Lost Note Affidavit Form Foreclosure In Pennsylvania

Description

Form popularity

FAQ

Second, before a residential mortgage can be foreclosed in Pennsylvania, the lender must give a 30-day notice of intention to foreclose (also known as an Act 6 Notice), giving the borrower an opportunity to cure, and prohibiting the lender from collecting attorneys' fees incurred during the notice period.

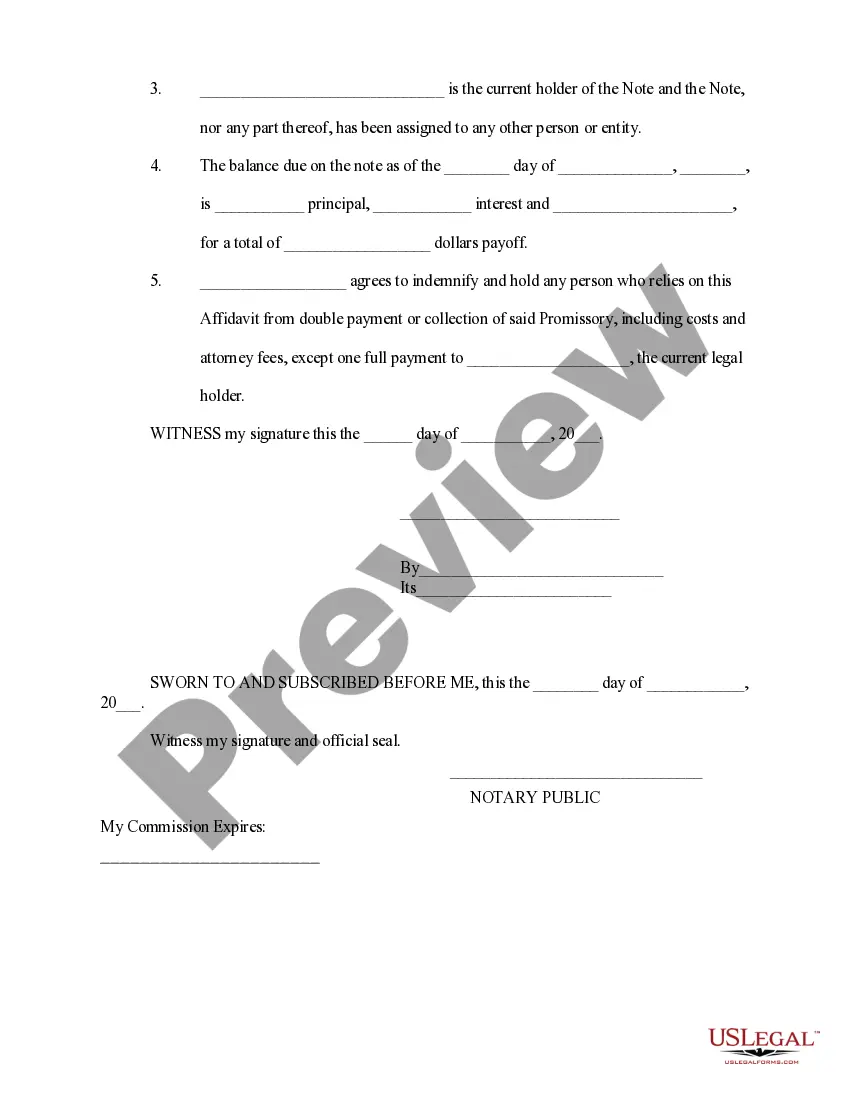

Typically, in a judicial foreclosure state, the lender proves the requisite facts by submitting documents and a written statement signed under oath (called an affidavit) by a person (usually a bank employee) who has reviewed the documents and who is supposed to have some personal basis for believing the facts to be ...

The affidavit is signed by the Lender and notarized. 6. Supporting Documentation a. A copy of the original promissory note is attached to the affidavit.

PA Act 6 and the Peer Review When the insurer receives a bill from the provider, the insurer has ninety (90) days to submit a challenge to the PRO. The PRO will assign a reviewer to review the medical record documentation to determine whether the services are reasonable and necessary.

Act 6 regulates the maximum lawful interest rate for residential mortgages in the state.

An LNA is a lost note affidavit, which is a sworn statement that represents and substitutes for a promissory note (other than an e-Note) that is lost, missing, or destroyed.

If you do not challenge a foreclosure, it may be completed about 120 days from your initial notice. Under 12 C.F.R. § 1024.41(f), the bank may not legally foreclose on someone's property unless they are more than 120 days delinquent with mortgage payments.

An LNA is a lost note affidavit, which is a sworn statement that represents and substitutes for a promissory note (other than an e-Note) that is lost, missing, or destroyed.