Form 8594 And Contingent Consideration In Clark

Category:

State:

Multi-State

County:

Clark

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

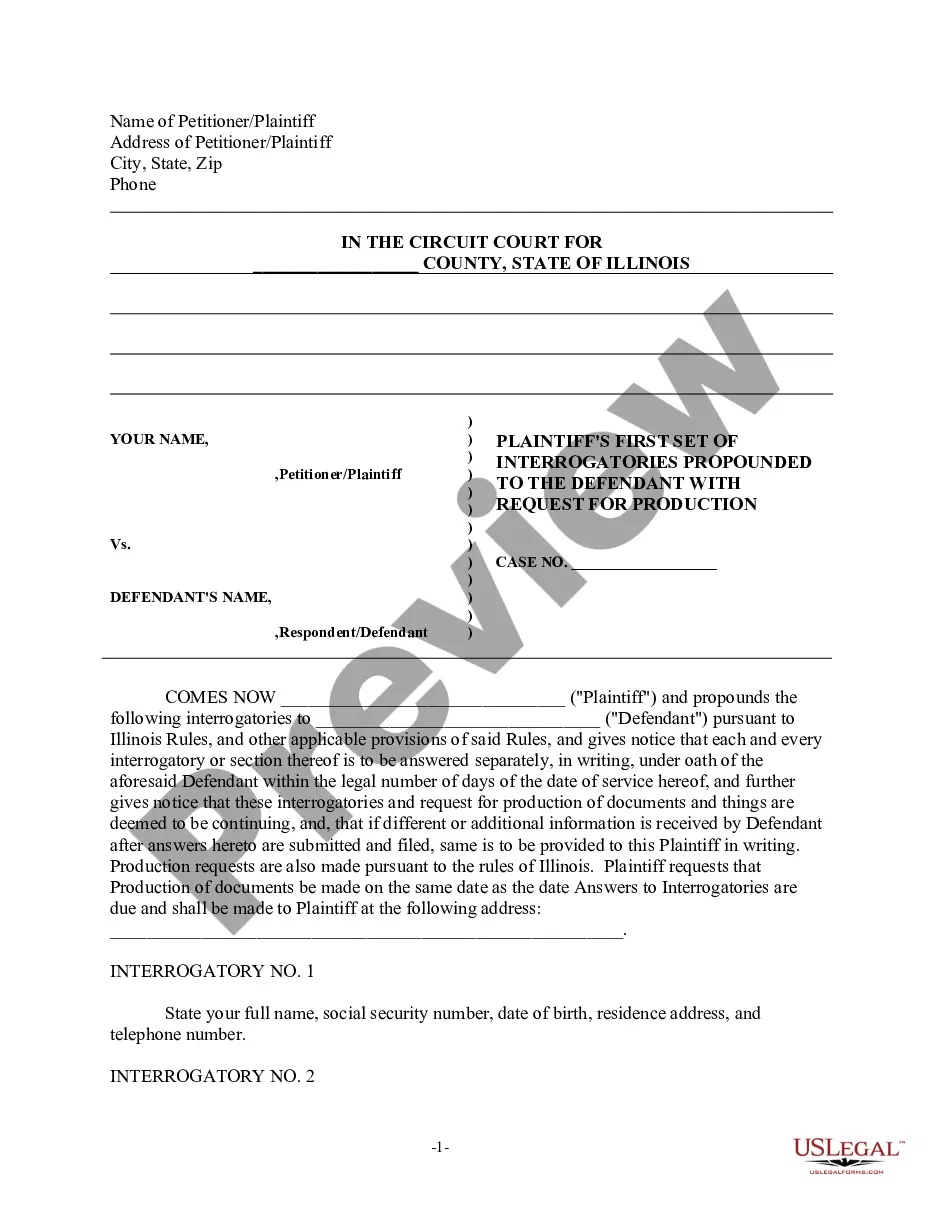

Form 8594 is essential for asset acquisition transactions, specifically when contingent consideration is involved, as seen in the context of Clark. This form provides a structured method for reporting the allocation of purchase price in asset sales, ensuring compliance with IRS requirements. The key features of Form 8594 include detailed sections for listing acquired assets, liabilities assumed, and specific allocation of the purchase price. For completion, it is crucial to accurately represent the assets and any contingent payments that may arise post-sale. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this form particularly valuable when structuring deals that involve complex payment arrangements linked to future performance. Filling out the form correctly can help prevent disputes and ensures both parties have a clear understanding of their financial obligations. Proper editing and customization are key, as users should modify the form to fit their specific circumstances and legal requirements, ensuring it reflects the actual transaction details.

Free preview