Accounts Receivable Contract With Nike

Description

How to fill out Accounts Receivable - Contract To Sale?

Creating legal documents from the ground up can sometimes feel overwhelming.

Certain situations may require extensive research and considerable financial resources.

If you’re looking for a more straightforward and cost-effective method of drafting Accounts Receivable Contract With Nike or any other documents without facing unnecessary hurdles, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can promptly access state- and county-compliant templates meticulously prepared by our legal professionals.

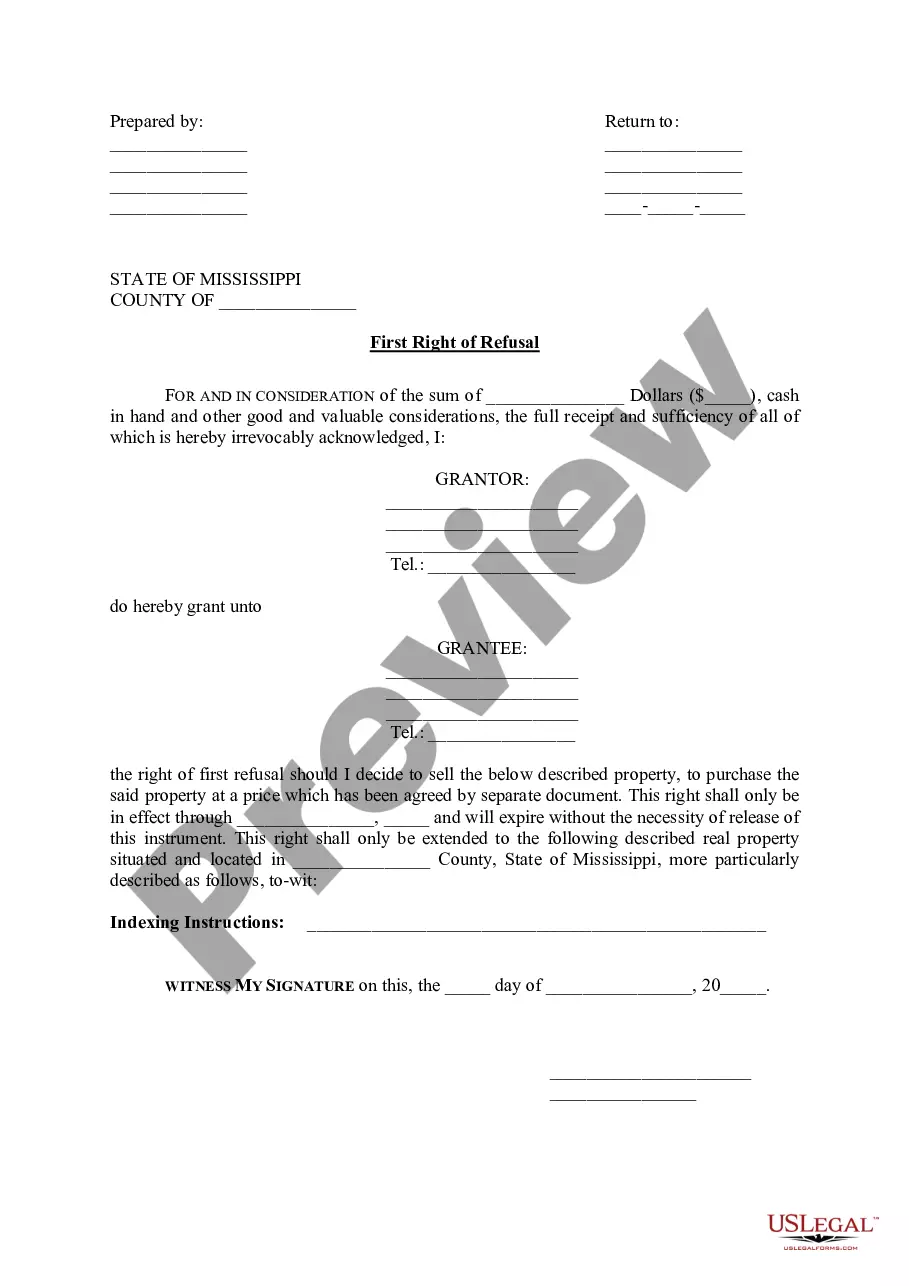

Check the form preview and descriptions to verify that you’ve located the document you need. Ensure the selected form complies with your state's and county's regulations and laws. Select the appropriate subscription option for purchasing the Accounts Receivable Contract With Nike. Download the document, then fill it out, validate, and print it. US Legal Forms enjoys a solid reputation with over 25 years of experience. Join us now and make document processing effortless and efficient!

