Formulario Seguro Withholding Tax In Cook

State:

Multi-State

County:

Cook

Control #:

US-00416BG-9

Format:

Word;

Rich Text

Instant download

Description

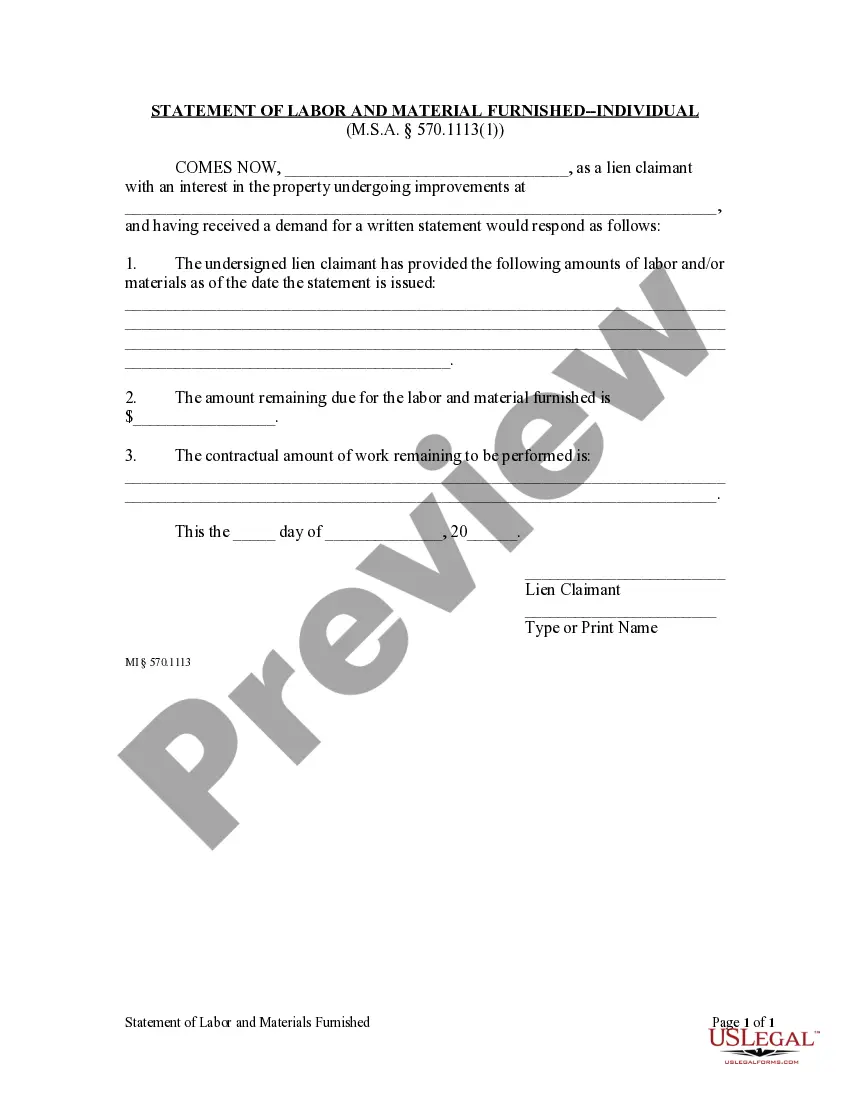

The Formulario seguro withholding tax in Cook is an essential document used for managing withholding tax obligations for employees in Cook County. This form allows employers to authorize the electronic debit and credit to their employees' bank accounts for tax withholdings. Key features include the ability to set specific deposit amounts and the provision for adjustments to ensure accurate accounting. To fill out the form, users must provide their bank information, specify whether the account is checking or savings, and sign to authorize the agreement. The form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants as it helps ensure compliance with local tax laws. Additionally, maintaining accurate records of these transactions can protect employers from potential taxation issues. Users should be aware that they must notify both their bank and employer in writing to terminate the agreement, and any cancellation becomes effective five business days after the last transaction clears. This form enhances clarity and communication between employers and employees regarding tax withholdings.