Rental Application Credit Check Without Permission In Nassau

Description

Form popularity

FAQ

Opt out permanently: Go to optoutprescreen or call 1-888-5-OPT-OUT (1-888-567-8688) to start the process. To complete your request, sign and return the Permanent Opt-Out Election form (which you get online).

You don't have to consent to a credit check. Of course, if you refuse, the bank, business, or other party that wants to look at your credit report can also refuse to do business with you. If you don't want the other party to access your credit report, discuss this with them.

Who can check your credit without your permission? Those who are performing soft credit inquiries can check your credit without permission, though they will often notify you regardless. People who might have reason to perform a soft credit check on you include: Potential landlords.

You must provide written consent before a prospective or current employer can get a copy of your credit report. Determining eligibility for government benefits or licenses. A legitimate business need in connection with a transaction that you initiated, such as a rental application.

You can access someone else's credit report by directly contacting one of the credit bureaus (TransUnion, Equifax, and Experian). Each of these bureaus technically gives their ratings independently, but all three of the scores should be quite similar for the same person.

Unless you're posting pictures of your credit reports on social media, your credit information shouldn't be available to the public. It won't show up as a search engine result, and your loved ones can't request it, regardless of your relationship.

Credit score requirements for apartments vary by landlord, but most require at least a 670. Landlords can also view your credit report for any delinquencies or accounts in collections. If you have a low credit score, landlords may ask for upfront payments, guarantors, or references.

