Cease And Desist Letter For Debt Collection In Travis

Description

Form popularity

FAQ

If you don't believe you owe the debt, you can dispute it with the debt collector and the credit reporting company. If you dispute the debt in writing within 30 days of receiving information about the debt from the collector, then the debt collector must send you verification of the debt.

Most debt settlement letters include: The date, name, and address of the credit card company. A notation after the address that this is regarding a hardship letter. The credit card number and amount of the debt. A short statement of your financial situation, why you're in that situation, and why full payment is a hardship.

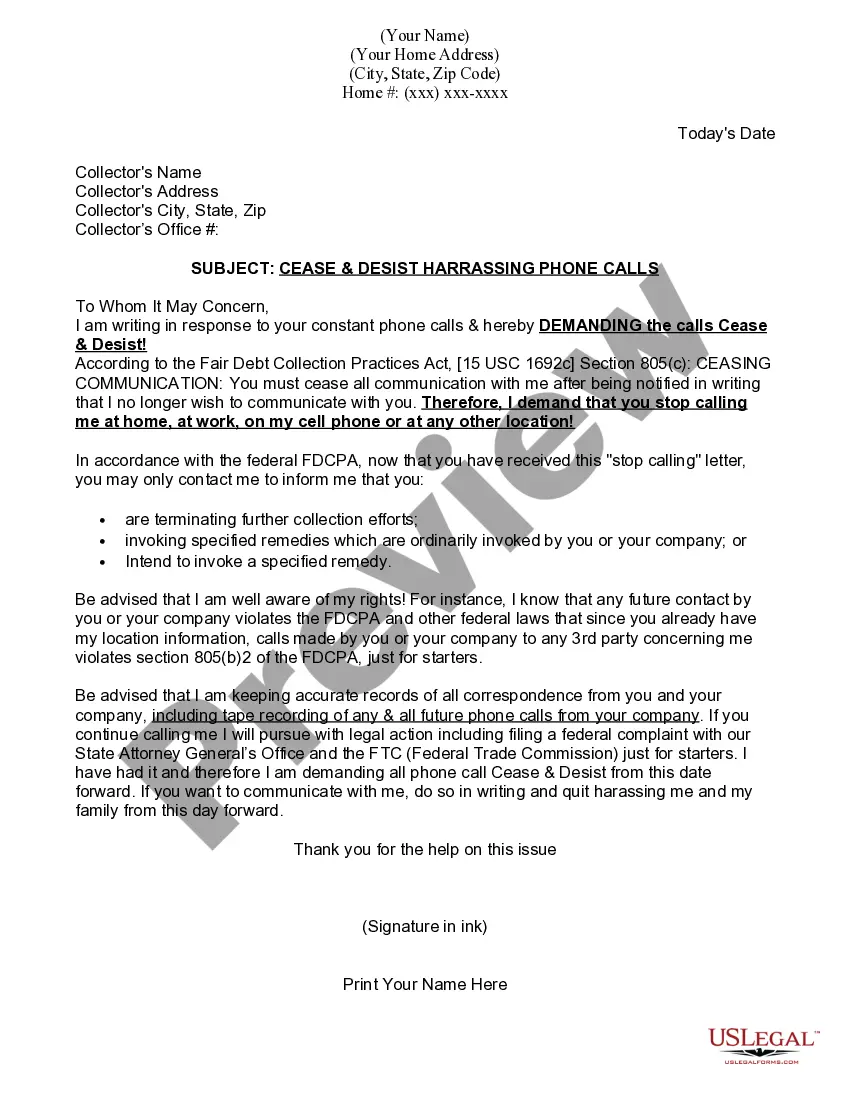

If you are writing the letter yourself, you should include the following information: Your name and contact information. Name and contact information of the person or business being asked to stop the behavior. Specifics about the activity you wish them to stop.

The Fair Debt Collection Practices Act lays out the rules for debt collectors and states that if the creditor is told to stop contacting the debtor, they must comply. If the harassing calls and letters persist, a cease and desist letter can be sent by an attorney to formally advise the creditor to stop violating the de.

Texas law gives someone 4 years to bring a lawsuit for unpaid debt.

Receiving a cease and desist letter is a serious issue. It indicates the sender's intention to pursue you for the alleged wrongdoing if you do not follow their demands. Receiving a cease and desist letter does not necessarily mean you will end up in Court.

Short Answer, 10 Years. If handled properly, a Texas judgment can exist indefinitely. But the creditor must be vigilant.