Asset Business Sale Form For Canada In King

Category:

State:

Multi-State

County:

King

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

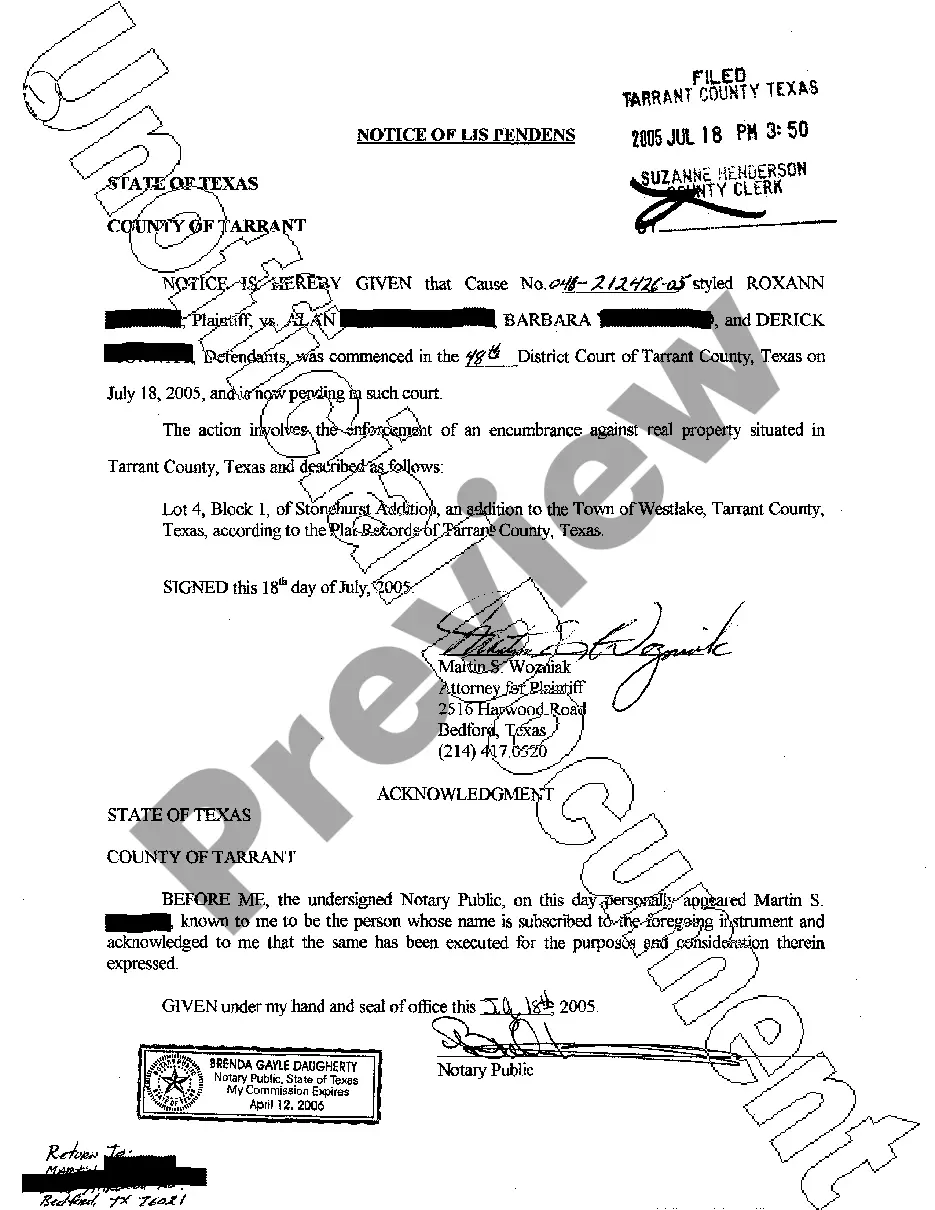

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

When you are considering becoming a business owner, you have the option of buying an existing business or starting a new one. Selling your business?A Business Purchase Agreement transfers a business entity from its owner to the buyer. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. In Manitoba, an asset purchase and sale transaction won't be complete without considering these three forms: 1. This article will discuss ten key considerations that should be taken into account when acquiring the assets of a Canadian business. Protect yourself with a customizable Sales and Purchase Agreement. A short form agreement for the purchase and sale of certain tangible and intangible property of a Canadian private corporation or limited partnership. Learn the key tax implications for three methods of buying or selling a business in Canada.