Lis Pendens In Missouri In Wayne

Description

Form popularity

FAQ

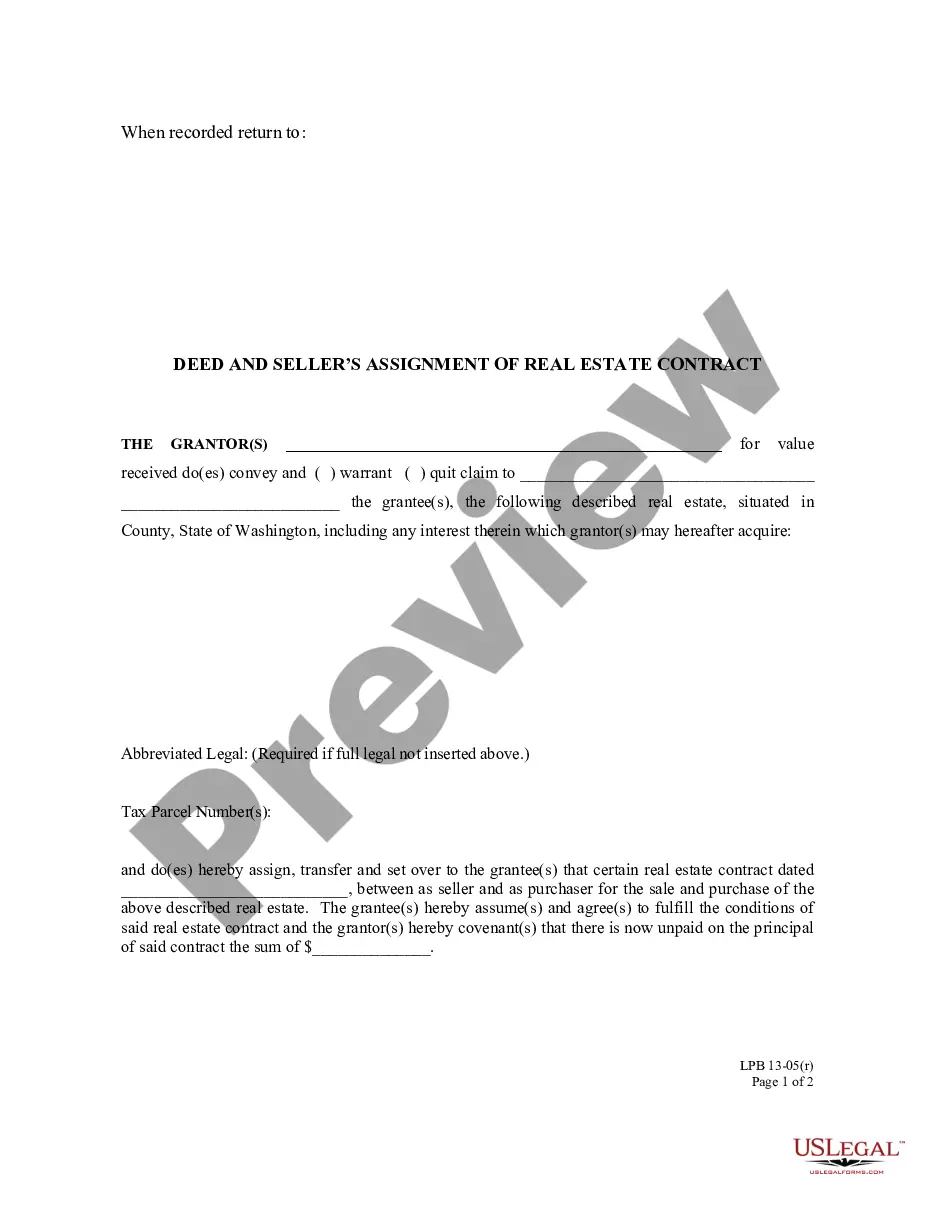

You may either prepare it yourself or contact a real estate attorney to prepare it on your behalf. If you choose to prepare it yourself you will need a standardized form (Quit Claim Deed, Warranty Deed, Beneficiary Deed, any type of Affidavit, etc.) that meets Missouri formatting requirements.

A: Yes, a quitclaim deed can protect you by getting the deed in your own name exclusively. This is possible through a divorce proceeding or your spouse can sign a quitclaim to relinquish his rights to the property.

When filling out the form: Write the full legal names of the Grantor and Grantee. Include the complete legal description of the property. Check existing property records or the current deed for accuracy. Follow all of the guidelines listed above in the section entitled “Missouri Quitclaim Deed Requirements”.

Sign the lis pendens document in the presence of a notary. File the lis pendens with the courthouse in the county where the property is located. Serve a notice of the lis pendens on involved parties, such as the property owner, if required.

A judgment lien is created automatically on any debtor property located in the Missouri county where the judgment is entered. For debtor property located outside the county where the judgment is entered, the creditor files the judgment with the county circuit clerk.

Such liens shall commence on the day of the rendition of the judgment, and shall continue for ten years, subject to be revived as herein provided; but when two or more judgments or decrees are rendered at the same term, as between the parties entitled to such judgments or decrees, the lien shall commence on the last ...

To search for a lien filed by the Missouri Department of Revenue you may access or contact your county Record of Deeds office. If you are inquiring about motor vehicle tax liens Ask Motor Vehicle!

Before filing a Missouri mechanic's lien, there are three notices you must file: a Notice to Owner, a Notice of Intent to Lien, and a Notice of Lien Rights. If these notices are not filed correctly or in the proper timeline, you will lose your right to file.

Short Answer: After filing a lis pendens, property sales may stall due to legal disputes impacting the title. Misfiling can result in sanctions or slander of title damages. Removal involves court-ordered expungement or voluntary discharge.