Statements Of Account Or Statement Of Accounts In Ohio

Category:

State:

Multi-State

Control #:

US-00400

Format:

Word;

Rich Text

Instant download

Description

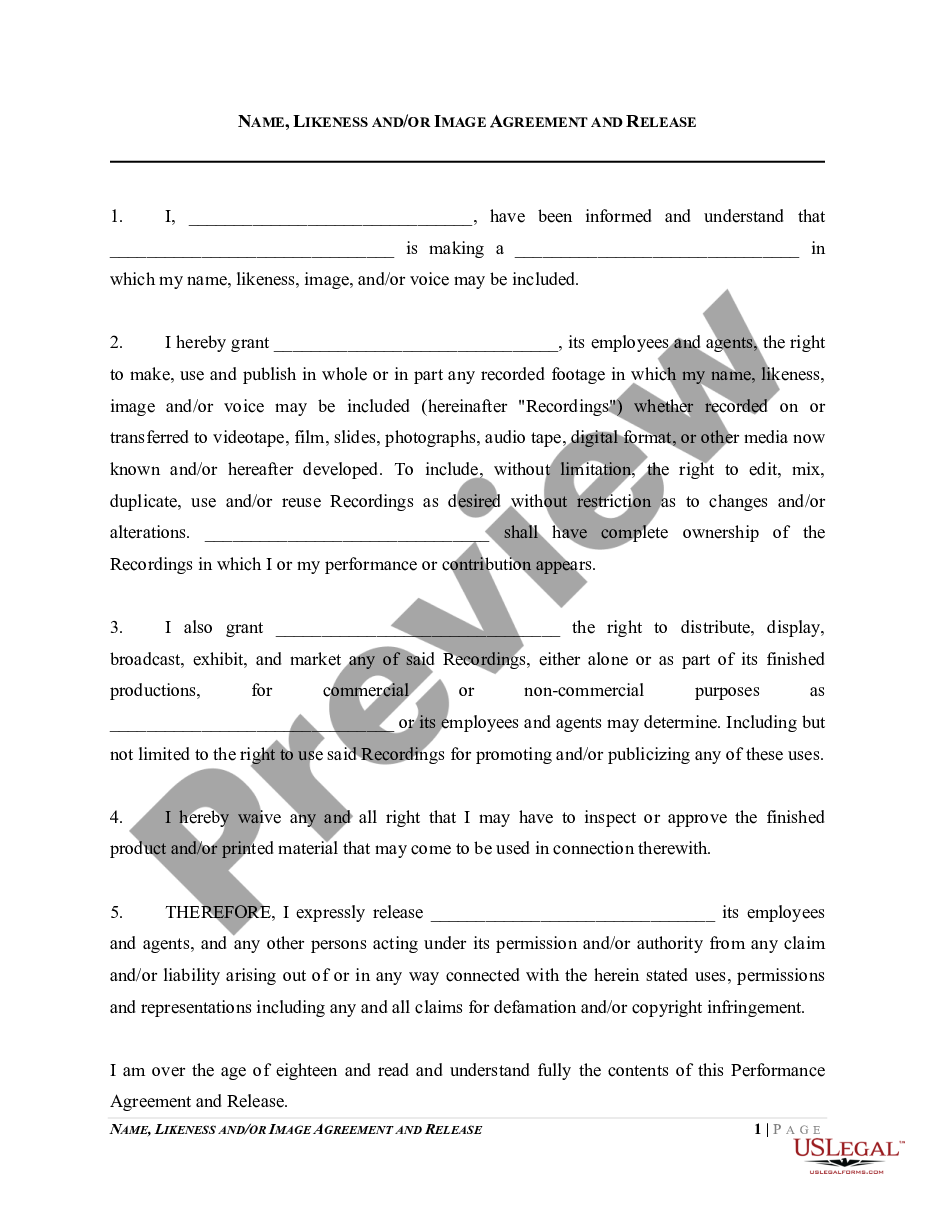

The Assignment of Accounts Receivable is a legal document used in Ohio to transfer rights to accounts receivable from one party (the Assignor) to another (the Assignee). This form ensures that all outstanding balances listed in the attached Exhibit 'A' are conveyed, including any associated invoices and rights to future payments. Key features include representations by the Assignor about the completeness and legitimacy of the accounts, stipulations regarding contestations or claims against the accounts, and provisions for future payments. This form is crucial for attorneys, partners, owners, associates, paralegals, and legal assistants as it facilitates the transfer of financial assets and provides legal assurances about the status of those accounts. Proper filling and editing require accuracy in detailing account status, ensuring compliance with all terms outlined, and maintaining clarity to avoid disputes. The form is especially useful for businesses seeking to manage cash flow and ensure proper receivables management by officially assigning accounts to third parties, thereby simplifying collections and improving financial position.

Free preview