Formulario Seguro Withholding Tax In Washington

State:

Multi-State

Control #:

US-00416BG-9

Format:

Word;

Rich Text

Instant download

Description

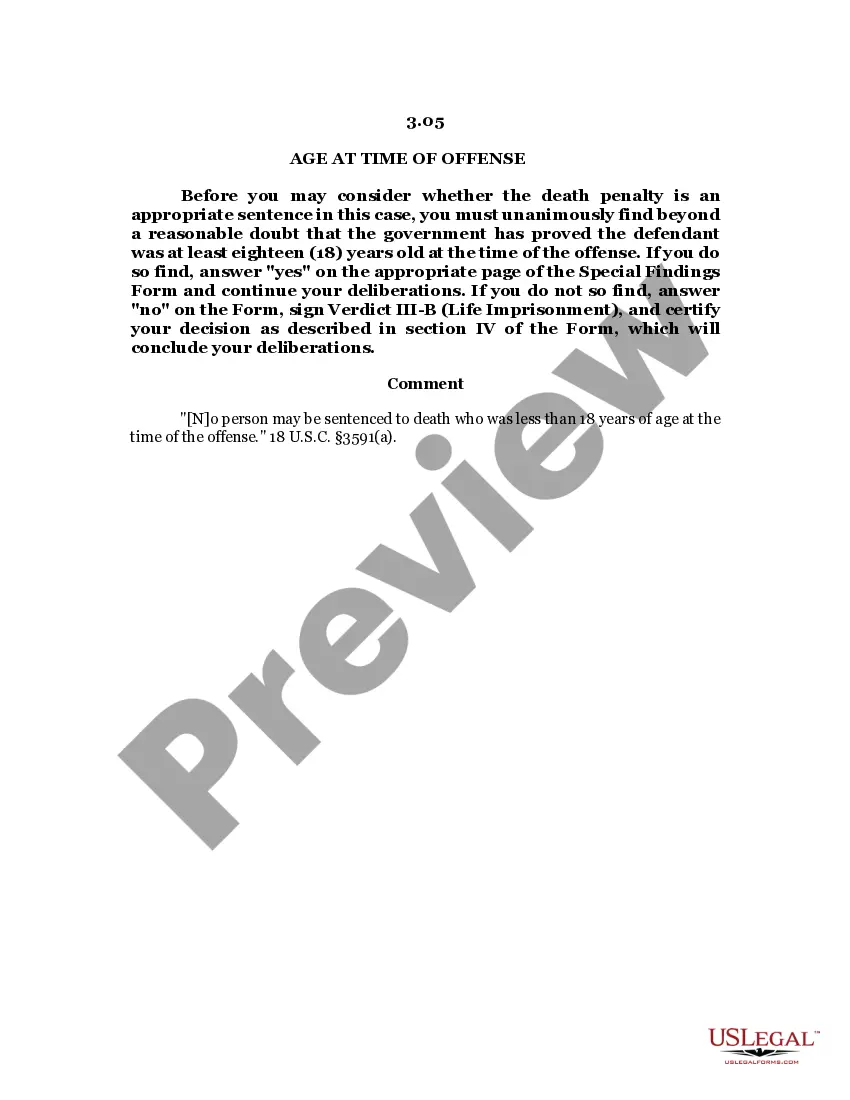

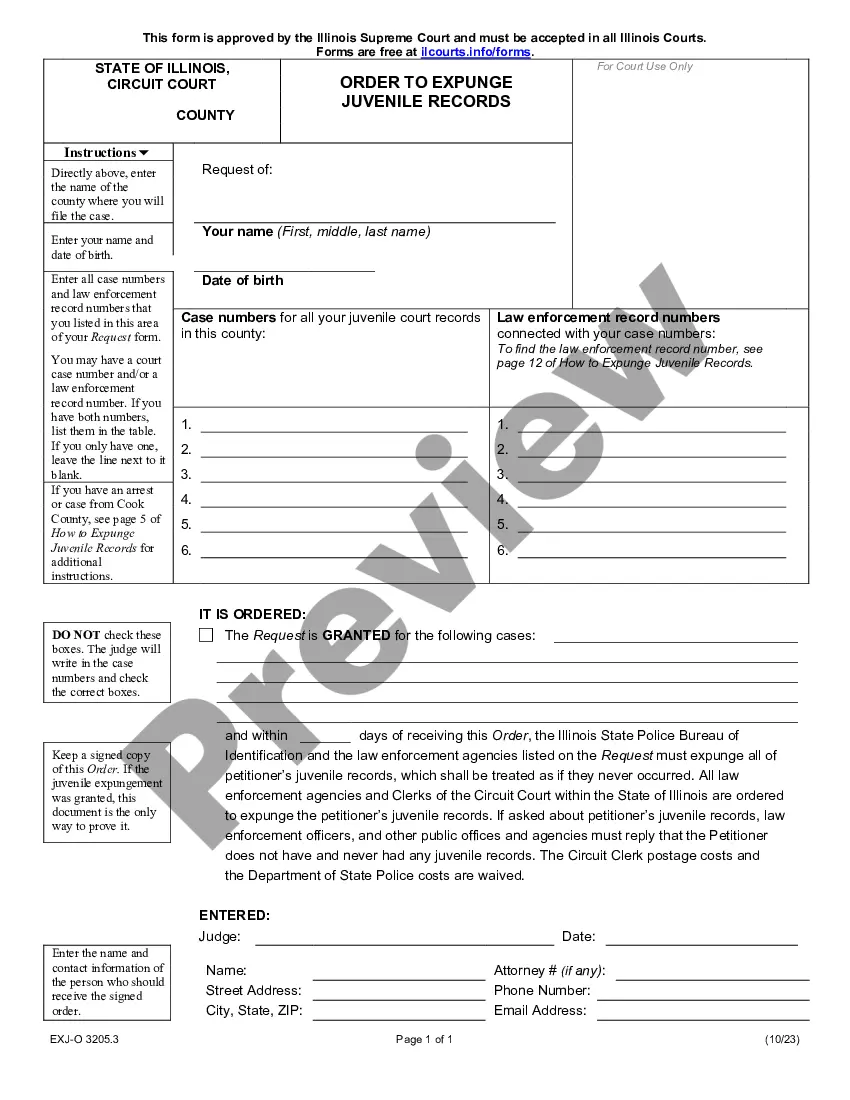

The Formulario seguro withholding tax in Washington is a key document used for managing tax withholding for employees. It allows employers to deduct the necessary taxes from employees' wages accurately, ensuring compliance with state and federal tax regulations. This form requires the employer's information, the employee's account details, and the amount to be withheld. Users should fill in the form with accurate bank account information and confirm the correct routing number. It serves various use cases such as setting up direct deposit for payroll processing or managing adjustments to tax withholding amounts. The target audience, including attorneys, partners, owners, associates, paralegals, and legal assistants, can utilize this form to streamline payroll operations and avoid potential penalties from incorrect tax filings. Hence, understanding its correct filling and editing procedures is essential to ensure legal and financial compliance.