Exchange Of Information Agreement With Australia

Description

How to fill out Exchange Agreement For Real Estate?

Individuals typically connect legal documentation with something intricate that only an expert can handle.

In a certain sense, this is accurate, as formulating an Exchange Of Information Agreement With Australia demands significant knowledge of the subject matter, including state and municipal laws.

Nevertheless, with US Legal Forms, the process has become easier: pre-prepared legal documents for various personal and business scenarios tailored to state laws are compiled in a single online repository and are now accessible to everyone.

Select the format for your template and click Download. You can print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: once obtained, they remain stored in your profile. You can access them whenever necessary via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents categorized by state and usage area, so it takes only minutes to search for the Exchange Of Information Agreement With Australia or any specific template.

- Previously registered users with an active subscription must Log In to their accounts and click Download to obtain the document.

- New users on the platform need to create an account and subscribe before they can save any paperwork.

- Here is a detailed guide on how to obtain the Exchange Of Information Agreement With Australia.

- Carefully review the page content to confirm it meets your requirements.

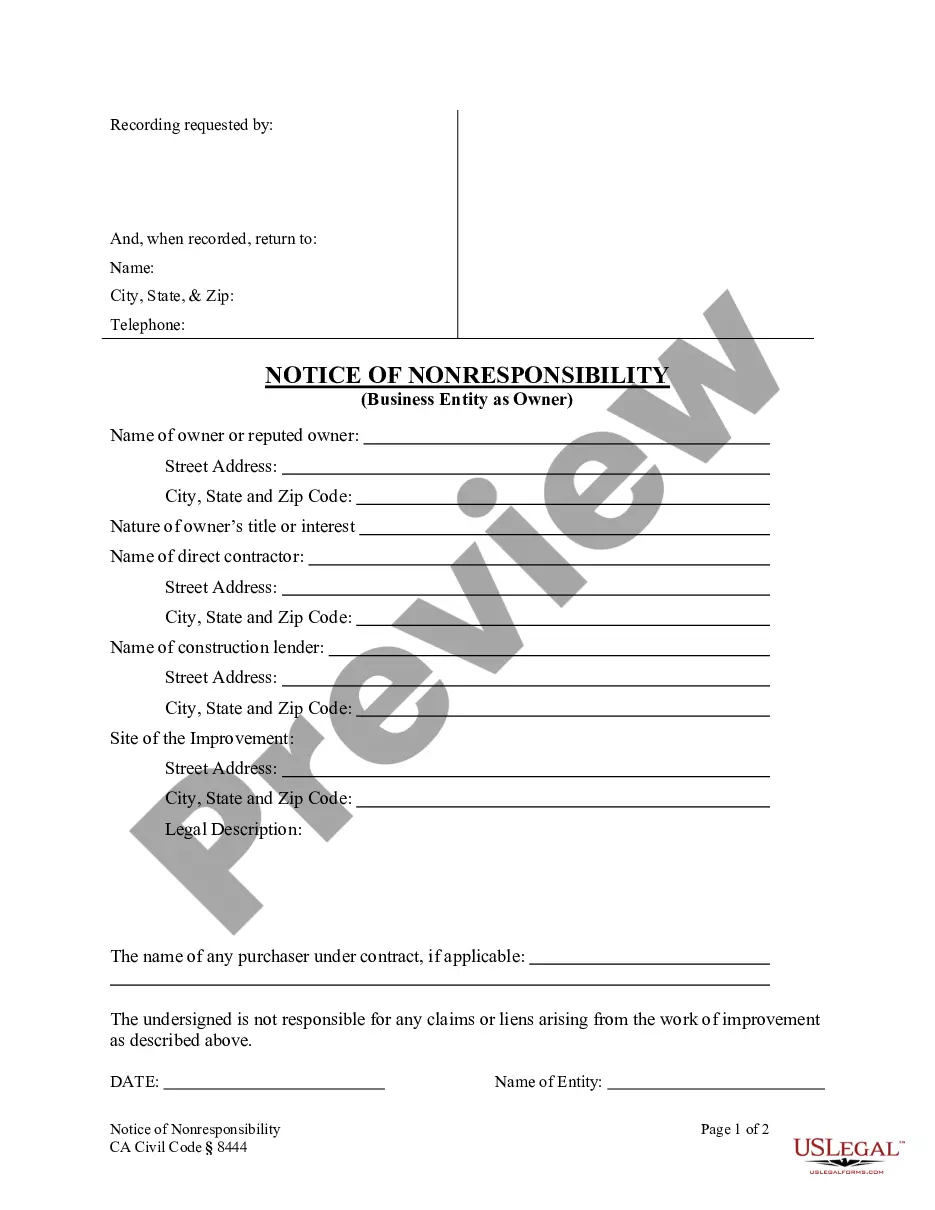

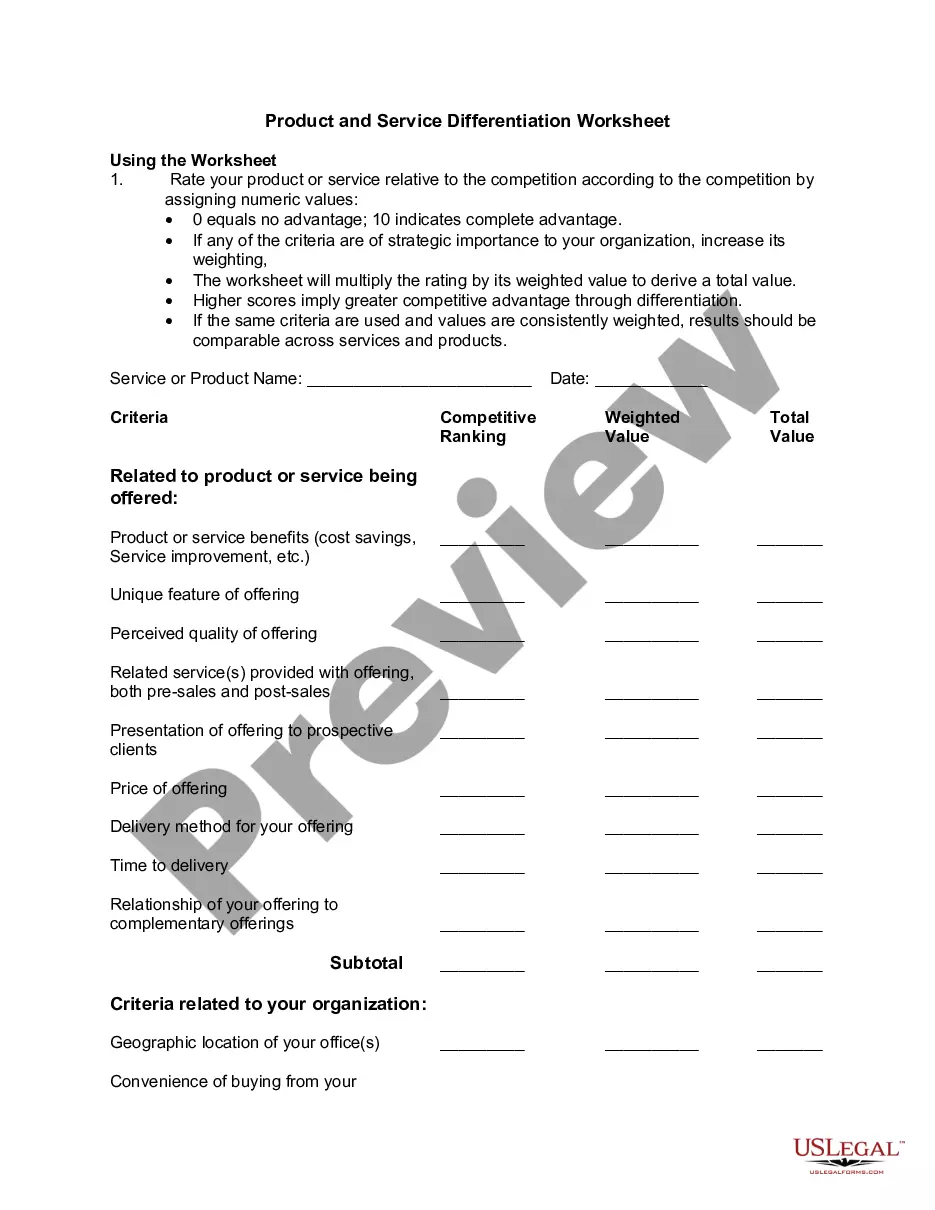

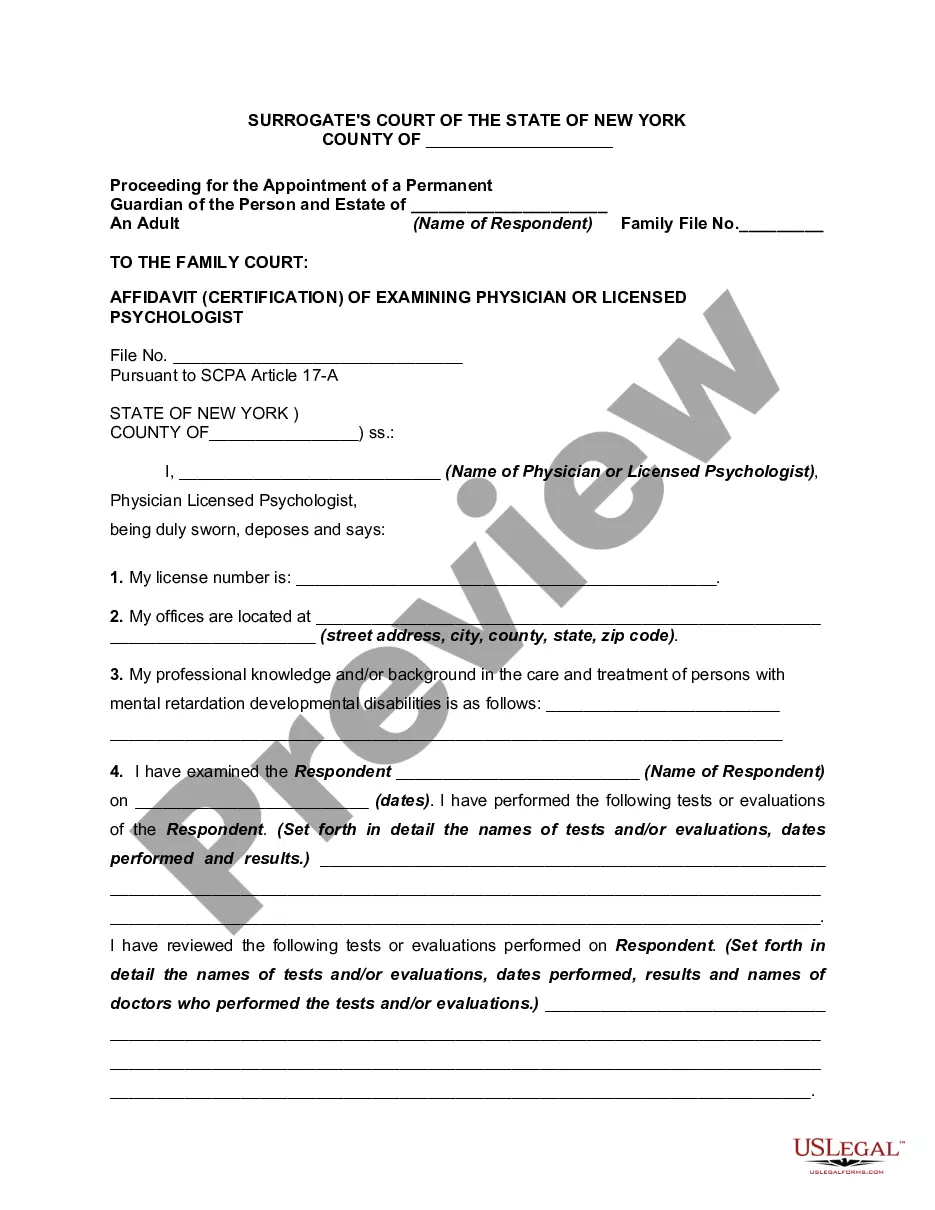

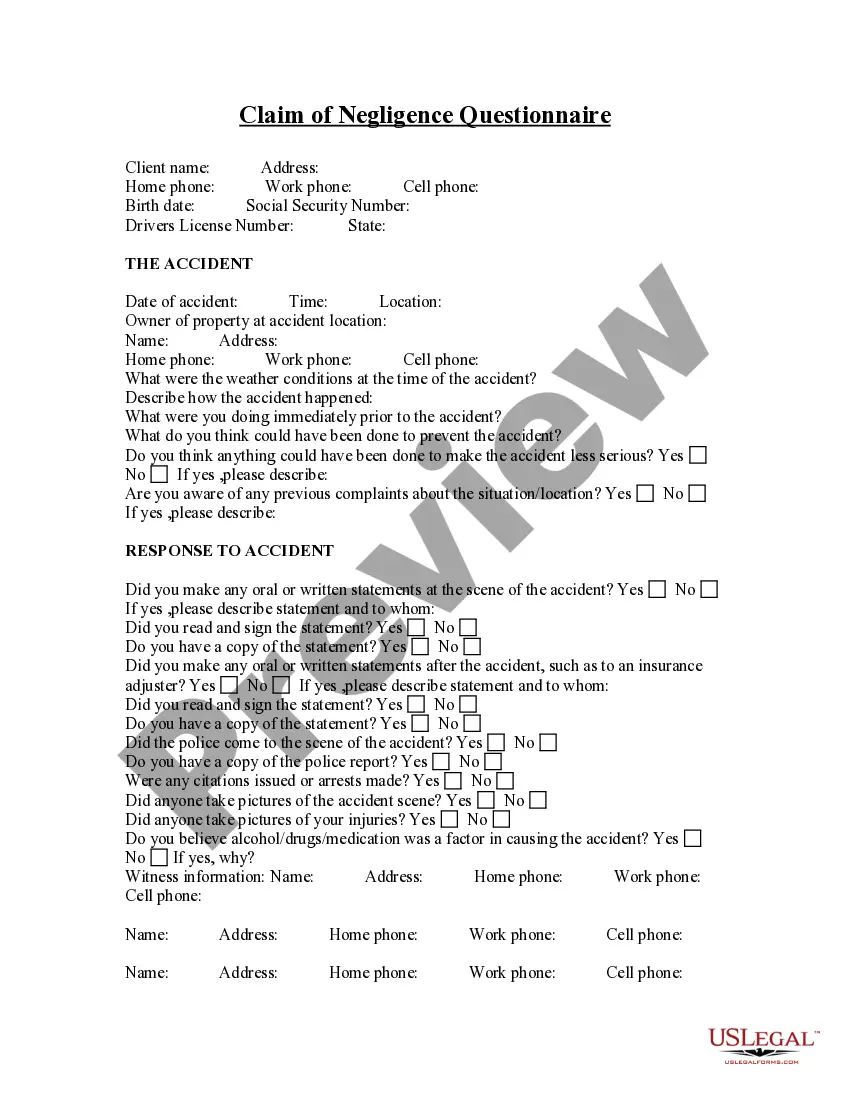

- Examine the form description or view it using the Preview option.

- If the previous option isn’t appropriate, find another sample using the Search bar in the header.

- Once you discover the suitable Exchange Of Information Agreement With Australia, click Buy Now.

- Choose the subscription plan that fits your needs and budget.

- Create an account or sign in to proceed to the payment section.

- Complete your subscription payment using PayPal or a credit card.

Form popularity

FAQ

What is a 1031 Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings.

A written agreement between the exchanger and the Qualified Intermediary (QI) defining the transfer of the relinquished property, the ensuing purchase of the replacement property, and the restrictions on the exchange proceeds during the exchange period.

The purpose of this Agreement is to promote international co-operation in tax matters through exchange of information. It was developed by the OECD Global Forum Working Group on Effective Exchange of Information. The Agreement grew out of the work undertaken by the OECD to address harmful tax practices.

A tax treaty is a bilateral (two-party) agreement made by two countries to resolve issues involving double taxation of passive and active income of each of their respective citizens. When an individual or business invests in a foreign country, the issue of which country should tax the investor's earnings may arise.

This agreement sets out the terms and conditions by which a management equityholder rolls over exiting equity in the target portfolio company and receives equity in a newly-formed holding company in a tax beneficial exchange.