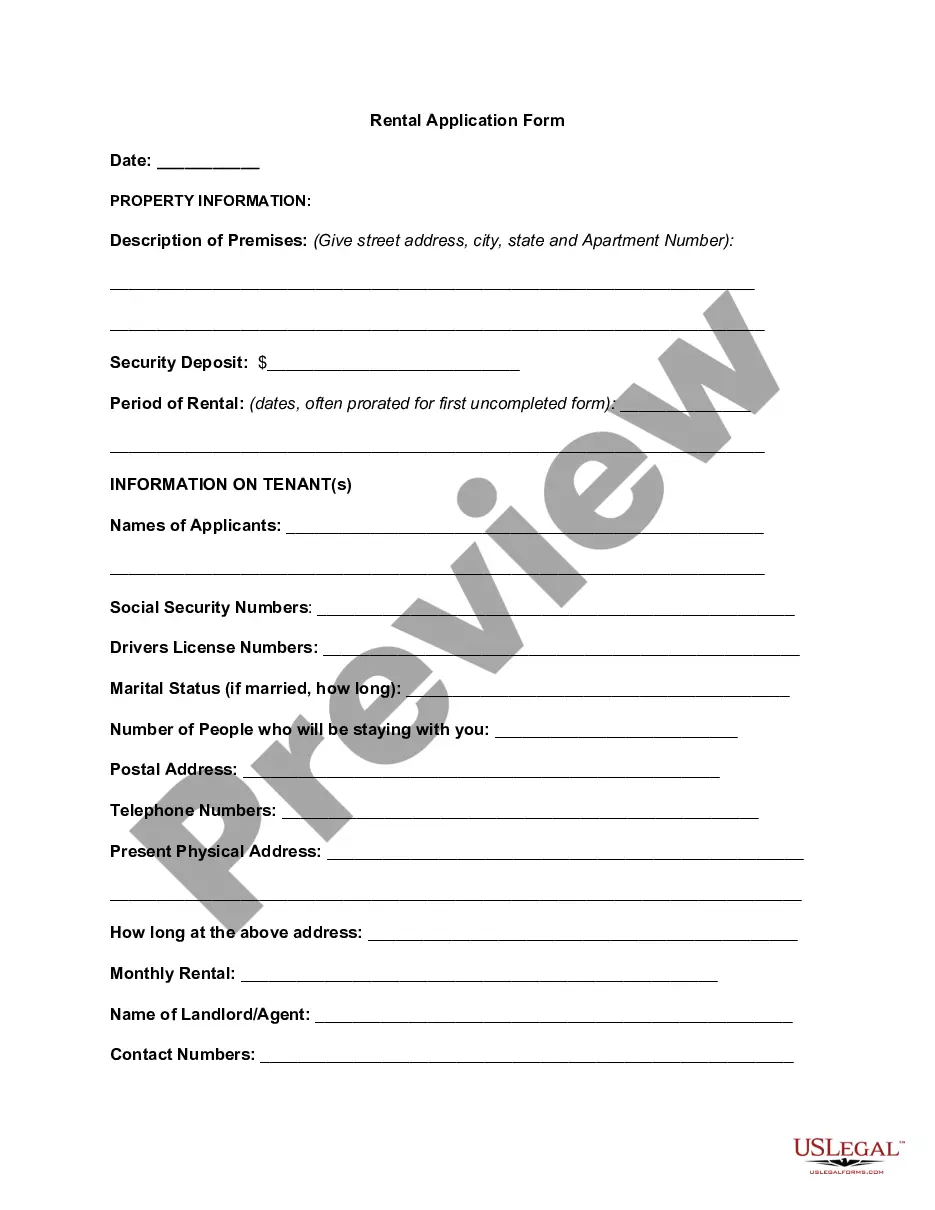

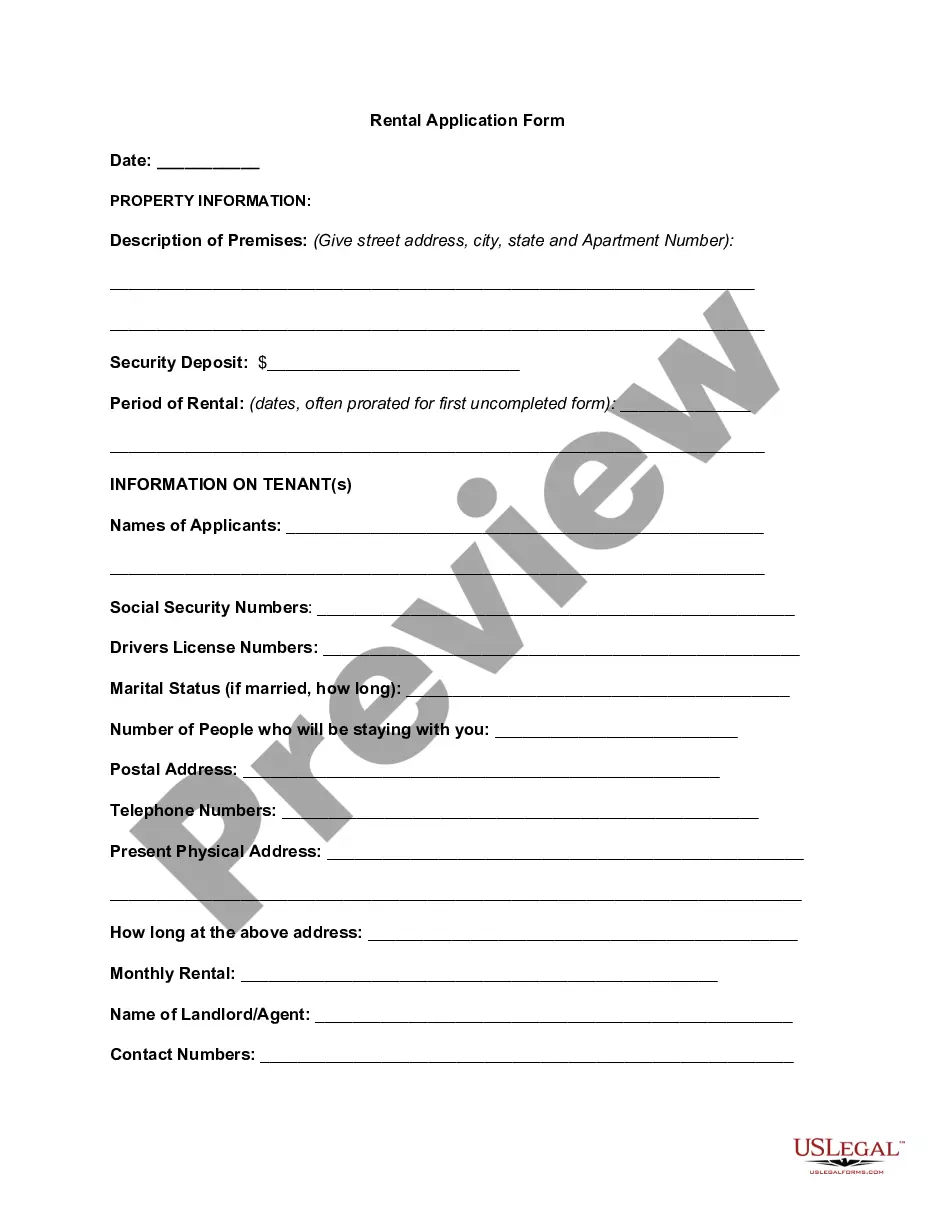

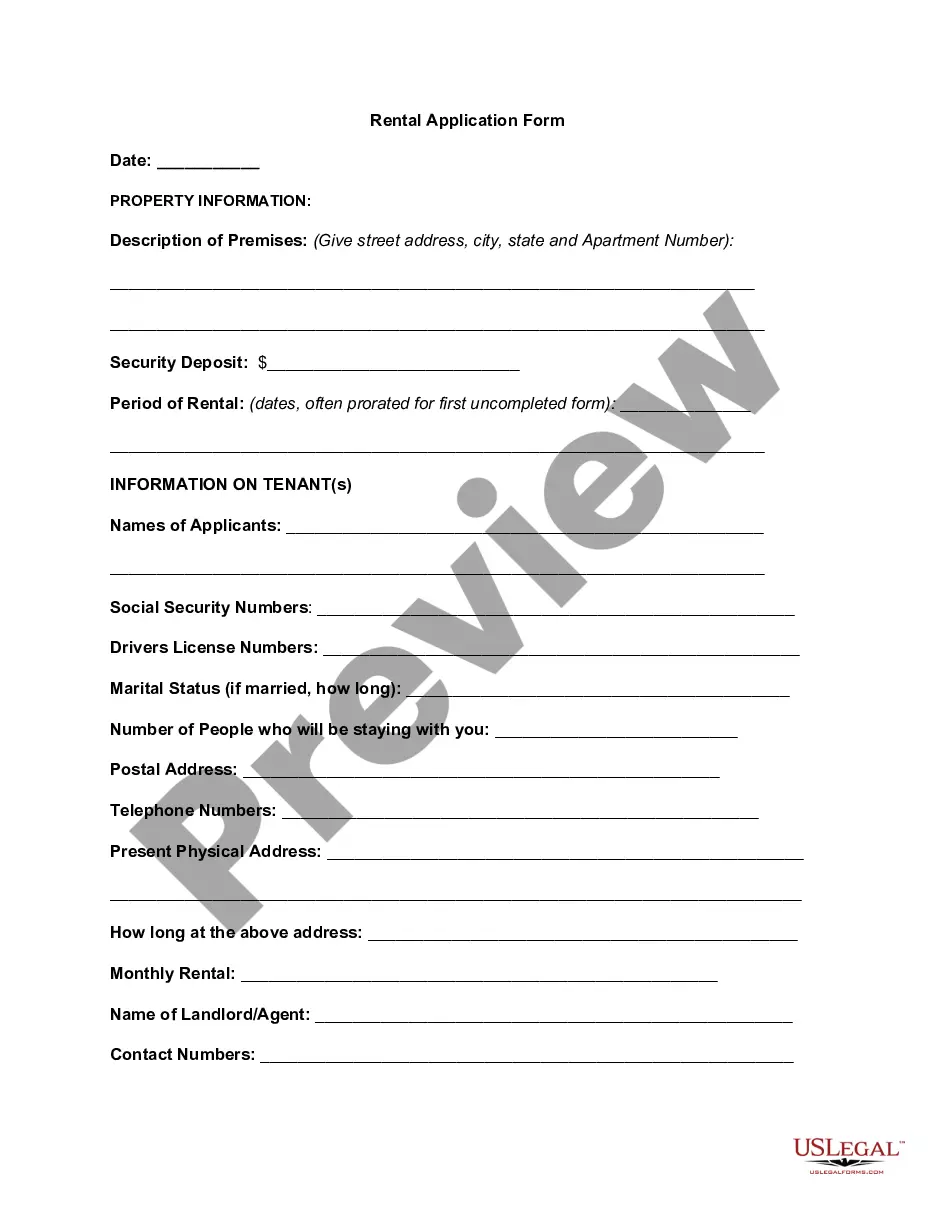

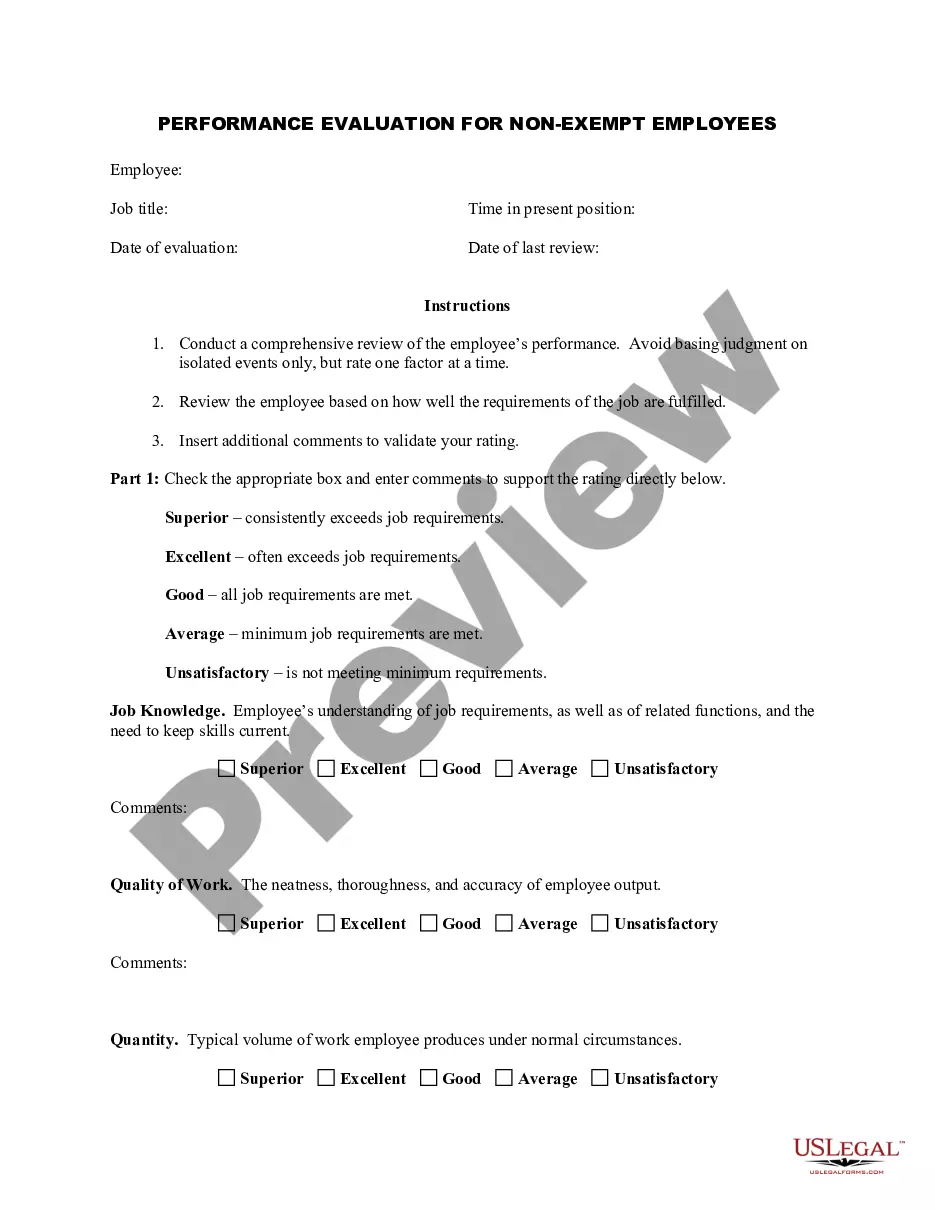

Once a prospective tenant completes a rental application, you'll need to: Verify the tenant's full name, employment history and residential address. Get the tenant's written permission to run a credit check. Choose a credit reporting agency to work with. Confirm you're the landlord of the rental property.

You can access someone else's credit report by directly contacting one of the credit bureaus (TransUnion, Equifax, and Experian). Each of these bureaus technically gives their ratings independently, but all three of the scores should be quite similar for the same person.

Access to credit reports is restricted to businesses with a specific need, and to consumers who request their own report. You may get another person's report if you have power of attorney or are the executor of an estate, or with permission. You may also obtain the report of your child, if he or she is a minor.