Form 8594 Vs Form 8883

Description

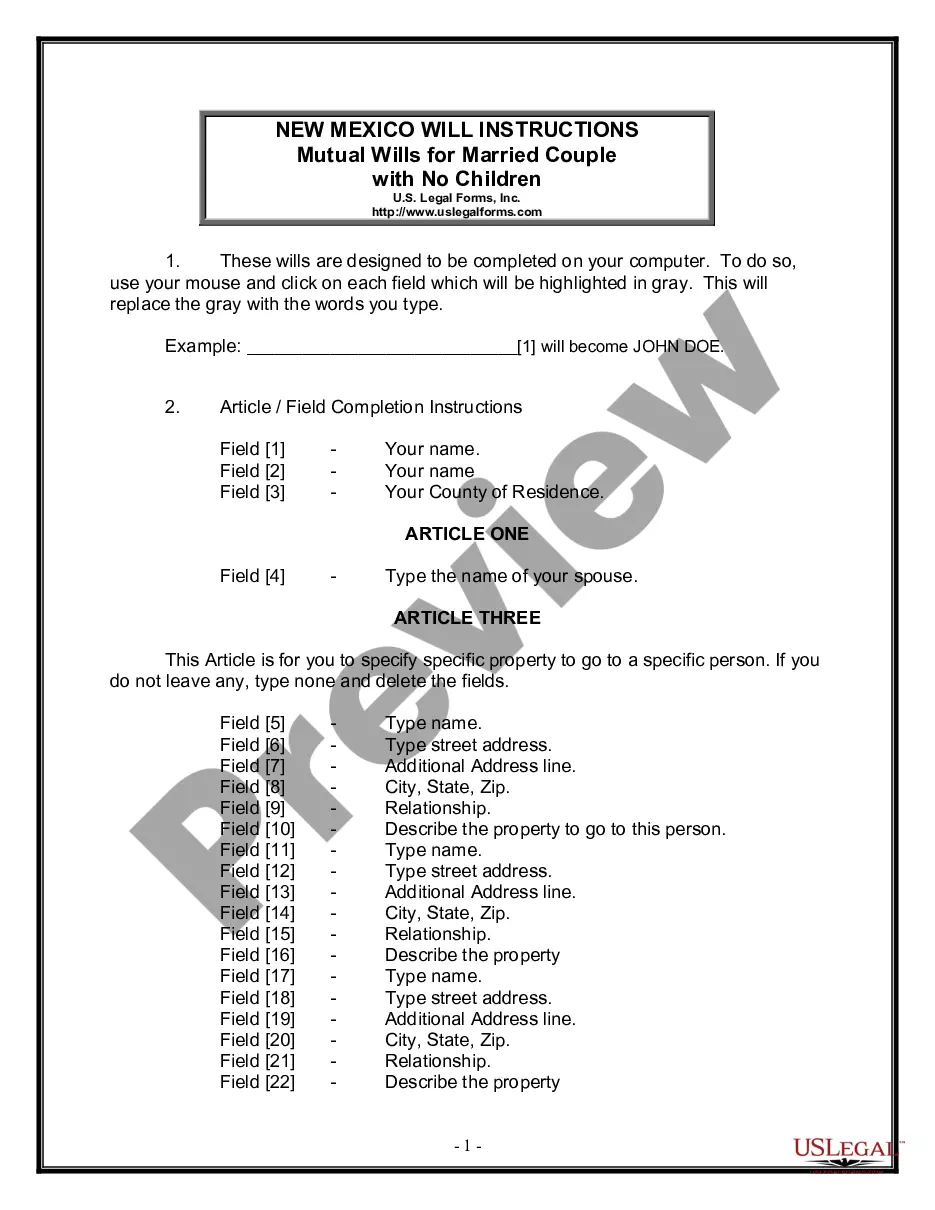

How to fill out Asset Purchase Agreement - Business Sale?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Certain situations may necessitate extensive research and substantial financial investment.

If you’re looking for a simpler and more economical method to prepare Form 8594 Vs Form 8883 or any other paperwork without unnecessary hassle, US Legal Forms is always accessible.

Our online library of over 85,000 current legal documents encompasses nearly all facets of your financial, legal, and personal matters.

However, before proceeding to download Form 8594 Vs Form 8883, consider these tips: Review the document preview and its descriptions to ensure you are selecting the correct document. Confirm the chosen form aligns with your state's and county's requirements. Select the most appropriate subscription option to purchase Form 8594 Vs Form 8883. Download the document, then fill it out, sign it, and print it. US Legal Forms has built a solid reputation with over 25 years of experience. Join us today and simplify the document completion process!

- In just a few clicks, you can effortlessly obtain state- and county-compliant templates meticulously assembled for you by our legal experts.

- Utilize our service whenever you require trustworthy and dependable resources through which you can conveniently locate and download Form 8594 Vs Form 8883.

- If you’re familiar with our offerings and have previously registered with us, simply Log In to your account, find the template, and download it instantly or retrieve it later in the My documents section.

- No account? No worries. Setting it up only takes a few minutes, allowing you to browse the library.

Form popularity

FAQ

You should file Form 8594 when you acquire a business's assets under certain conditions. Generally, this form needs to be submitted alongside the tax return for the year in which the acquisition happens. Timely filing helps maintain accurate records and ensures that your transaction is documented properly. Keep in mind the key distinctions of Form 8594 vs Form 8883 to fulfill your obligations effectively.

Form 8833, also known as the Treaty-Based Return Position Disclosure, allows taxpayers to disclose positions taken under a tax treaty. This form helps protect taxpayers from potential penalties related to positions they may take when filing returns in accordance with tax treaties. It's important to keep this form in mind, especially when considering the distinctions between Form 8594 vs Form 8883, as they serve different purposes in tax reporting.

You can file Form 8453 along with your tax return to the IRS. Make sure you include it in the envelope with your paper filing if you are submitting a physical return. If you are using e-filing, the software will guide you through the process, eliminating the need for physical mail. Understanding where to file this form in relation to other tax forms like Form 8594 vs Form 8883 can help streamline your tax process.

Yes, Form 8594 must reflect the terms and allocations agreed upon by both the buyer and seller to ensure transparency and compliance with IRS regulations. Proper matching facilitates smoother transactions and reduces the risk of audits or disputes. In the debate of Form 8594 vs Form 8883, understanding the alignment between these forms can clarify asset transfers and tax implications, making it important to consult with professionals or utilize resources like USLegalForms for accurate guidance.

WC-1 EMPLOYER'S FIRST REPORT OF INJURY OR OCCUPATIONAL DISEASE.

The claimant shall be paid benefits so as not to exceed a maximum benefit of sixty-six and two-thirds percent of the claimant's average weekly wage earnings, wherever earned, at the time of the date of injury not to exceed one hundred percent of the average weekly wage in West Virginia.

All West Virginia employers are statutorily required to maintain workers' compensation insurance coverage.

How much does workers' compensation insurance cost in West Virginia? The average cost of workers' compensation in West Virginia is $57 per month. Your workers' comp premium is calculated based on a few factors, including: Payroll.

West Virginia Workers' Compensation & Disability For example, if one of your employees suffers a work-related injury and can't work for five calendar days, they'd only receive benefits for two days of missed work. However, if the employee can't work for 10 calendar days, they'd receive benefits for all 10.

The Initial Process for WV Workplace Injury Claims The employer files the Employers' Report of Occupational Injury or Disease (OIC-WC-2). The employee completes section I of the OIC-WC-1 form, providing contact information; the employer, job title, and employment status; and details about the injury.