Asset Purchase Agreement Irs Form In Ohio

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

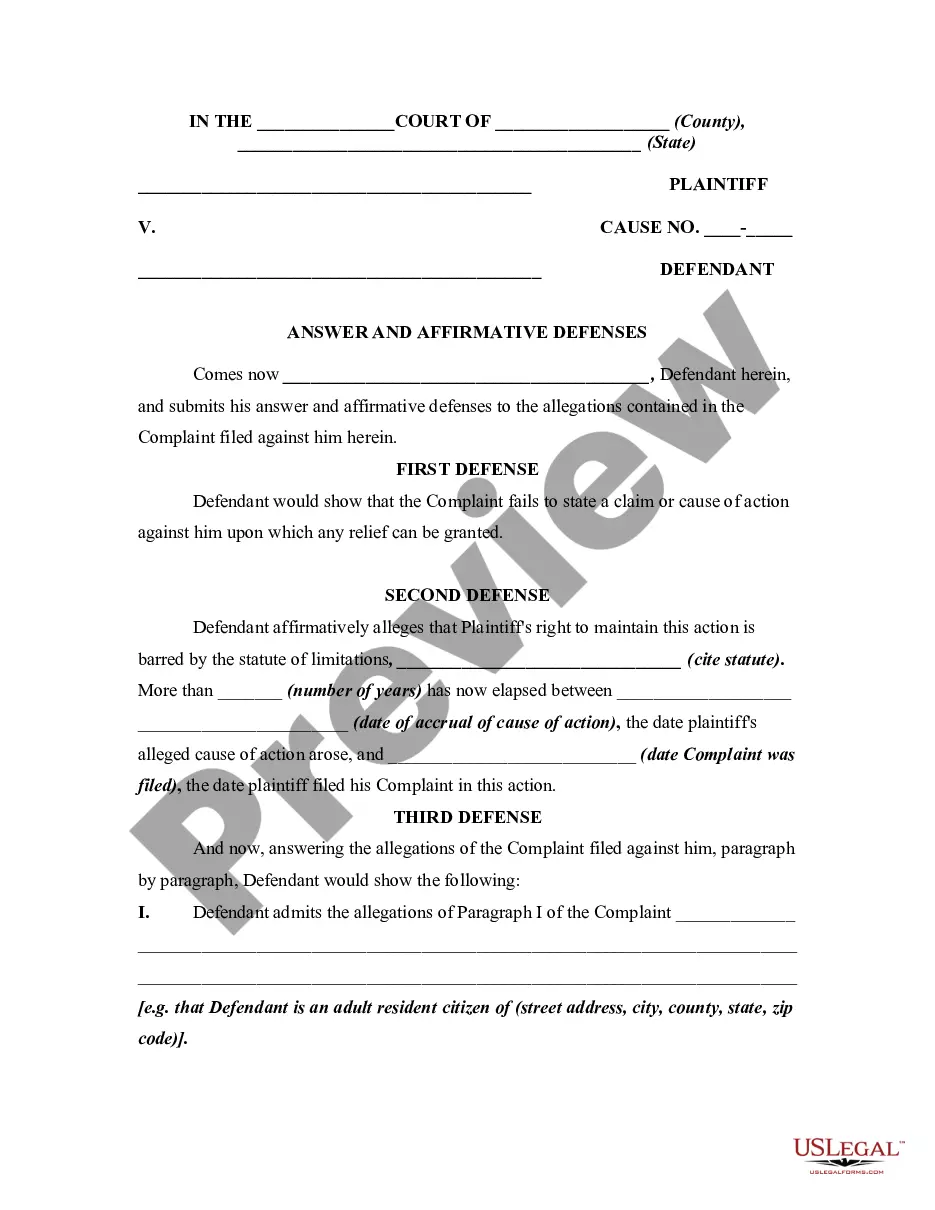

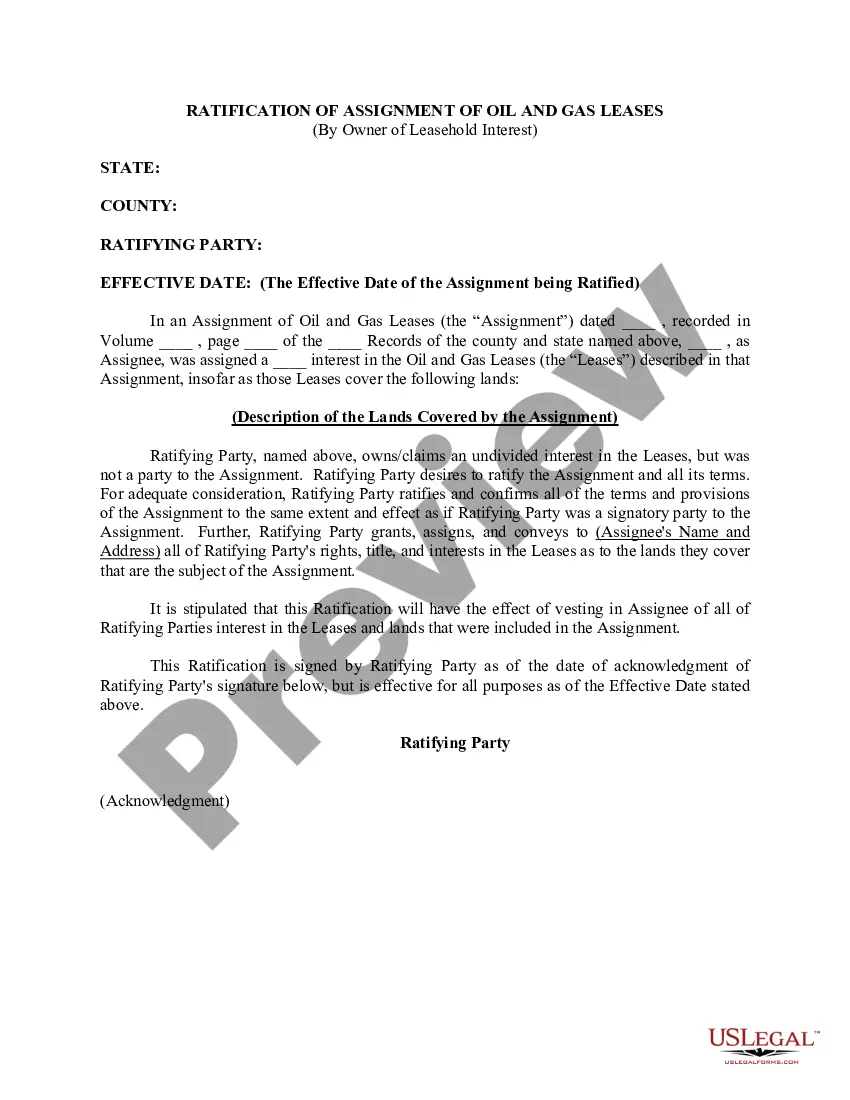

The Asset Purchase Agreement IRS Form in Ohio serves as a crucial legal document between a seller and a buyer regarding the transfer of business assets. This form outlines the terms under which the seller agrees to transfer specific assets, such as equipment and inventory, while also detailing any liabilities that the buyer may assume. It includes sections on the purchase price, payment arrangements, and representations and warranties from both parties, ensuring a comprehensive understanding of ownership rights and obligations. Users are encouraged to fill in relevant information, adjust the applicable provisions, and seek legal guidance to ensure compliance with Ohio law. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in the sale or acquisition of business assets. They can utilize it to facilitate negotiations, protect client interests, and provide a legally binding framework for asset transactions. By adhering to clear language and structure, the form enables effective communication between parties with varying levels of legal expertise.

Free preview