Public Records On Credit Report

Description

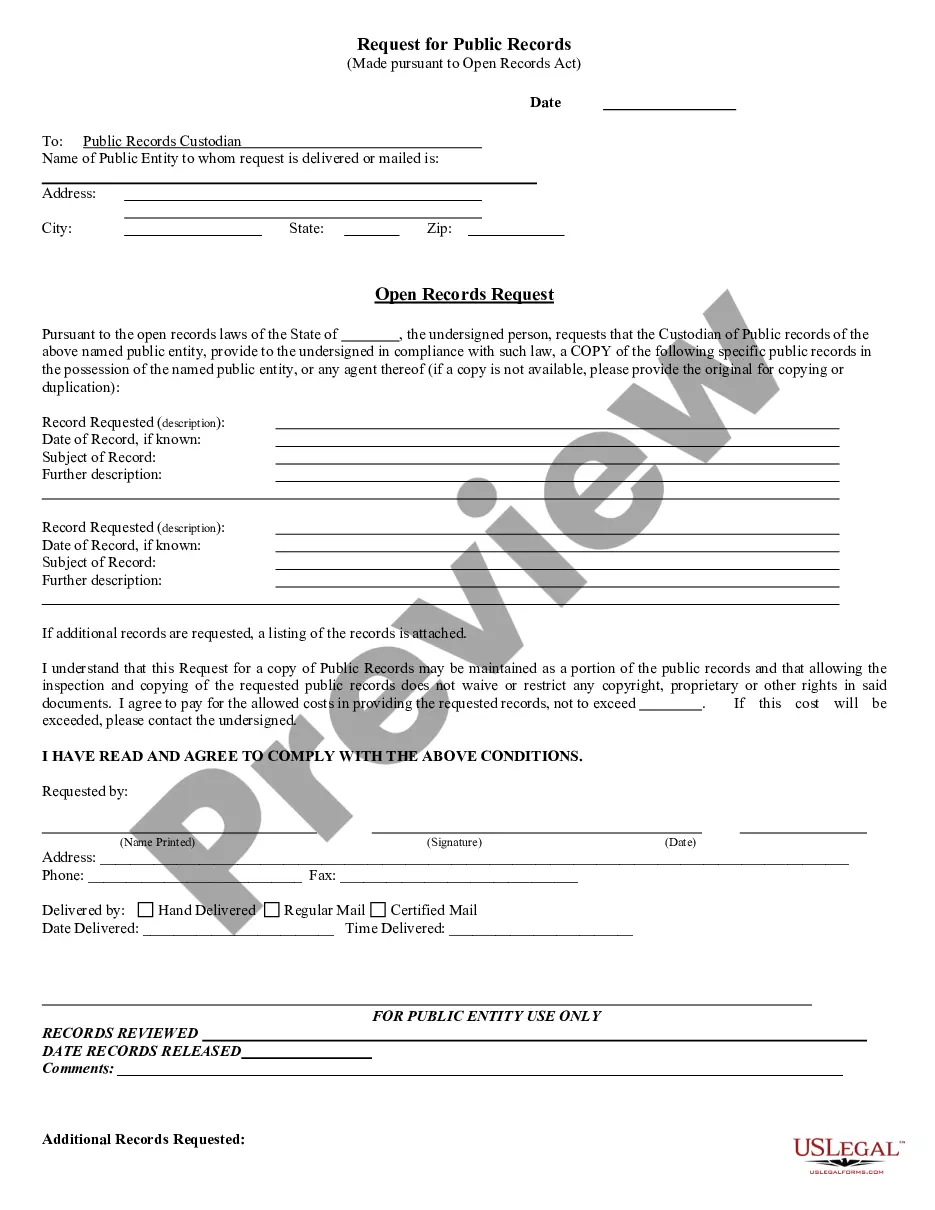

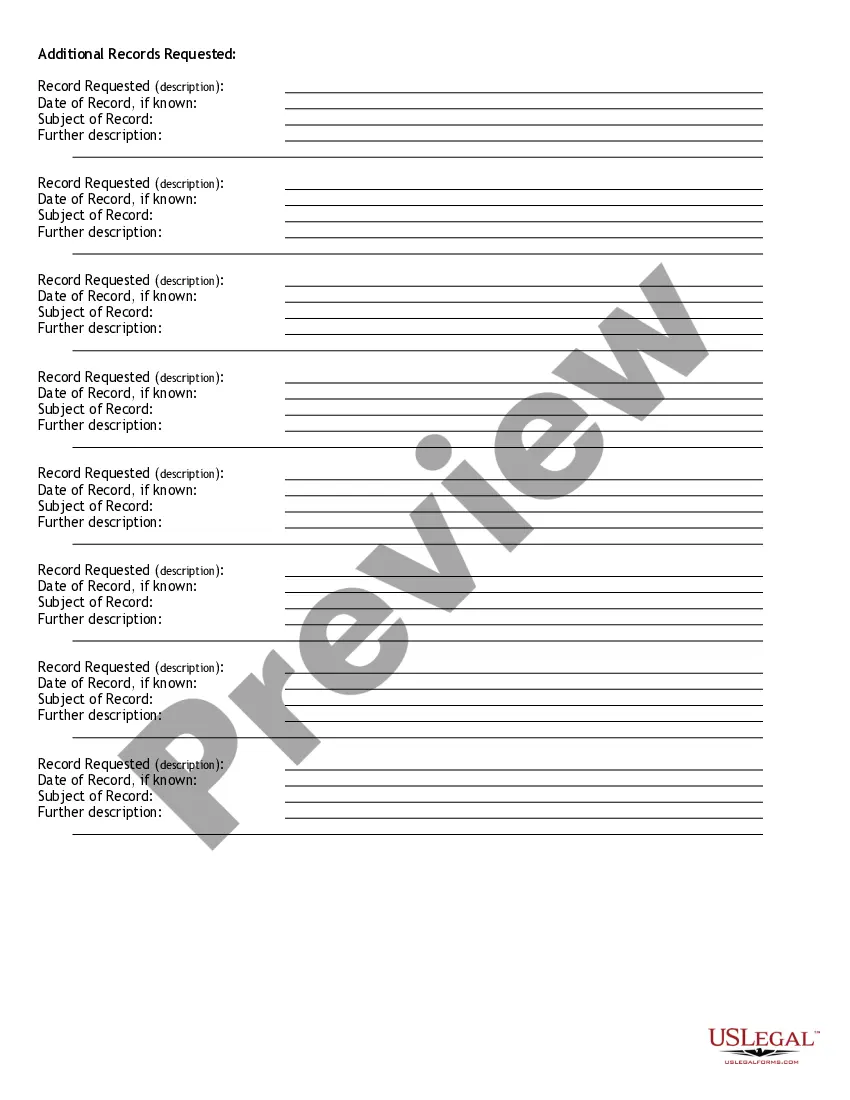

How to fill out Public Records On Credit Report?

Individuals commonly link legal documentation with complexity that only an expert can navigate.

In a sense, this is accurate, as preparing Public Records On Credit Report requires considerable understanding of subject matter criteria, including state and local rules.

