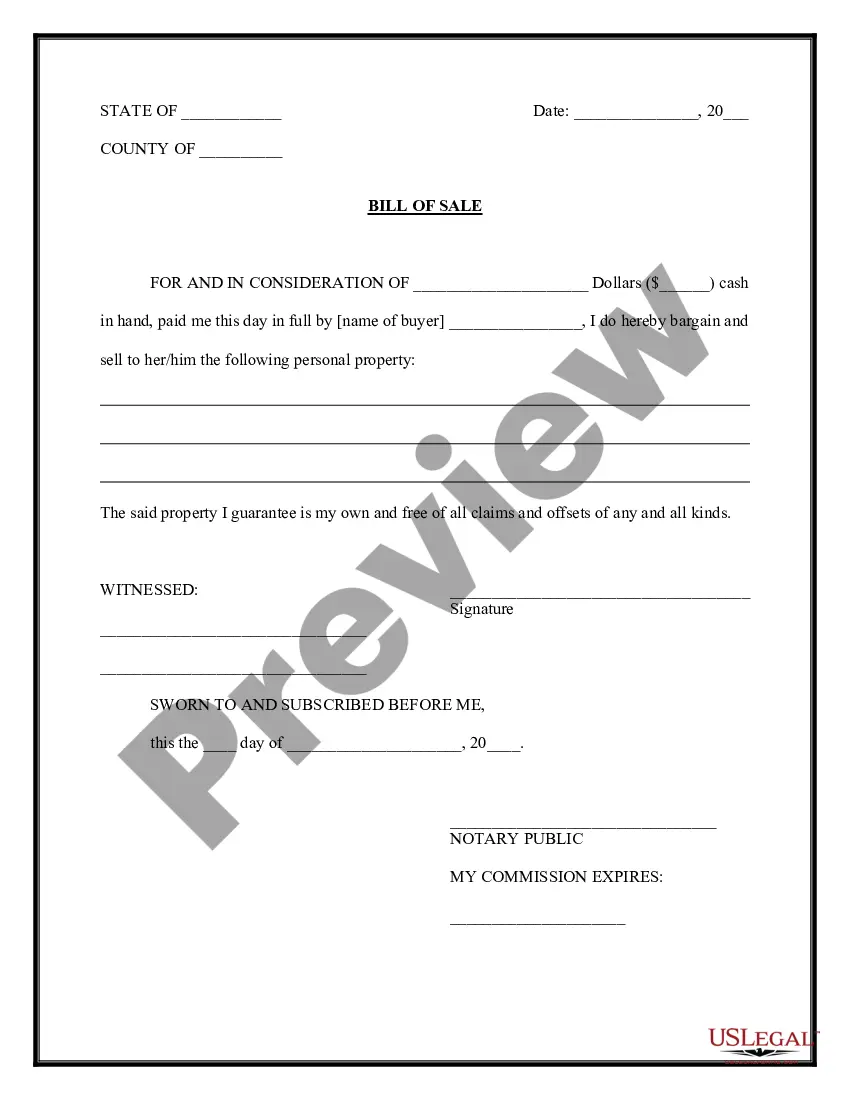

For the Bill of Sale to hold legal weight in Utah, certain requisites must be fulfilled: Signature Requirement: Both buyer and seller must sign the document. Notarization: While not always mandatory, notarizing the signatures provides an added layer of legal protection.

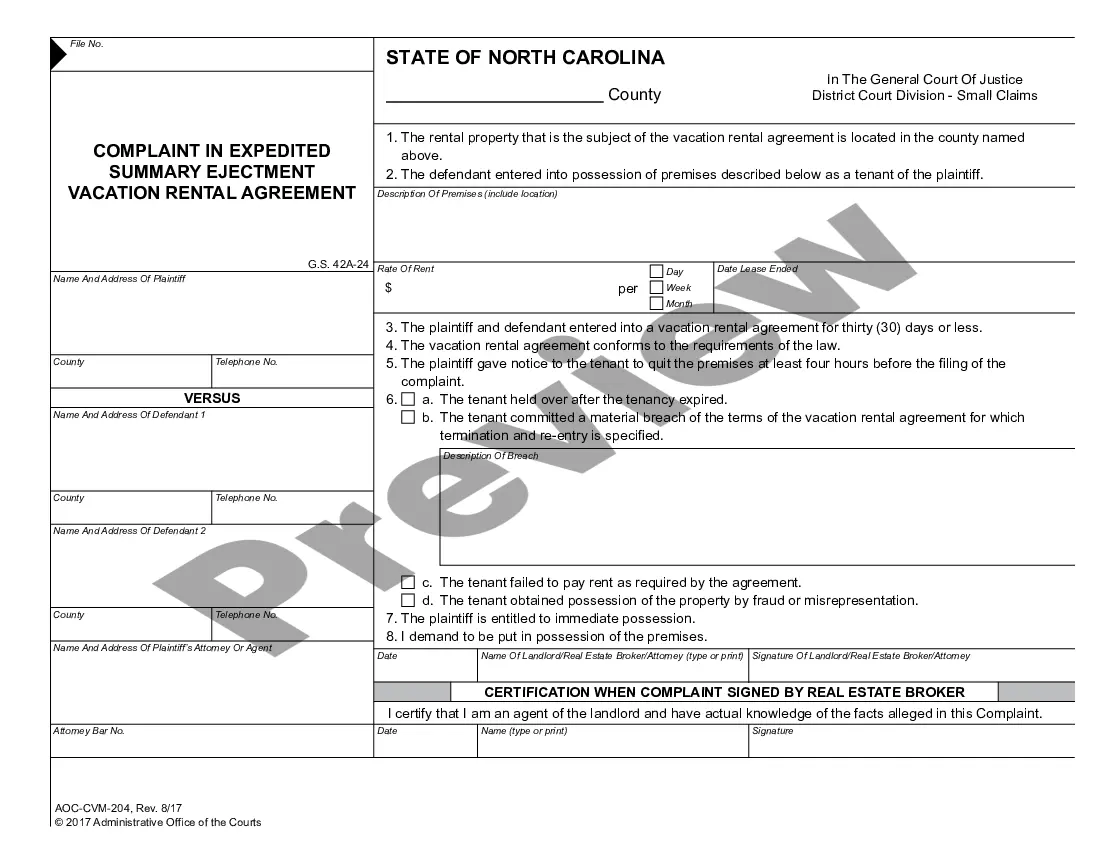

Transferring a car title usually requires the vehicle title itself and a title application, the parties' addresses, signatures from the previous and new owners, and details on the vehicle and its value. These documents look different from state to state, but the information they require is generally the same.

The bill of sale can be handwritten or typed/printed, but it should be in ink, not pencil. If desired, you can use the TC-843, Bill of Sale provided by the DMV.

Avoid white-out, scribbles, and strike-throughs. Back of the title top half in Section A - print name(s) in the box where it reads "Print Name of Seller." Back of the title right below where you printed name(s) - sign name(s) on the line where it reads "Signature of Seller (and Joint Seller)."

No. A vehicle bill of sale for a private party transfer does not need to be notarized.

While Utah law does not require a notary to keep a journal, here is a good question to ask yourself when considering whether or not to keep one: How will you defend yourself in a court of law if a notarization is called into question? If your answer is: “My notary journal”, you would be correct.