- Utilize our website whenever you require a dependable and trustworthy service through which you can swiftly find and download the Accounts Receivable Contract With Nike.

- If you're already acquainted with our services and have set up an account, simply Log In to your account, choose the template, and download it immediately or retrieve it later from the My documents section.

- Not registered yet? No worries. Setting it up takes minimal time, allowing you to peruse the catalog.

- However, before you proceed to download the Accounts Receivable Contract With Nike, consider these guidelines.

Form popularity

FAQ

Nike engages in contracts with various entities, including suppliers, retailers, and professional athletes. These partnerships enhance Nike's brand presence and product distribution. Additionally, understanding the nature of these contracts, including accounts receivable agreements, can provide insight into Nike's operational strategies. Platforms like USLegalForms can assist you in navigating contract agreements and ensuring compliance with legal standards.

To establish a partnership with Nike, you need to present a unique value proposition that aligns with their brand values and objectives. Focus on how your business can enhance Nike's offerings or market reach. Consider reaching out through their official channels or attending industry events where Nike representatives may be present. Remember, a well-structured proposal that outlines a potential accounts receivable contract with Nike can greatly increase your chances.

Nike's average accounts receivable reflects the amount owed to the company by its customers for goods sold on credit. Typically, this figure fluctuates based on sales volume and payment terms. Understanding Nike's accounts receivable contract can help you analyze its financial health. You can find detailed financial reports on Nike's website or through financial news platforms.

The accounts receivable turnover ratio for NIKE reflects how efficiently the company collects its outstanding receivables. A higher ratio indicates that NIKE effectively manages its credit policies and collects payments promptly. When entering into an accounts receivable contract with NIKE, knowing this ratio can help your business assess the risk of payment delays and plan accordingly.

NIKE experienced a significant drop in market value due to various factors, including poor earnings reports or negative market sentiment. Such drastic changes can impact investor confidence and affect the company's financial strategies. For businesses involved with NIKE, understanding these fluctuations is essential when negotiating an accounts receivable contract with NIKE to ensure protection against financial volatility.

The average accounts receivable in accounting varies widely depending on the industry and company size. It typically represents the amount a business expects to collect from its customers within a specific timeframe. Companies like NIKE may have significant accounts receivable amounts due to their high sales volume, emphasizing the importance of a solid accounts receivable contract with NIKE to ensure timely payments.

As of the latest financial reports, NIKE has manageable levels of debt, which is not uncommon for large corporations. The company's ability to generate substantial revenue helps it maintain a healthy balance sheet. Understanding NIKE's financial standing can be critical when entering into an accounts receivable contract with NIKE, as it reflects the company's financial stability.

Yes, an accounts receivable contract is considered a legally binding agreement between two parties. It outlines the terms of payment for goods or services rendered, ensuring that both parties understand their obligations. When dealing with an accounts receivable contract with NIKE, it's essential to clarify all terms to avoid any misunderstandings.

The accounts receivable process begins with issuing invoices to clients after delivering products or services, like in an accounts receivable contract with Nike. Next, you should record these invoices in your accounting system to track what is owed. Then, monitor payments and send reminders as necessary. Finally, reconcile your accounts to ensure all payments have been received and recorded accurately, which US Legal Forms can help streamline with its comprehensive resources.

To contact Nike's corporate office, you can visit their official website and navigate to the 'Contact Us' section for detailed information. They provide various communication options, including phone numbers and email addresses. If you have inquiries related to an accounts receivable contract with Nike, reaching out directly can lead to quicker resolutions. Additionally, US Legal Forms can assist you in drafting any necessary documents before you make contact.