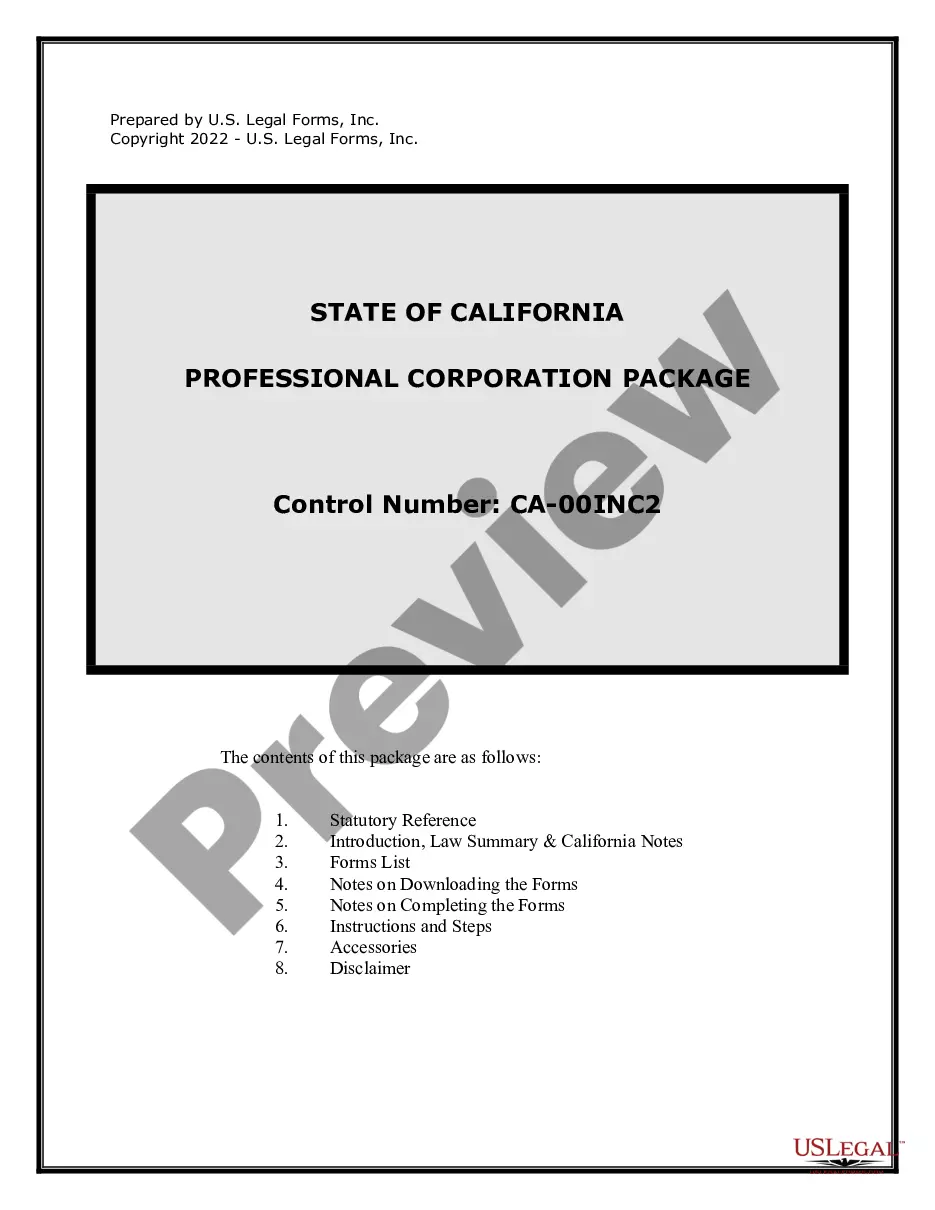

However, with US Legal Forms, everything has become simpler: pre-prepared legal documents for any life and business occasion tailored to state regulations are collected in a single online directory and are now within reach for everyone.

All templates in our library are reusable: once acquired, they remain stored in your profile. You can access them anytime via the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and use area, so searching for Public Records On Credit Report or any specific document only takes moments.

- Previously registered users with a valid subscription must Log In to their account and click Download to access the form.

- New users to the service will first need to create an account and subscribe before they can download any documents.

- Here is the step-by-step instruction on how to obtain the Public Records On Credit Report.

- Carefully review the page content to confirm it meets your requirements.

- Examine the form description or check it via the Preview feature.

- If the previous sample isn't appropriate, find another document using the Search bar above.

- Once you find the appropriate Public Records On Credit Report, click Buy Now.

- Select a subscription plan that fits your needs and budget.

- Log In to your account or create one to proceed to the payment page.

- Complete your payment for the subscription using PayPal or a credit card.

- Select the format for your document and click Download.

- Print your document or upload it to an online editor for easier completion.

Form popularity

FAQ

In most cases, you cannot view someone else's credit report without their permission. Legal regulations protect this sensitive information to prevent misuse and privacy violations. However, there are exceptions, such as when you are applying as a co-signer or involved in a legal process. If you are concerned about how public records on credit reports may affect a relationship, consider discussing credit management openly with the concerned party.

Yes, Brazil does have a credit report system similar to those in the United States and Canada. Brazilian financial institutions use these reports to assess the creditworthiness of individuals. Public records on credit reports in Brazil also include information about debts, payment histories, and legal judgments. Knowing how your credit works in different countries is essential if you're planning to move or invest abroad.

While not everyone can access your credit report, certain entities like banks, credit card companies, and mortgage lenders can obtain it when you apply for credit. Additionally, landlords and insurance companies might check your credit report as part of their approval processes. Understanding how public records on credit reports are accessed can help you manage your credit better. You can also request your own report to review its contents.

