Asset Purchase Form Irs In Fulton

Category:

State:

Multi-State

County:

Fulton

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

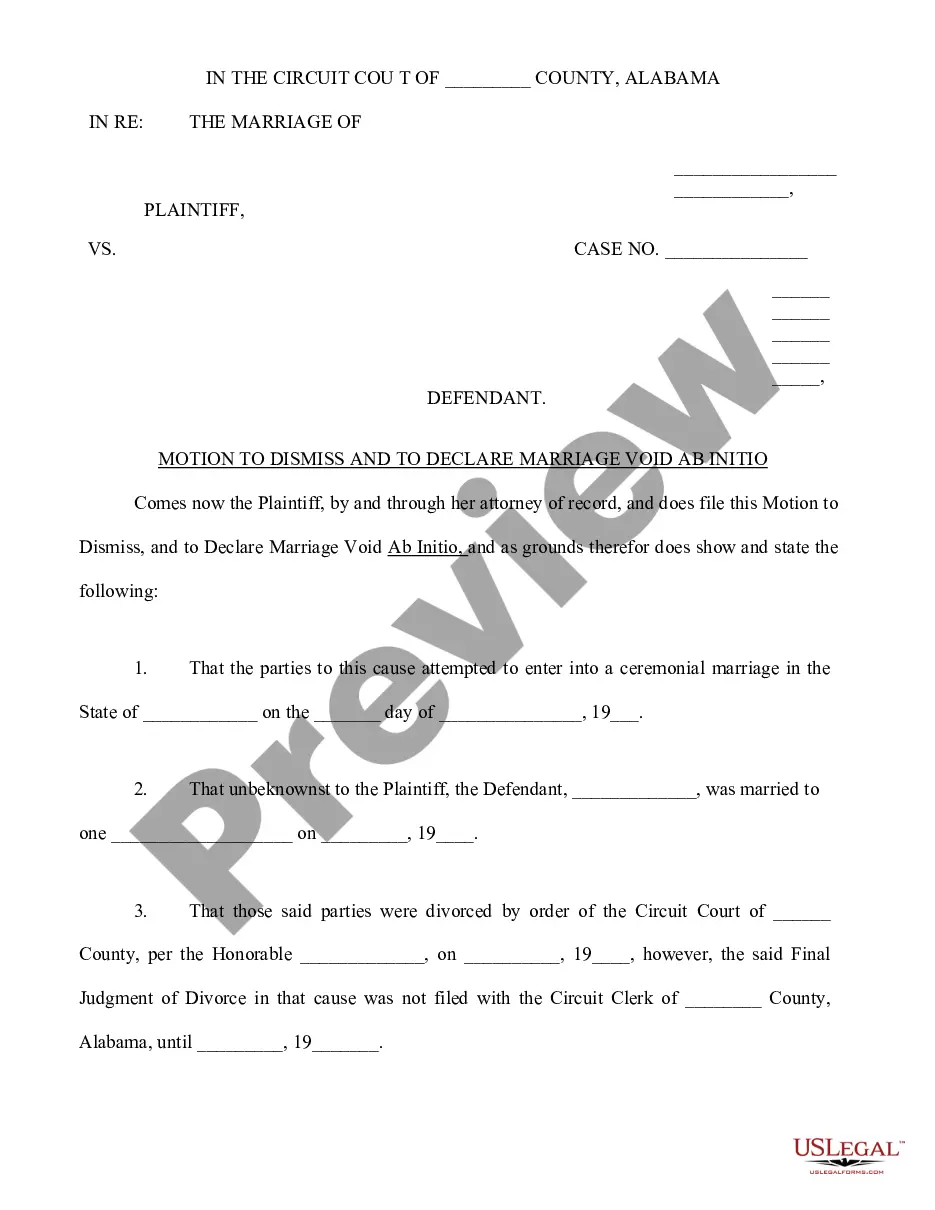

The Asset Purchase Form IRS in Fulton is a critical document for parties involved in the acquisition of business assets, primarily focusing on the sale of equipment, inventory, and goodwill. This form outlines the terms of the asset purchase agreement, identifying key elements such as the purchase price, liabilities, and representations made by both the seller and buyer. It serves as a legal contract detailing the responsibilities of each party and the condition of the assets being sold. Filling out this form requires precise attention to detail, including listing all assets and any exclusions, and ensuring that each party's obligations are clearly articulated. Legal professionals, including attorneys and paralegals, can utilize this form to facilitate asset acquisitions or guide their clients through the purchasing process, ensuring compliance with legal standards. Business owners and partners will find this form useful to formalize transactions while protecting their interests in the sale or purchase of assets. Editing the form may involve adjusting terms to meet specific agreements between the parties. Overall, this form is an essential tool for achieving transparency and accountability in asset transactions.

Free preview