Cease And Desist Sample Letter For Collection Agency In Franklin

Description

Form popularity

FAQ

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

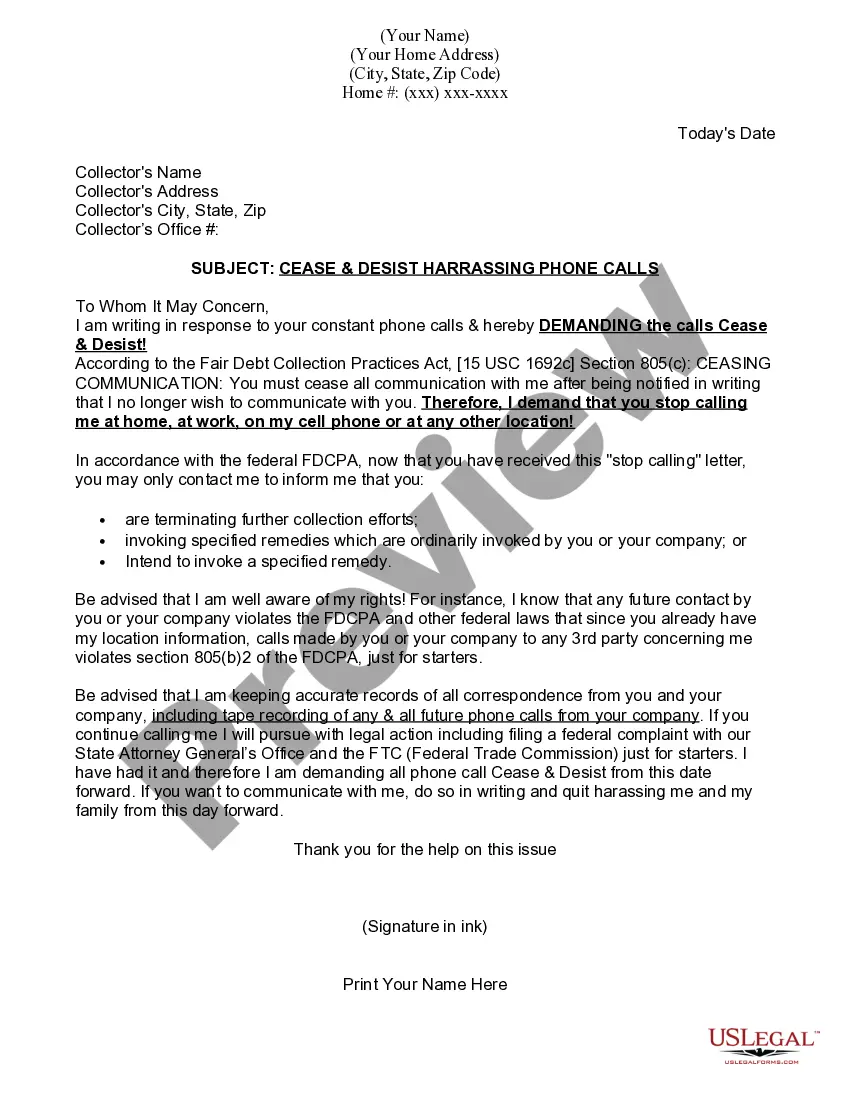

A cease and desist letter is a formal written request that tells a debt collector to stop contacting you. It is your right under the Fair Debt Collection Practices Act (FDCPA) to limit how debt collectors can communicate with you.

Call or write the collection agency to explain why you want the account deleted, such as that you're hoping to get a mortgage. Explain the circumstances that led to the account being sent to collections. There's no guarantee that the collection agency will agree, but there's no harm in asking.

If you write a letter, instead of using the tear-off form, the debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or ...

I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies. If you have already reported it, please contact the credit reporting agencies, inform them that the debt is disputed, and ask them to delete it from my credit report.

Based on my prompt full payment of my debt to you, I would like to request that you apply a goodwill adjustment to remove the collection tradeline from my credit report. Granting this request will help me improve my overall credit history and demonstrate my consistency as a creditworthy borrower.

What is the 11 word credit loophole? The 11 word credit loophole does not exist, despite common misconceptions. If you're wondering, the phrase “Please cease and desist all calls and contact with me immediately” is often mistakenly believed to have special legal power.

Debt Relief Calculator: - You Can Use an 11 Word Phrase to stop debt collectors in their tracks. Here's the phrase: Please cease and desist all calls and contact with me, immediately. After you stop the debt collectors, you can then understand which options you have to resolve your debt. He.

Effective cease-and-desist letters include the following information: A thorough yet concise and clear description of the activity that must be stopped. The legal basis for your claim. The consequences if the recipient of the letter fails to comply. A deadline by which the activity must stop.

Bottom line: You can stop a collection agency from calling you by writing them a letter telling them not to call you anymore- that you're not paying the debt, and why. If they call again, then google ``FDCPA attorneys'', call one, tell them whats going on.