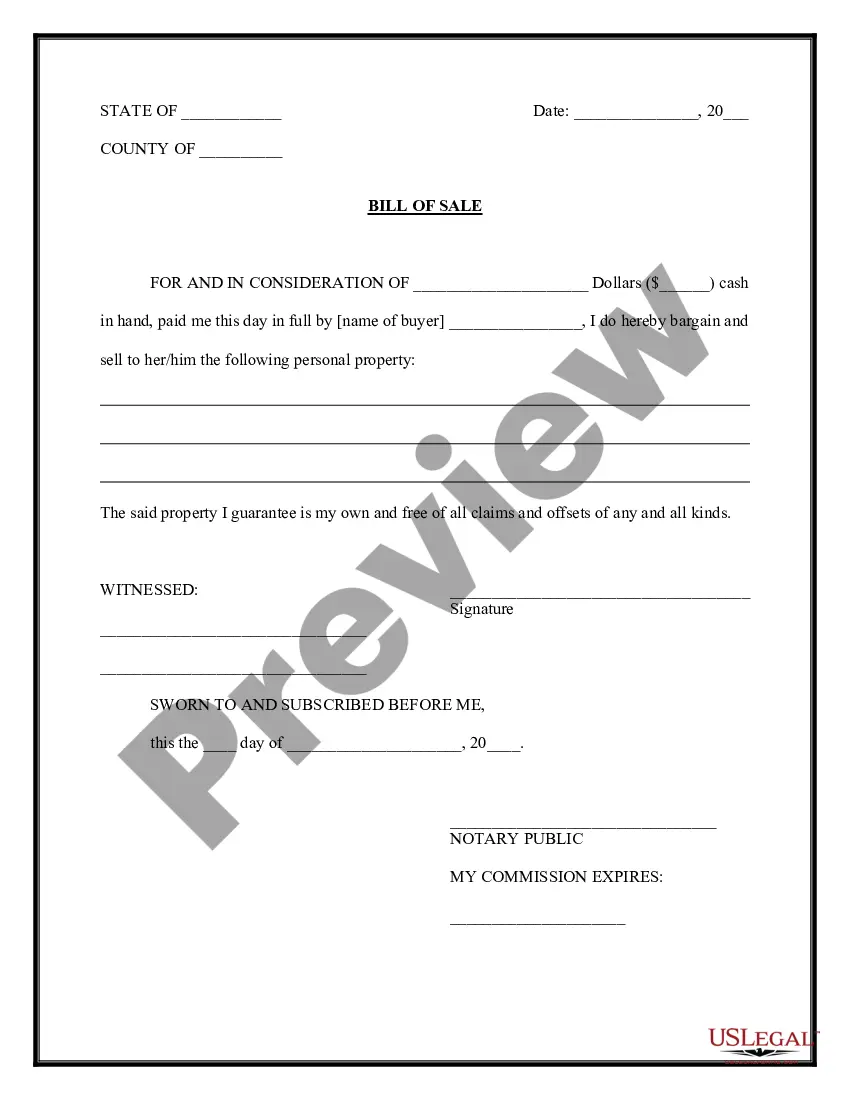

For your convenience, the complete English version of this form is attached below the Spanish version. In this form, the seller agrees to sell to the purchaser certain items of personal property. The seller warrants that the property is free from all claims and offsets of any kind.

Bill Of Sale In Spanish Template For Car In Dallas

Description

Form popularity

FAQ

Even though it is not a legal requirement in Texas, you have every reason to complete a bill of sale when selling your car.

The title application must be accompanied by the Comptroller's joint affidavit and must be filed in person by either the recipient or donor.

To fill out the Texas Residency Affidavit, you'll need someone who lives at the same address as you. This person will need to fill out the Affidavit and provide proper identification and two documents that verify residency. If the person is a family member, they must provide proof of the family relationship.

Yes, Texas recognizes handwritten bills of sale as valid, as long as they contain all the necessary information and are signed by both the buyer and the seller.

Both the seller and buyer must fill out Form 130-U.

Form 130-U The application is used by the County Tax Assessor-Collector (CTAC) and the Comptroller's office to calculate the amount of motor vehicle tax due. The application includes a motor vehicle tax statement section to document the following: the motor vehicle sales tax due on a Texas sale of a motor vehicle.

A Texas motor vehicle bill of sale is a legal document used to demonstrate that a motor vehicle has been legally sold. The state does not require the document to be notarized, but it does suggest1 that both parties jointly visit the county tax office when the seller is signing over the title of the vehicle.

Sellers need to submit a Vehicle Transfer Notification (Form VTR-346) to make sure the state record shows the car or truck was sold. You must have the name and address of the buyer to complete the form. Submitting this form is important even if you sold or traded your vehicle to a dealer.

Both parties must sign a Texas bill of sale. The buyer and seller's signatures make the document legally binding. While notarization isn't mandatory for most transactions, it offers additional legal protection. Notarizing the document helps prevent disputes by validating the identities of the parties involved.

Texas does not require a bill of sale except for bonded titles. The seller will need to provide you the original title for the car, signed as appropriate front and back. There will need to be no lienholders shown anywhere on the title, such as a bank, car note lender, etc.