Asset Acquisition Form 8594 Instructions In Fulton

Category:

State:

Multi-State

County:

Fulton

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

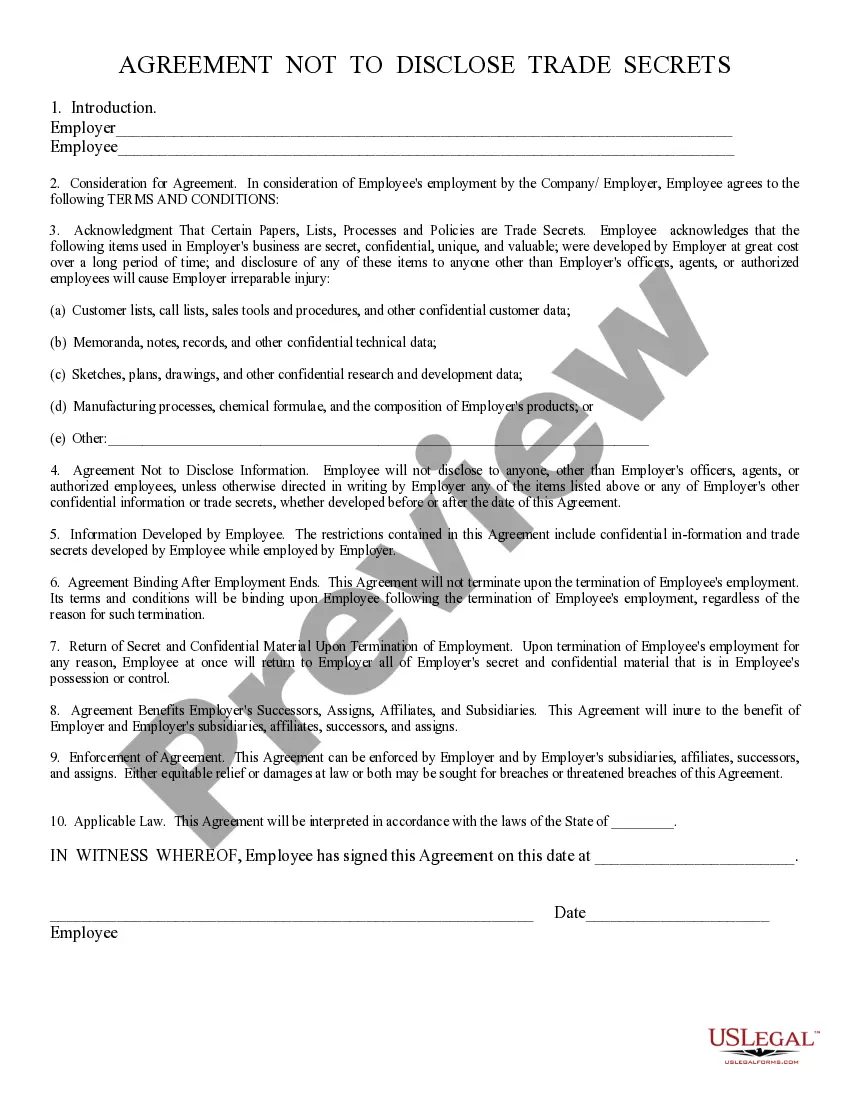

The Asset Acquisition Form 8594 instructions in Fulton provide detailed guidance for the acquisition of assets through a purchase agreement, making it essential for the structured transfer of various business assets. Key features include stipulations regarding the assets being sold, such as equipment, inventory, and goodwill, along with the exclusion of certain liabilities. The instructions outline methodologies for filling out and finalizing the agreement, emphasizing clarity in the allocation of the purchase price. Specific use cases are pertinent for attorneys, partners, owners, associates, paralegals, and legal assistants involved in transactions, as they facilitate a comprehensive understanding of the obligations and rights of all parties involved. Moreover, the document emphasizes the importance of due diligence, with requirements for proper authorizations, representations, warranties, and conditions precedent to the transaction. Practitioners are instructed to carefully navigate the procedures to ensure compliance with legal standards and to establish a clear understanding among parties regarding their commitments and expectations. Overall, these instructions assist users, regardless of their legal background, in completing asset acquisition transactions effectively and confidently.

Free preview