Fixed Asset Purchase With Gst Entry In Orange

Category:

State:

Multi-State

County:

Orange

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

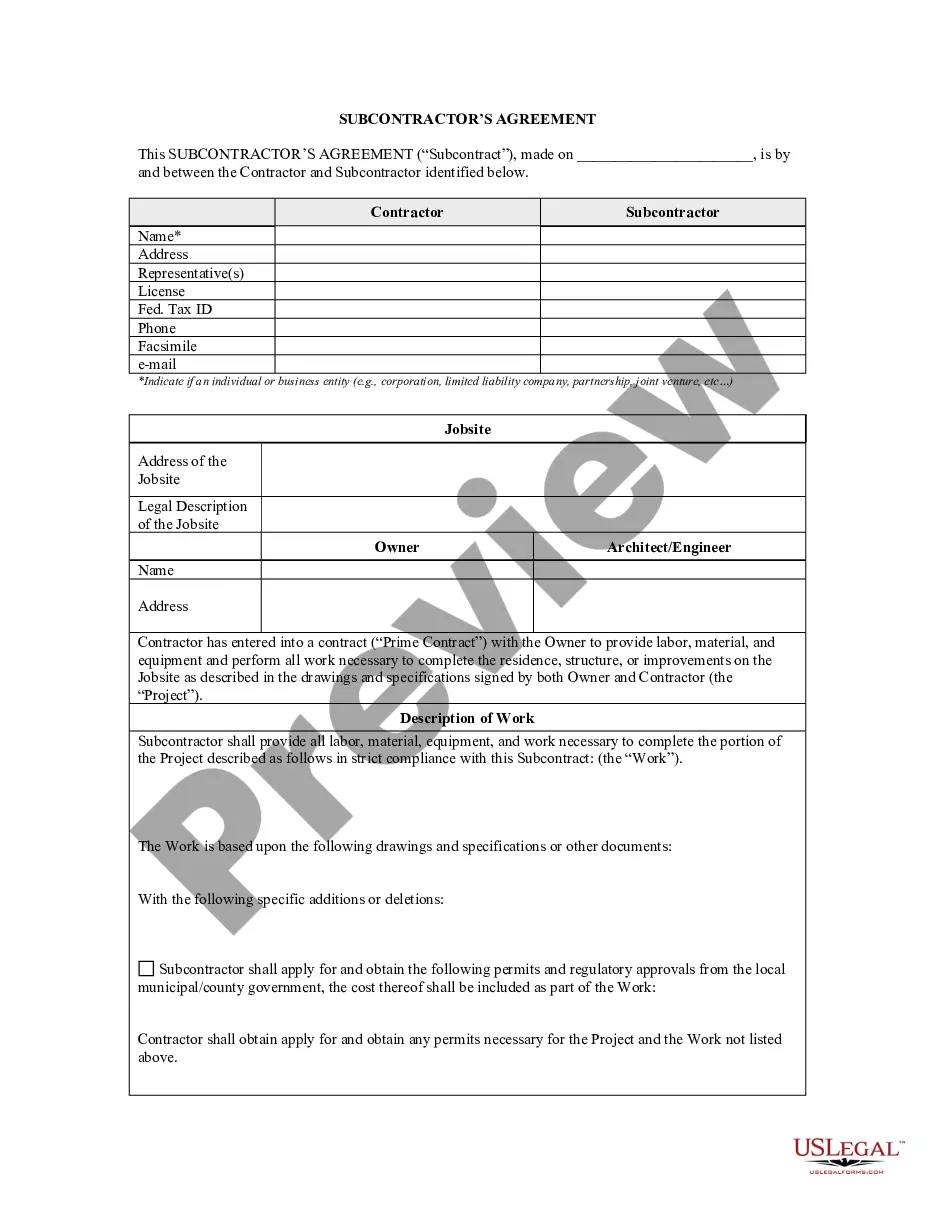

The Asset Purchase Agreement is designed to facilitate the sale of fixed assets with GST entry in Orange. This agreement details the terms and conditions under which the Buyer acquires assets from the Seller, including equipment, inventory, and goodwill, while explicitly stating the liabilities that are not assumed by the Buyer. Key features include clear sections on the purchase price allocation, payment methods, and security interests maintained by the Seller until the Buyer fulfills its obligations. Filling in the agreement requires precise information about the assets and parties involved, ensuring that users follow the specified format for dates and monetary amounts. Attorneys, partners, owners, associates, paralegals, and legal assistants will benefit when processing asset purchases, clarifying roles and responsibilities during negotiations and closings. Relevant use cases involve mergers, acquisitions, or business divestitures, providing a structured approach to asset transfers in compliance with applicable laws. The form emphasizes the importance of due diligence and necessary disclosures, serving as a critical tool in transactional law.

Free preview

Form popularity

FAQ

Yes, businesses can claim Input Tax Credit (ITC) on fixed assets if they are used solely for business purposes. Proper documentation, such as a valid tax invoice, must be maintained, and the asset should be capitalized in the books of accounts. ITC cannot be claimed if the asset is used for personal purposes.

? 1️⃣ Sale of Immovable Fixed Assets (Land & Buildings) ✅ Sale of an under-construction building → GST @18% applies (Treated as a supply of services).