Restrictive Covenants In A Debt Contract In Oakland

Description

Form popularity

FAQ

A restrictive covenant that runs with the land is typically prohibitive in nature, meaning it restricts or limits what a property owner may do with the property. Examples include restrictions such as limitations on building height or prohibition against certain uses (pesticide use, for instance).

How do I challenge a restrictive covenant? Express release: It may be possible to negotiate the release or variation of a restrictive covenant. Indemnity insurance: It is possible to obtain indemnity insurance to protect against the risk of a person with the benefit of a restrictive covenant seeking to enforce it.

A restrictive covenant is a provision in a real property conveyance that limits the grantee's use of the property.

Restricting investment activities Negative debt covenants are in effect when a lender restricts the borrowing party from engaging in investment activities without their consent. It is done to lessen risks that may arise from substantial investment expenditure amounts.

Some of the most common restrictive covenants include: Alterations and extensions to the building. Changes to the use of a property, for example, converting a building into flats or turning a house into business premises. Rent and lease restrictions. Limitations on pets. Limitations on home colour.

For example, restrictive covenants can prevent owners and tenants from making certain renovations, having pets, parking RVs in the driveway, or raising livestock.

An employee can challenge a restrictive covenant if they believe it is unreasonable or prevents them from finding suitable employment. If the covenant is too broad or not essential to protecting the employer's business, it may be deemed unenforceable by the courts.

Restrictive covenants are most common when your property is part of a homeowners association, inium association, or planned community. Typical limits include restrictions on how many people can occupy the home and the colors you are allowed to paint the exterior.

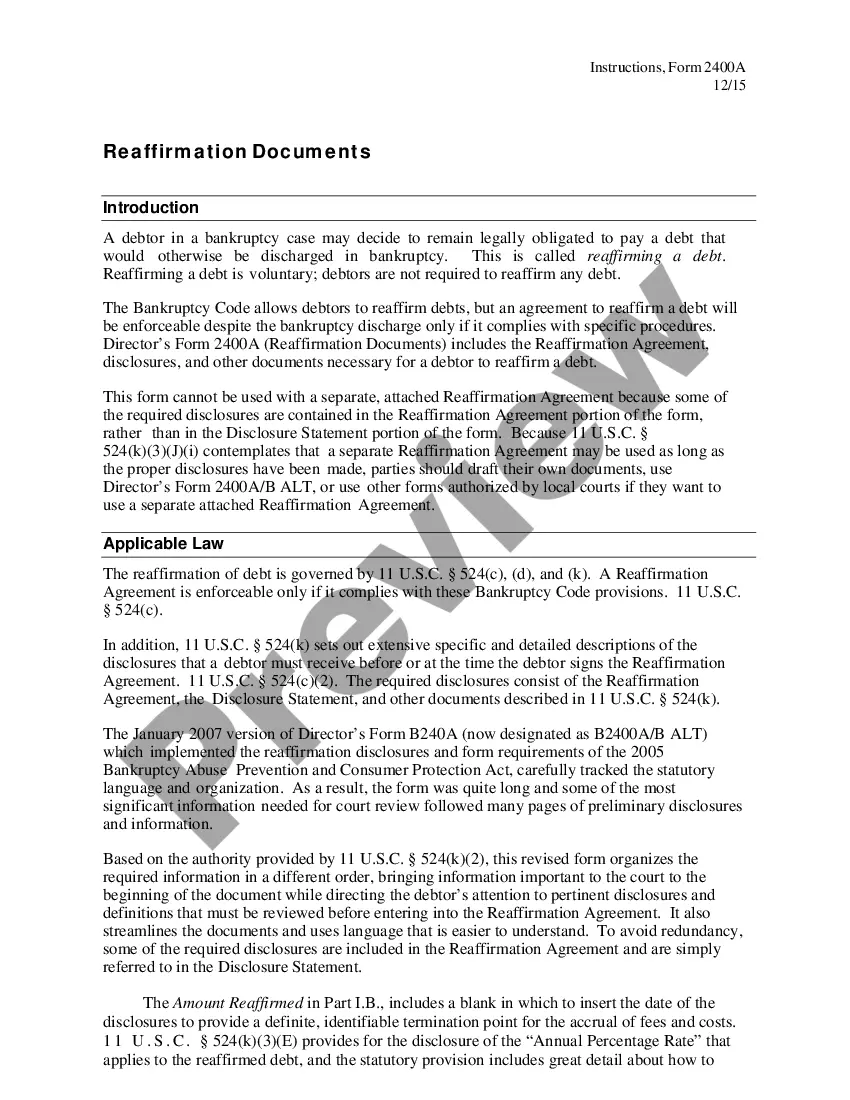

Debt covenants are limitations placed on borrowers to protect the interest of the lenders, as part of a lending agreement. By agreeing to abide by the covenant, the borrower can obtain loans with more favorable terms since the risk to the lender is lower.