Generally, your credit score is accessible to authorized parties such as lenders and financial institutions when you apply for credit. However, you have the right to access your score as well, allowing you to stay informed about your financial standing. Public records on credit reports can impact your score, affecting what lenders see. Consider using services that provide insights into your credit to better understand how your score is calculated.

In Canada, public records can stay on your credit report for up to six years. This includes bankruptcies, which are listed for a maximum of seven years. After this period, the public records are typically removed, allowing your credit history to start fresh. It is always good to monitor your credit report to ensure that it accurately reflects your financial history.

Making your credit report private involves placing a security freeze or fraud alert on your report. This action limits access to your credit report, preventing identity thieves from opening new accounts in your name. Additionally, you can directly contact the credit bureaus to inquire about further options to protect your information. Utilizing tools from platforms like USLegalForms can simplify this process.

A public consumer report provides details about an individual's financial history, including credit accounts and public records. It is different from a traditional credit report as it encompasses a broader range of information. Keeping track of your public consumer report can help you maintain a robust financial standing.

Public credit often includes instances such as registered loans or tax liens that appear in public records. These entries are available for public viewing and can greatly impact your financial reputation. Being aware of what defines public credit will aid in managing your financial health effectively.

A public credit rating reflects an individual's creditworthiness based on data found in their credit report, including public records. This rating helps lenders determine how likely you are to repay borrowed funds. It's essential to monitor your public credit rating regularly, as even minor errors can lead to decreased scores.

A public credit report is a report that includes information gathered from public records related to your financial behavior. It helps potential lenders assess your risk level before extending credit. Understanding the contents of your public credit report is crucial, as it can influence your ability to secure loans and credit cards.